views

The average monthly rent in some of the top cities in India witnessed a sharp rise on account of increase in demand. Even as the demand for owning a house picked, the home loan rates were keeping prospective buyers anxious about the investment.

Now according to a latest report by property consultant Anarock, some cities have seen a jump in their rental price over a period of time.

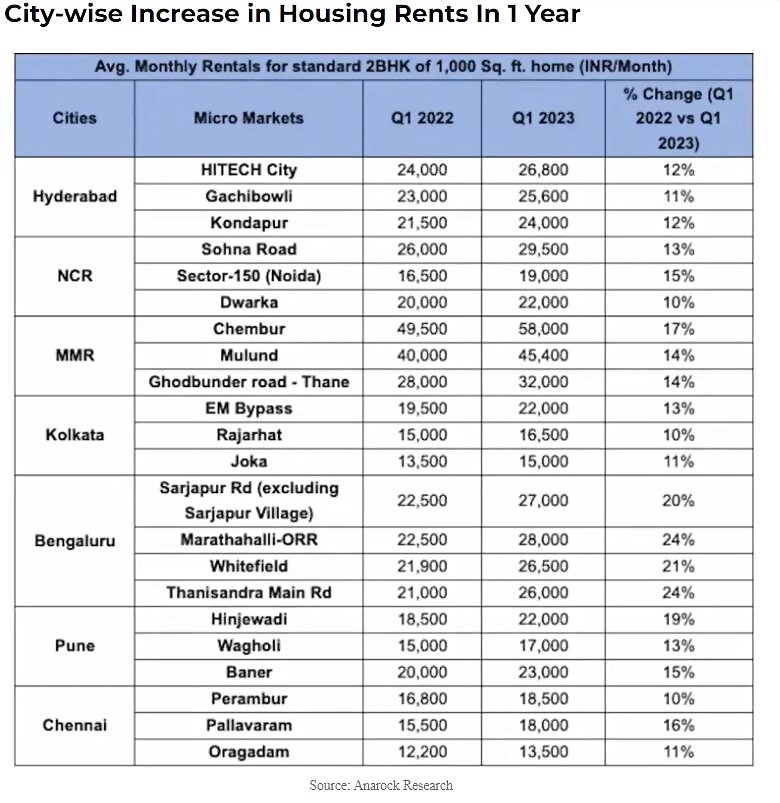

Cities like Bengaluru, Pune, Delhi-NCR, Mumbai Metropolitan Region, Chennai, Hyderabad and Kolkata registered a rise of average monthly rent between 11 to 24%.

Karnataka’s capital Bengaluru led the cities where rent saw a jump of 24% in some of the areas of the city.

North and east Bengaluru have witnessed maximum appreciation of up to 24% in average monthly rent for a 1,000-square feet two-bedroom apartment in the last one year among 7 major cities, according to Anarock.

Anarock said that Thanisandra Main Road and Marathahalli-ORR in Bengaluru recorded the highest residential rental growth of 24% each year-on-year in the January-March period for a standard 2BHK home of 1,000 square feet area.

Whitefield and Sarajpur in Bengaluru were at second and third positions with 21% and 20% growth, respectively, in rental between January-March 2022 and January-March 2023.

The consultant said that areas in east and north Bengaluru have seen a spurt in rental demand.

Bengaluru currently has the highest rental yield of 4.1% among all major cities, followed by Mumbai with 3.9%.

Prashant Thakur, senior director and head- research, Anarock Group, said, “When it comes to rental demand and zooming rents, Bengaluru currently stands out among the top 7 cities, with east and north Bengaluru the biggest blips on the rental radar map owing to the IT/ITeS belt there.”

Abhishek Tripathi, co-founder, Settl, said, “In a place like Bangalore during the pandemic, huge capital was deployed into hiring talent, especially in the IT sector and startups. During the same time, due to labour shortage, the increase in building supply was restricted and when the lockdown restrictions were removed and offices started to open up, people started moving to tier-I cities and settling down.”

“This disparity has created a housing crisis, especially in tier 1 cities in Bangalore. Hence, the increase in rent is a result of these multifarious factors,” Tripathi said.

As per the report, average monthly rentals for a standard 2BHK home of 1,000 sq ft at Thanisandra Main Road increased from Rs 21,000 per month in Q1 (January-March) 2022 to Rs 26,000/month in Q1, 2023.

At Marathahalli-ORR, average monthly rentals increased from Rs 22,500/month last year to Rs 28,000/month in Q1 2023.

The data showed that Pune’s three standout markets with high rental growth between Q1 2022 and Q1 2023 are Hinjewadi, Baner and Wagholi, which witnessed rental value growth of 19%, 15% and 13%, respectively.

In Chennai, the top 3 markets to witness high rental value growth are Pallavaram, Perambur and Oragadam, with rents in this period growing by 16%, 10% and 11% respectively.

In NCR, the top three markets were Sohna Road in Gurugram (rental values increased by 13%), Sector-150 in Noida (15% growth) and Dwarka in Delhi with a rental value growth of 10%.

In MMR, the top three markets for rental value growth were Chembur, Ghodbunder Road (Thane) and Mulund, which saw 17%, 14% and 14% growth, respectively.

Kolkata’s top three markets with high rental value growth between Q1 2022 and Q1 2023 were EM Bypass, Joka and Rajarhat, where rents rose by 13%, 11% and 10%, respectively.

In Hyderabad, the top three markets were HITECH City and Kondapur, which saw rental values increase by 12% each, and Gachibowli with 11% growth.

Interestingly the latest data came after another report, which stated that more than 95% of prospective homebuyers feel that a further increase in interest rate on home loans will affect their purchase decisions, according to a CII-Anarock survey.

“96% surveyed buyers confirm that further home loan rate hike will affect housing demand…Higher home loan rates will affect their home buying decisions in the future,” Anarock had said in a statement.

The RBI in its recent monetary policy kept the repo rate unchanged, contrary to the market expectations.

For over 80% property seekers, price remains an important factor as apart from home loan rates, the basic cost of property has been on the rise in the last one year.

(With inputs from agencies)

Read all the Latest Business News, Tax News and Stock Market Updates here

Comments

0 comment