views

Learning How to Exchange Your Credit Card Points

Review the rewards catalog. Your credit card company may provide you with a print or online rewards catalog. The catalog will typically detail the structure of the rewards program and will list the reward options available. Each reward will have a unique code and the required number of points needed to redeem it. After reviewing the catalog, call the customer service department or go online to redeem your selected reward. Be sure to have the reward code handy and check that you have accrued enough points to receive the desired reward. Your monthly credit card statement will list the number of reward points you have earned.

Call the card's customer service department. For help redeeming reward points, you can contact your credit card’s customer service line. Most rewards programs will allow you to redeem your points over the phone. The representative can let you know your available point balance and what rewards are available to you. They can also answer any questions you may have about your point accumulation and how long it will take to receive your reward.

Redeem your rewards online. Most credit card companies will provide you with access to your credit card statements, reward options, and redemption choices on an online portal or mobile banking app. Once you have signed into your account, look for a section that references your credit card points, such as “Redeem My Rewards,” or “Use My Points.” Click through to this section to review and claim your reward. Collecting your rewards online is similar to a regular online shopping experience, where you browse through the items available and add them to your cart. Instead of supplying payment information during the check-out process, you will be able to easily complete the transaction by exchanging your reward points.

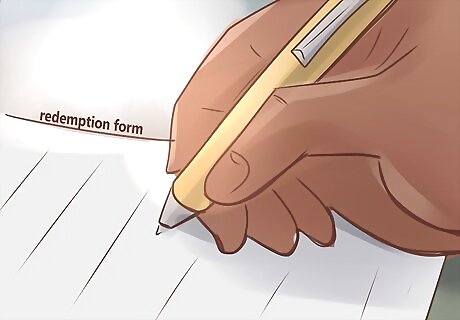

Complete a redemption form. Some reward programs will allow you to complete a redemption form, which you can then mail or fax to the credit card company. This form will ask that you provide a description of your selected reward along with the reward code, which can be found in the rewards catalog. The form can usually be found in your online or print rewards catalog. Be aware that it may take longer to receive your rewards when you use this redemption option.

Use your credit card to make purchases as usual. As you make purchases, you will accrue reward points for each dollar or other currency you spend. If you use your card for most purchases and pay off your bill in a timely manner, you can quickly accrue reward points. Be sure that you can pay off your credit card on time so you do not have to pay a late free.

Selecting a Reward Option

Cash out your reward points. Sixty-one percent of cardholders elect to redeem their points by transferring them into a cash. Typically, a card will provide 2% cash back on your purchases, but many cards now have a rotating point system—some months you will earn double points while buying groceries with your card, and other months you may earn more when you use your card at particular gas stations. This complicated system may make it difficult to keep track of how many points you have accumulated and how much money you will receive. However, redeeming your points for cash is a great way to ensure that you can spend the money however you wish.

Use your points for gift cards. Gift cards are a great way to redeem your reward points. Credit cards typically offer 1 cent for each point you accumulate. If your company offers gift cards for stores where you typically shop or would like to shop, this option may be the best for you. Some credit card companies have a limited selection of shops to choose from, which may not be helpful if you do not shop at those particular stores. Your credit card contract or catalog should detail your options for redeeming gift cards.

Elect to have your points transferred to a financial investment. There are a few credit cards that allow you to transfer your points into an a financial investment, a savings account, or an individual retirement account, or IRA. These cards often have excellent customer service as they are affiliated with particular financial institutions and brokerage firms, and the rewards percentage is usually higher than the average 1%. In addition, it makes contributing to your financial accounts easy.

Choose to spend your points on products. Many banks and credit card companies will allow you to log in to your online account and browse their online shop where your credit card points are your currency. This seems like a great option to finally snag a gadget or product you have had your eye on, but often the product price in the online shop is much more expensive than it is in a regular store. Research the product you want before redeeming it in the rewards shop.

Redeem your points for travel. Many reward options offer travelers the chance to translate points into discounted airline tickets, rental cars, and hotel stays. If you frequently travel, this may be a great option for you. However, there are only certain times when you can redeem these perks. If you try to book travel during a blackout time, you won’t be able to redeem your credit card points. Be sure to ask your credit card company about their policy for booking travel with your reward points.

Comments

0 comment