views

Setting Up A Contract

Make your payment policies clear at the time your services are retained. However your business is approved, whether it's by a client meeting, or by you submitting a bid, at some point, your client must agree to your estimated price for the work they want to be done. If your payment policies are stated clearly on your contract, bid, or whatever document you use to bind the contract, you are ahead of the game.

Accept all forms of payment and encourage credit card payment. In this way, you have a better chance to be paid in a timely fashion even if the client doesn't have the funds at the current moment. Shop for a merchant account provider with the best terms.

Get a deposit in advance. Unless you have a long-standing relationship with the client, get a deposit in advance, and then plan to collect another portion midway through the job. Usually, this is 30/30/40 - 30% in advance (to bind you, and to enable you to purchase materials), 30% upon completion of some agreed-upon benchmark, such as delivery of comps (rough sketches, if you are an artist, or small printouts if you make signs or do other design type work, etc.), and the balance upon completion. Be sure to define "completion" to mean on the day you deliver the work.

Offer a discount if they pay within 30 days or whatever arrangements you make in your contract and on your invoice. Alternatively, insert a clause with a penalty amount if an invoice is not paid on time.

Collecting Payments

Start out being friendly but persistent when collecting payments. Don't hesitate to escalate the situation if a customer hasn't paid on time despite your best efforts with the contract. The challenge is to get paid without jeopardizing your future relationship with the customer.

Accept upfront payments if the customer offers. Many times a client will ask, "Do you need a check now?" and the business owner says, "No, that's okay, we'll get it at the end." Don't do this! If the customer is happy to pay upfront - let them!

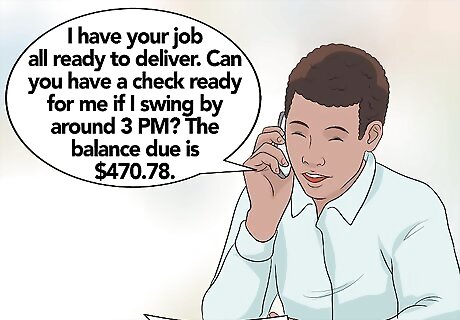

Make arrangements for payment before you deliver the final product. Hold back enough so that they will need to pay you before you deliver the finished job. It is not unprofessional for you to do so, though many business owners consider this a "low-rent" practice. It's not low-rent - it does not telegraph to your clients that you cannot afford to await payment. Rather it lets them know that you are a professional accustomed to being paid for your work on time. Just say something like, "Hey, Mr. Jones, I have your job all ready to deliver. Can you have a check ready for me if I swing by around 3 PM?. The balance due is $470.78."

Follow up every day until you receive your money. This should start the very next day after your payment was due. Obviously, you should try to get paid before this need arises. However, sometimes, you have a lapse in judgment, or you're lulled into a sense of security by a client you've had no problems with in the past. Once your client realizes your payment policies are lax, they will opportunistically attempt to exploit it. Remember - every minute that you are working to get paid is a minute that (A) you are working a second time for money you've already earned and (B) you are not working on a new job, which still needs to be finished on time.

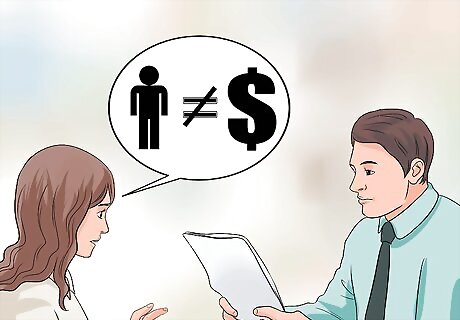

Apply your payment policies to every single customer. Don't give friends, friends of friends or family any special treatment. If anything, treat them with even less trust than a stranger - they often attempt to take advantage of your relationship. If the client has not paid you by your due date, call them immediately and ask for payment. If you are put off till the next day, call again the very next morning.

Contact the credit agencies. Printing a warning on the bottom of your invoices is fine, but if you fail to follow it up, you won't ever be taken seriously. For customers who are consistently late in paying, contact the credit agencies, Experian, TRW, etc., and report late-payers if the payment is more than 30 days late. Call the client first, and let them know that you're terribly sorry to do it, but unless you receive their payment before the 30-day deadline, you will have to report it to the credit agencies, thus damaging their credit. It's a powerful incentive to pay.

Collecting Smarter Not Harder

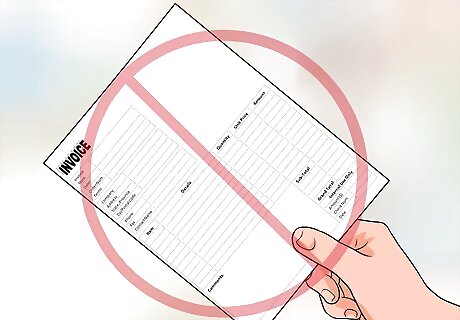

Stop sending paper invoices. Postage is expensive and putting hard copies in the mail only slows down the process. Send invoices via email or invest in an automated billing system that will email invoices for you and continue to send reminders to the client until the invoice is paid. The client can also pay online.

Do what lawyers do and ask for a retainer. This is an amount paid upfront that you draw down as you complete the work. When that amount is used up you ask the client to replenish it before you continue on with the work.

Set up a recurring billing system. Here the client provides a credit card or bank account number and you take what you are owed on the same day each month.

Hire someone to follow up on your accounts receivable. If you can afford it, this gives you a more professional appearance and makes payment seem more urgent. Even if it's your spouse, who uses another name to make the calls, this way your amiable relationship with the client is not jeopardized by crass calls about money.

Don't hesitate to report people to a collection agency if you don't get paid. Often, collectors will pay up to 50% of what you're owed, just for the opportunity to try to collect it.

Comments

0 comment