views

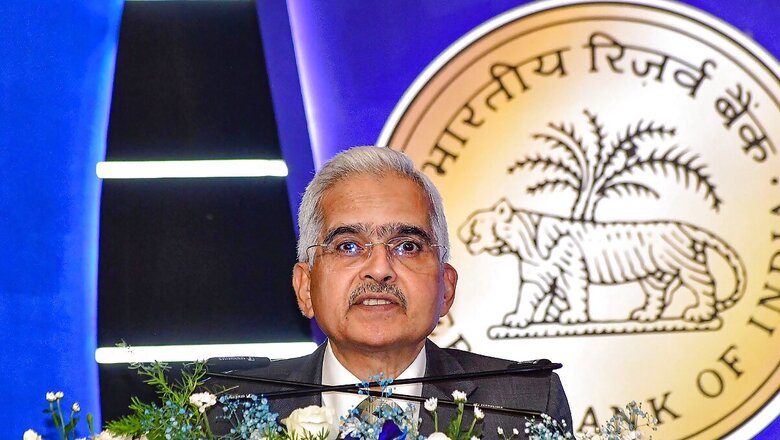

Attrition at some private sector banks is “high” and the Reserve Bank of India is “closely” looking at the issue, RBI Governor Shaktikanta Das said on Tuesday. In the comments that come amid some major banks reporting attrition rates of over 30 per cent, Das said every bank has to build a core team to take care of such issues.

He also said that the career outlook of youngsters has changed with regard to job switching and added that the youth is “thinking differently” on this aspect.

Speaking at an industry event in Mumbai, Das said this is an “impatient generation”, where youngsters are switching jobs faster, as against the earlier generation’s tendencies to stick longer in a job. This is resulting in the high attrition rate, he said.

It can be noted that disclosures made in the annual reports revealed that many private sector lenders experienced an attrition of over 30 per cent in FY23.

Attrition of a company is the gradual reduction in the size of its workforce due to voluntary employee departures, such as resignation or retirement.

Employee attrition is a natural part of any business, but high attrition rates can be costly and disruptive. When employees leave, it can take time and resources to recruit, hire, and train new employees. Additionally, high attrition can lead to a loss of knowledge and expertise, and can damage morale among the remaining employees.

“We are also looking as a part of our supervision, the rate of attrition, which is seen to be high in certain private sector banks, and we have asked them to look at it,” news agency PTI quoted Das as saying.

“We are looking at it very closely because we find that the times have changed, and banks also need to give greater focus on this rate of attrition,” he added.

Drawing attention towards the changing preferences, Das said while the older generation stuck around for over 15-20 years in a job, the current does not and also hinted that switching jobs adds to the credentials on a CV these days.

Das said there is a need for the bank to build up its core team, which should grow with the bank over the years to take care of concerns around attrition. He said there are a slew of opportunities in banking, non-banking finance companies and the fintech sector, which are attracting talent, but added that the RBI prefers leaving it to the management to deal with the issue, rather than prescribing anything.

The RBI looks at the overall balance sheet of a bank when it makes suggestions on business models, Das said, adding that the central bank is not keen on micromanagement. Das also said the RBI’s supervision has not fallen behind the curve as compared to other countries, and is in sync with the requirements of the times.

(With PTI inputs)

Comments

0 comment