views

Selecting a Reputable Searching Agency

Determine your needs from the background check. A “background check” is a general term that includes a wide range of information that one person may want to know about another. Conducting a background check for a potential roommate or tenant is much different than conducting a background check for an employee. For a tenant, you will be more interested in a financial background check, while for an employee you will want to focus on your applicant’s history of criminal convictions. Some of the areas to consider checking are: criminal history civil records driver records employment history educational background license verification credit history personal references

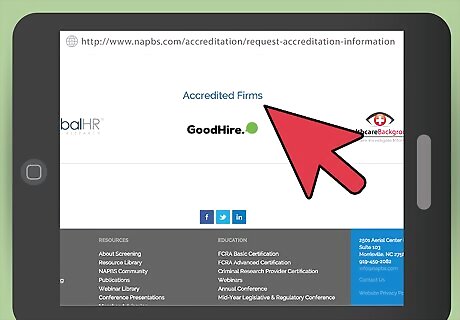

Use a company that is accredited by the NAPBS. The National Association of Professional Background Screeners (NAPBS) maintains a list of companies that are accredited to perform background searches. Review their information and contact the company or companies that will provide the service you need. You may select one company whose specialty is financial information, while another company may specialize in criminal records checks. Avoid questionable online commercial sites. A quick Internet search for “background check” will produce many, many companies that claim to be able to provide a “free” or “immediate” background check on anyone in the country. Many of these companies perform limited or incomplete record checks, using sources that are actually available to anyone in the general public. As a result, the information that you get may not be very reliable. Stick to NAPBS accredited companies.

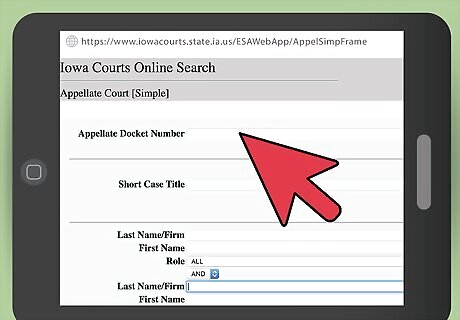

Assess your ability to complete the background check on your own. If you are needing to do a background check and you do not have the funds to hire an accredited service, think about conducting your own search. When completing your own search, be aware that it will take time and effort on your part to get the information you need. If you are not confident in your ability to conduct a proper background check on your own, it would be wise to spend money to have someone do it for you. To complete your own background check, start by doing basic searches online. When you conduct a search, put the person's name in quotation marks and then type what you are looking for (e.g., arrests, bankruptcy filings, addresses, phone numbers). However, be aware that a lot of information you find on the internet is not verified and may be false. Follow up your basic search by using verified government websites. For example, if you found that someone might have an arrest record, check your state's court system website. For example, in Iowa, you can search for court records by using the court's online search function. Ask the person for information. One of the easiest ways to get started on conducting your own background check is to ask the person for specific information, which might include their full name, address, phone number, and social security number. In addition, you might put together a short questionnaire that asks whether the person has ever been charged or convicted of a felony, or whether the person has ever filed for bankruptcy. You can then use this information to verify their answers online.

Try hiring a lawyer. Regardless of whether you use a professional service or conduct a background check on your own, you might want to hire a lawyer to make sure you are complying with the law. A lawyer will be able to tell you what information you can ask for without getting into trouble. To find a qualified lawyer, contact your state bar association's lawyer referral service. After answering a few questions, you will be put in touch with various lawyers in your area.

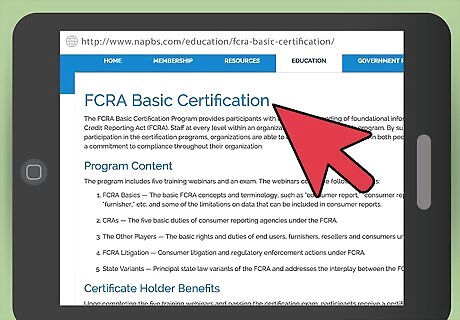

Be sure that you, or your searcher, comply with the federal Fair Credit Reporting Act (FCRA). This federal law requires certain disclosures to the person you are checking on, to prevent any secret or private background checks. If you use an accredited or certified background screener, you will be assured of compliance with the FCRA.

Get authorization from your subject before conducting your check. In today’s society, people understand that background checks are a common part of almost any application. For many types of research, you will need that applicant’s permission to get the records that you need. As part of your application packet, whether for a job, a residence, or something else, you should include a form that the applicant will sign, which will give you permission to conduct the background check that you need. Check online for templates of authorization forms. Additionally, whatever company you use to conduct the search will probably have a form that you can reproduce and include in your application materials.

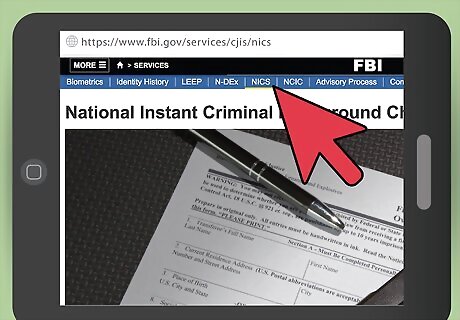

Use the NICS for firearms checks. The National Instant Criminal Background Check System, or NICS, is administered by the FBI and provides immediate information to people involved in the sale of firearms. Registered and licensed sellers of firearms, known as Federal Firearms Licensees (FFL), have access to the NICS. FFLs can call an access telephone number and receive an immediate reply about the eligibility of a prospective buyer.

Interpreting the Results of a Background Check

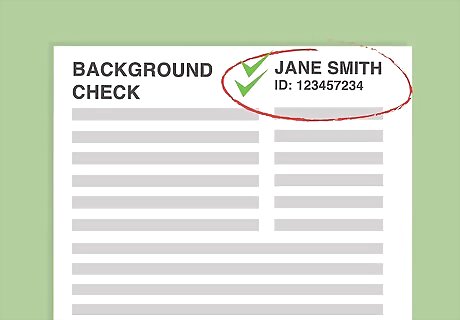

Verify the identity of the subject of the information you receive. The first thing you should always do is check that the report you receive matches the subject who is applying to you, whether for employment, residence, or anything else. To aid in verification, collect as much detailed information from the individual as possible before you conduct your search. Use such data as middle names or initials, prior addresses, and spouse or family information.

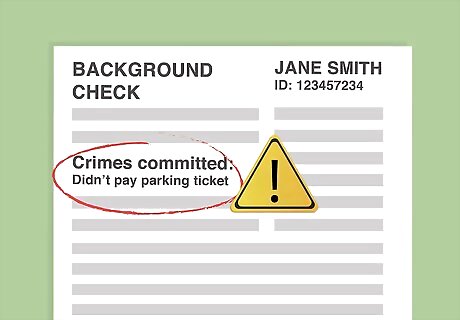

Decide the importance of any criminal information. A background check that turns up a history of some criminal activity by your subject does not automatically mean that you must deny that person’s application, whether for a job, a residence, or something else. You have the right to interpret the report that you receive and determine for yourself whether the history would justify a denial. For example, if you are hiring someone as a school bus driver, a recent conviction for a moving motor vehicle violation would probably be important enough to deny the application. But a history of parking tickets from many years ago would probably not. If you are checking on prospective tenants or roommates for an apartment, you may or may not be concerned if the individual has a conviction for marijuana possession. It will be up to you to decide if that factor is important. Be aware that, in some positions, you may not have the freedom to exercise discretion. In some hiring positions, for employees who care for the elderly or for young children, for example, you may be required to interpret the background check very strictly.

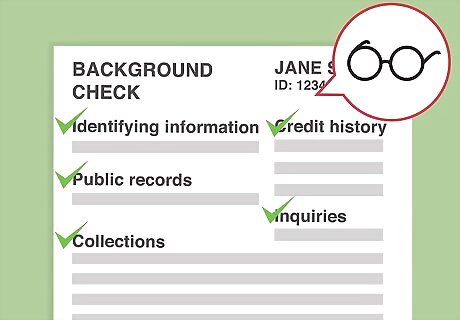

Read all parts of a financial credit report carefully. A financial credit report, which will generally come from one of the three major credit reporting agencies (TransUnion, Equifax or Experian), generally consists of five sections. You will want to review all sections of the report carefully and determine whether the information that you receive is important to you. Identifying information. It is most important that you verify that the report you receive matches the person who is applying to you. Check such details as the full name, including middle name if you have it, and the individual’s address. If you have any questions about the matching identity, you will need to contact the reporting agency to find other ways to verify a match. Public records. In the public records section of the credit report, you will find information that comes from county, state and federal courts. It will include such information as civil judgments, tax liens and bankruptcies. You will want to review the dates of each specific item in this section to determine its relevance. A bankruptcy case, for example, from many years ago, may not be relevant today, if everything else appears strong since that date. Collections. In this section, you will see if the individual has had any debts turned over to professional collection agencies. Someone with a long list of collections may be a risky person to take on as a tenant or to hire as an employee in charge of finances. Credit history. In the credit history section, also identified as “Trades,” you will see the subject’s buying and payment transactions. You will be able to use this information to see if the subject pays his or her bills in a timely fashion and is generally responsible with credit. Inquiries. This section provides a list of other offices, individuals or agencies who have made requests about this subject’s credit. By itself, an inquiry is not necessarily a negative point. However, if you find a large number of inquiries, you may question the reason.

Seek professional assistance if necessary. If you have questions regarding the results of any part of a background check, reach out and ask questions. If you conducted the search yourself, then you will want to contact the agency who provided you with the report to ask about its meaning. If you used a background checking company, call the company directly to ask about how to interpret any part of the report. You don’t want to make a decision about someone’s application based on an incorrect interpretation of the data.

Review any negative information with the subject of your search. Part of the Fair Credit Reporting Act is that the subject of a background search is entitled to be notified of negative decisions. He or she has the right to review the information that led to a negative decision, and may be able to appeal or explain. Before you make a final decision, you should report any negative information to your subject and ask for an explanation.

Controlling Your Own Background Check

Know your credit history. Before you apply for a job or a loan, you should know the information that your prospective lender or employer is going to find out. Get copies of your own credit reports before you go into the process of applying. Review the reports carefully, and contact the reporting companies or any individual lenders if you find things on the reports that need to be corrected. In some cases, you may be able to have negative items removed if they are old or if they are incorrect.

Understand your right to limit reference checks. You have the right, as part of applying for a new job, to limit the people that the employer contacts for reference checks. If you know that a past employer or supervisor is going to give a negative report about you, you may not want to let a prospective employer make that contact. You need to understand, however, that specifically limiting the contacts that a prospective employer may make is likely to raise concerns. A prospective employer might conclude that you are hiding something and use that as a reason not to hire you. Consider your options carefully. You may be better off letting the prospective employer make any contacts, and then explain a problem you had with your old boss, if necessary.

Be aware of your "social media footprint." Hiring personnel are likely to use all the resources that they have available in making decisions. This could include such things as Facebook, Twitter and Instagram postings. Before you submit any applications that are going to include a background check, you should conduct your own check of your social media footprint. Search for your name and see what information is available. You don't want a potential employer seeing photos of wild parties or reading any inflammatory comments that you may have posted about problems with your last boss. Either remove any compromising photos or other information, or change the security settings on your accounts. Make sure that private information is kept private. If you find accounts that you no longer use, it would be a good idea to close them.

Comments

0 comment