views

X

Research source

Gathering Necessary Documents

Organize your proof of identity and residency. You must confirm your identity before you can participate in a SIP. Standard documents you will need include your PAN card and additional proof of residency – typically a driver's license or utility bill. Check the website of any fund house to determine what other documents might be used to meet the criteria for proving your identity and residency.

Scan your documents. If you're planning to apply for a SIP online, you'll need digital copies of the documents you plan to use to prove your identity and residency. Scan both sides of the documents, unless the reverse side is blank. You also have the option of going to a branch of the fund house you want to use and opening your SIP in person. If you do this, simply take your original documents with you.

Get a passport-sized photo made. Whether you're opening your SIP online or in person, you will need a recent passport-sized photo for your account. If you're opening your account online, you'll need a digital copy of your photo as well. You can use a photo you already have, as long as it was made in the last 6 months or so.

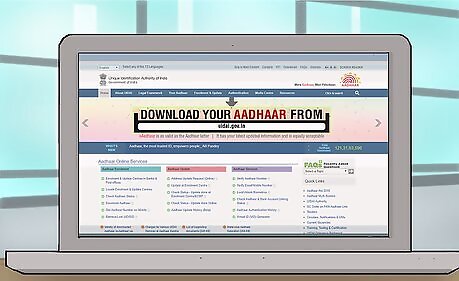

Get an Aadhaar number to simplify the process. The Aadhaar number is a unique, completely random 12-digit number that is used to safely verify your identity through the use of a one-time password sent to your mobile phone. Go to https://uidai.gov.in/ to begin the enrollment process. Your identity and residency will be verified. It can take up to 90 days to get your Aadhaar number.

Becoming KYC Compliant

Visit a KYC registration website. The "Know Your Customer" (KYC) process is required before you can invest in mutual funds. There are independent registration websites that will complete the process online. Individual fund houses may also have their own online services. The KYC process verifies your identity and residency. The process was developed to safeguard financial transactions in India. The Cams Kra company provides KYC services for a number of fund houses. If you plan to invest with more than one fund house, you may want to use Cams Kra so you only have to go through the KYC registration process once.

Enter your personal information. Through the KYC process, you will be asked to provide your name, address, phone number, PAN, and other identification information. If you're completing the KYC process online, this information must be backed up with scanned documents. If you open your SIP in person, you will fill out a KYC form that contains basically the same information as what you would enter online.

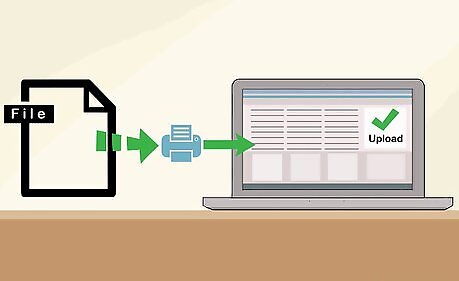

Upload your scanned documents. To complete the KYC process online, you must have scanned copies of your PAN card and the document you are using to prove your residency. If you're going through the KYC process in person, simply bring your documents with you. The broker will review your documents and may photo-copy them for your file.

Complete your in-person verification. You also must confirm your physical identity through in-person verification. Despite the name, you no longer have to go anywhere and meet with someone face-to-face. Rather, you can video-conference over the internet. You often can arrange for this verification immediately after you complete the other steps in the KYC process. The camera will film you and record the film for later review. If your computer doesn't have a working webcam, you will have to make an appointment at the fund house branch nearest you to complete the in-person verification process.

Use your Aadhaar number to eliminate verification steps. If you have an Aadhaar number, you can enter it instead of doing in-person verification or uploading scanned documents. Once you enter your Aadhaar number, the KYC system will verify it. You will be sent a one-time password to your mobile phone, which you must enter to complete the process. If you use the Aadhaar-based KYC system, your investment is limited to Rs 50,000 per year. Once this threshold is crossed, you'll have to complete the in-person verification before you can invest any more.

Registering with a Fund House

Choose a scheme that matches your investment goals. There are many different fund schemes, and one that might be right for someone you know may not be best for you. While you don't have to know everything about mutual funds to start investing, learn the basics so you can compare schemes and choose the best one for you. Look at the past performance of the fund, and compare that performance to the performance of its benchmark index as well as similar funds. A good fund typically performs similar to the benchmark, and may out-perform its peers. Focus on long-term performance as opposed to short-term performance, while at the same time paying attention to how the fund performed during downturns in the market. A fund that still shows strong returns during a downturn is likely a more stable investment. Higher-risk funds will be more volatile and reactive to market shifts. Evaluate the level of risk. Higher-risk fund schemes may offer greater returns, but also carry the danger that you could lose all or most of the money you invest. For long-term investing, look for lower-risk schemes that still have healthy returns.

Fill out an application form. The fund house where you decide to open your SIP will have an application form that asks for basic identity and residency information, as well as banking and financial information. You will also be asked to connect your KYC compliance information. On your application, you'll specify how much you want to contribute to your SIP, and how often. You can contribute as often as daily. Most people choose a monthly contribution. You can fill out the application and submit it online. You also have the option of printing it and taking it in to the nearest branch in person. If you want to invest in more than one mutual fund scheme, you may have to complete a separate application for each scheme.

Select the top-up option if you want to increase your SIP amount. On your application, you have the option of choosing to top-up the amount you contribute to your SIP periodically. You likely want to do this if you anticipate that your income will steadily increase over time. You can specify when you want to top-up your amount, and by how much. For example, you may decide to double the amount you contribute to your SIP every 5 years.

Use a flex SIP if you have uncertain income. If you are a freelancer or contract worker, or a college student who only works part time, you may want to start investing with a flex SIP. This SIP gives you the freedom to specify the amount you want to contribute each month. You can also set triggers, which increase or decrease the amount you contribute as you specify when specific financial conditions are met. For example, you might set your SIP to debit Rs 500 from your account each month, but to debit Rs 1,000 if your bank account balance is Rs 3,000 or more.

Complete your mandate form. The mandate form allows the fund house to take regular direct debits from your bank account. You provide your account number and banking information, along with the amount to debit and dates or frequency to debit that amount. If for some reason the debit doesn't go through – for example, you had less money in your bank account than the amount of the debit – your SIP is still active. You would simply skip that contribution. The next month your account would be debited as usual. There are no penalties for mixed payments.

Submit your forms and first payment. Your first payment doesn't necessarily need to be the same amount as your regular contribution in most cases. The fund house will let you know what the amount of your first payment should be. You can submit your documents online, or you can bring paper documents into a fund house branch near you. Your first payment can be made by direct debit from your bank account, or you can write a personal check. When using personal checks to fund your account, you would submit a year's worth of post-dated checks, one for each month's contribution.

Register your account online. After you've set up your SIP, go to your fund house's website and look for a registration or "new investor" link. You can use this to set up your online account so you can manage your SIP. With online access, you can make additional contributions into your SIP at any time. You also can change the amount or frequency of your automatic contributions if you want.

Comments

0 comment