views

In the bloody era of bare-knuckle boxing, the first ever world heavyweight championship took place on Hampshire meadows in 1860, between two men totally unlike each other. American John Heenan, a well-read musician and gold prospector, fought Briton Tom Sayers, the illiterate son of a cobbler. The fight went down as the most brutal in history. They punched each other to near-death, and fought on despite Heenan losing his sight and Sayers dislocating a shoulder. After 140 minutes and 37 rounds, police intervened to stop the fight inconclusively. It had been so savage that it forced both the fighters into retirement.

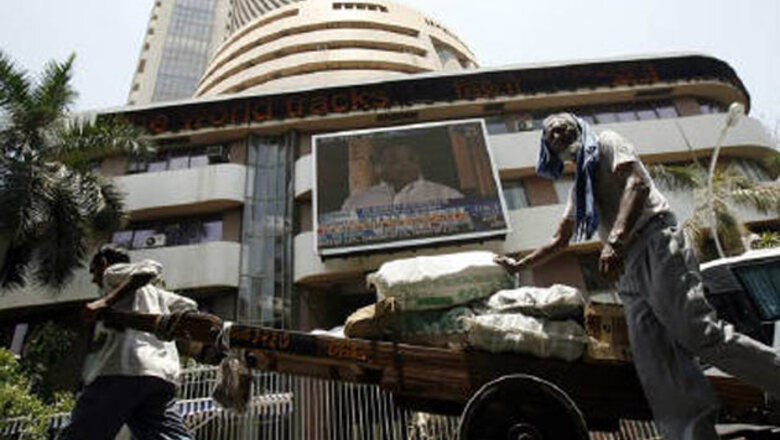

In the much gentler present, however, such fights don’t take place in the meadows. They are often hosted at the boardrooms in the world of money. Equally ferocious and cunning, these fights nevertheless involve adversaries in their suits delivering heavy blows in practiced vocabulary. Not a drop of blood may be shed, but fortunes are made and lost, careers are built and demolished, heroes born and buried. In ruthlessness, they make the boxing ring look like the Garden of Eden.

This is the story of one such fight. The battlefield is India’s stock market, the stakes are the lucrative fees for putting through the millions of buy and sell orders for shares, bonds, currency and their derivative contracts. The adversaries, just like the prize fighters at Hampshire, are two diametrically opposite characters, common only in their killer’s instinct. And it is already developing into a bloody good fight.

On the one side is National Stock Exchange (NSE), which has replaced the Bombay Stock Exchange (BSE) as India’s premier bourse. It has an impeccable pedigree with the country’s best-known public and private institutions as well as marquee foreign financial giants as its shareholders. It has built up a virtual monopoly in stock derivatives and enjoys a net profit margin of more than 50 percent. Its benchmark index, the 50-share Nifty, is increasingly becoming a global asset. NSE is run by suave and classy executives.

On the other corner is MCX-SX, India’s newest stock exchange promoted by the Financial Technologies group of Jignesh Shah, a maverick businessman who quit a career as an engineer at BSE to become an entrepreneur just about the time NSE was starting 15 years ago. Shah is known for his lightning speed of execution. After all, he made a billion dollars in about a decade and built India’s largest commodities exchange in half that duration. To run the stock exchange, he has put together a team of aggressive strategists and technology experts who share his love for a good fight.

The two will come to blows in a matter of two, perhaps three, months when MCX-SX starts hosting the trading of equity shares and their derivatives. The clash will most certainly change the way you and I invest. In the marketplace, they will hit each other where it hurts most – transaction fees, trading and settlement norms, membership drives, variety in investment products, global outreach and ways to attract the non-investing public into the markets.

The duel shall come later, but the sparring has begun already. Both NSE and MCX-SX have unleashed an information war, leaving neither media nor regulators and courts unaddressed in their quest to discredit each other. Doubtless, their rivalry has a longer history, but it has reached a feverish pitch in the last few weeks as the D-day approaches. MCX-SX portrays NSE as a monopolist who doesn’t want competition, while NSE portrays Shah’s group as an unruly fighter that must be contained.

Ugly as it may be, the fight has already brought us benefits. It has thrown light over the way the stock market is run in the country. In a population of 1.2 billion people, less than 15 million have turned investors so far. Questions are being asked about taking investing to the next 100 million. India had a vibrant network of regional stock exchanges even a decade or so ago and the need for reviving activity in those corners is being felt now.

NSE is ever keener to dispel any notion of its being a slumbering giant and MCX-SX is going the extra mile to assert its credibility. It might all lead to a happy ending if the fight yields investors a more efficient and transparent market at sustainably lower costs of transaction.

The next frontier

The day the first equity deal is put through MCX-SX, it would have earned a rare distinction. There are exactly 99 major stock exchanges in the world and MCX-SX would be the 100th. Forty percent of the world’s stock exchanges are less than two decades old. They are changing the face of the industry with technology. Stock trading, a largely national affair till the 1990s, has become global thanks to electronic trading.

As one who made money in the burst of technology in the exchange business, Jignesh Shah quickly moved on to run exchanges himself. His flagship venture, Financial Technologies (FT), provides software for broker terminals and has a commanding market share. Eighty percent of NSE brokers use FT’s software. The Multi Commodity Exchange of India (MCX) promoted by him has become the world’s sixth largest commodities futures exchange, overtaking London Metal Exchange. His group has branched into other asset classes such as currency and power. The next frontier is the equity market.

The temptation is understandable. The stock exchange business is exploding the world over. Global trading volumes have reached an unprecedented $ 500 trillion, or nine times the world’s GDP. Each transaction fetches a risk-free fee to the exchange. Volumes are growing at 20 percent a year and core profits (earnings before interest, tax, depreciation and amortisation, or EBITDA) can be as high as 60-80 percent. The business offers steady cash flow in return for a one-time investment and the stickiness of customers (members) is high.

Indian exchanges are poised for even better performance, says a research report by IDFC-SSKI. Their current turnover of $ 4 trillion could balloon to $ 10 trillion by 2014. Indians are diversifying their investment across asset classes, from equity to commodities, currency and even power. The growing economy is spurring investment interest in smaller towns and even villages. On the other hand, India’s regional stock exchanges have been pretty much marginalised by the Big Two: NSE and BSE. The latter is largely a spot exchange for shares and hasn’t found success in new revenue streams. That leaves just NSE to bite into this very big apple.

Not if Shah has his way. With MCX for commodities, he has already stolen a march over everybody, including the National Commodity and Derivatives Exchange (NCDEX) promoted by NSE and a clutch of financial institutions. Currency trading on MCX-SX has already overtaken the corresponding volume on NSE. He believes he can find similar success in equities. But that would hit the core of NSE’s business; the same NSE which gave Jignesh Shah the first big break in business years ago.

The odd man in

Jignesh Shah was once sent to London by his employer BSE so that he may learn the modern advancements in stock exchange technology and implement them back home. A few of his colleagues also went to places like New York and Tokyo. Shah says they all came back in September 1993 fully armed with the latest knowledge of world markets and waited. They waited for 15 months for BSE to roll out its initiative. But BSE ended up outsourcing the job and the group got frustrated, says Shah. On January 1, 1995, they broke their three-year bonds with BSE and started an exchange software business on their own. Shah says he paid BSE Rs. 15 lakh on his and his friends’ behalf as penalty for breaking the bonds. It proved to be a shrewd investment. Thirteen years later, he had stepped into the Forbes Billionaires List as the world's 1,014th richest man.

Back when he was starting out, he went to both BSE and NSE demonstrating the broker terminal software his company had developed. With big companies like Tata Consultancy pitching for the same business, the odds were quite against Shah. He was neither a financial expert nor a trader. He wasn’t a software architect either. “I didn’t know the difference between shares and debentures when I joined BSE,” Shah says. But he succeeded in his presentation to NSE. FT was empanelled along with the big companies. And he soon outsold his competitors. Even after all these years and the current bitter fight with NSE, there is nostalgia and gratitude in Shah’s voice as he recounts that turning point.

The second time Shah was considered an odd man out was when he started MCX in 2003. Again, his lack of pedigree was cited by critics. Not many gave him a chance against the expertise available at NSE’s baby, NCDEX. Again, Shah had the last word. In seven years, MCX has become the benchmark platform for trading in metals and energy, though it has lost out to NCDEX in agricultural commodities.

Shah then looked around for other classes. He decided to start a stock exchange and also set up an ecosystem of multi-asset exchanges abroad. He started currency futures on the stock exchange and waited for approval to start equity trading. On the other hand, NSE was also moving into Shah’s territory, financial software. With each stepping on the other’s toes, an all-out war was inevitable.

Four out of five NSE brokers use ODIN, a computer-to-computer linkage software developed by FT. On October 2008, NSE put this on a watch-list saying that there have been member complaints of bugs and performance issues. It also rejected FT’s application for the issue of any new licences. Shah was livid with what he saw as a measure to stifle competition. He went to court alleging malafide intentions on the part of NSE. The court has appointed KPMG to do a systems audit and asked NSE not to stop issue of fresh licenses. The battle goes on.

NSE also gives NOW, a competing software developed by a group company, free of cost to brokers. Its policy is to popularise the new product until it gains wide acceptance. But Shah asserts this is predatory pricing designed to hit ODIN.

There is another fight going on in the currency futures segment. NSE eliminated the transaction charges on currency futures saying it wants to attract trades. Shah complained to the Competition Commission of India (CCI) calling this a monopolistic practice. He says NSE, with annual net profit of more than Rs. 500 crore, could afford to waive fees, but that forces the nascent MCX-SX to do the same to remain competitive. As a result, MCX-SX has incurred a total loss of Rs. 85 crore till now.

Next, NCDEX lowered transaction charges on commodities to a mere 5 paise per Rs. 1 lakh for evening trades as against Rs. 2 to Rs. 3 during the day. It was a major threat to MCX in commodities where it doesn’t have big volumes. Shah’s team followed it up vigorously and the regulator, Forward Markets Commission (FMC), stayed the price cut. A subsequent court case confirmed the decision.

A move by Power Exchange India (PEI), jointly promoted by NSE and NCDEX, has also led to a delay in MCX’s plan to start electricity futures trading. When MCX applied for FMC permission, PEI petitioned the Central Electricity Regulatory Authority (CERC) saying FMC doesn’t have the authority on power futures. The two regulators are engaged in a turf war right now and a quick decision looks unlikely.

The fireworks will become more brilliant in the next few months as the fight shifts to the marketplace. Ironically, amid all this quarrel, NSE has retained its 1 percent stake in MCX that it bought five years ago. Shah’s group, too, retains an identical stake in NSE. The mutual share ownership is a way for each to keep a close eye on the other; or it is grudging respect that one has for the rival’s strategic genius and the knockout punch that could come anytime.

Ready for the invasion

At the top floor of Exchange Square in the Mumbai suburb of Andheri, just outside Jignesh Shah’s office, is a private lawn of the size of a badminton court. “It is an ideal place for under-arm cricket,” says Shah adding, “I have this because I can relax here when others do the work.” The cricket bit may help reassert his middle-class moorings, but the one about not working is intriguing. Shah has worked furiously for the past 15 years to become one of the most powerful men in India’s financial markets. So, it is hard to think of him as relaxing. But he does insist that he has left the management of both MCX and the new stock exchange to his team and spends 15 days in a month in Singapore.

Shah says he has now moved on to the role of a mentor in FT group, trusting his friends Dewang Neralla, V. Hariharan and others to run the operations. The stock exchange is in the hands of his lieutenants Joseph Massey, managing director and CEO, and U. Venkataraman, executive director.

If Shah lives up to his hands-off approach, it’ll actually mark a turnaround in his management style. “Jignesh has a peculiar way of working,” says a former executive who has worked with Shah in major ventures. “He is a control freak. He wants to get into every small aspect and detail of a plan. He sits with his managers and takes complete charge to the extent that the managers start to feel uncomfortable.”

But Shah must end his micro-managing and focus on shaping up a global strategy for FT group. Technology has broken down all barriers to investing and before long, the Indian market could become a hunting ground for foreign exchanges. He also knows how NSE has scripted its own globalisation strategy, taking Nifty global and bringing foreign indices to India.

With Shah’s new thinking, FT is moving to run multi-asset exchanges in Singapore, Dubai, Botswana, Mauritius and Bahrain. These plans have already missed their deadlines and FT investors would be watching whether he can pull them off. “By the end of FY 2011, three of these bourses will go on stream,” he says. “I spend all my time now thinking of new markets.”

But there is one thing to settle before he can totally devote his time to foreign ventures. The war with NSE has just begun and the task of carving out a space for MCX-SX in a community besotted with NSE won’t be easy. Massey’s team will have to show good volumes quickly on the spot as well as derivatives markets to become a serious player. It will be extremely difficult to convince NSE members to shift their volumes to the new exchange. “As observed globally, once volumes gravitate to an exchange, very rarely do they migrate to a different platform. Thus, liquidity is sticky,” Nikhil Vora, research director at IDFC-SSKI, wrote in a recent report.

Untested waters

To have any chance, MCX-SX will need to go beyond the existing community of brokers, traders and investors. The Indian exchanges may have done very well in improving governance and risk management systems but they have failed to attract a large number of people with disposable income hoarded in fixed deposits, real estate and gold. MCX-SX will target them.

There are four key elements to MCX-SX’s business model with the underlying theme being, expand the market rather than fight for the same pie.

One route to go is through regional stock exchanges, a risky and previously failed ploy. MCX-SX is in talks with some regional exchanges to get their members on its trading platform. Many of these brokers had become dormant or started serving as sub-brokers to NSE members. Massey says it would be aspirational for them to gain direct access to a national exchange as principals.

The next task would be to get local companies to raise money through the tie-up with local exchanges. Many of these companies don’t issue a public offer at all, because they lack the ambition to be noticed nationally and the local exchanges are also inactive.

In trying to revive the regional stock exchange (RSE) network, Shah is playing a game where the country’s best thinkers have failed twice. RSEs became redundant with the emergence of a national market for stocks thanks to NSE and later BSE. Strong vested interests prevented many of these RSEs from modernising. Attempts like the Inter-Connected Stock Exchange and BSE’s Indo Next tried to create a common network but failed because the order books remained fragmented and each RSE pulled in a different direction. Massey knows this only too well, having once headed ICSE. He would have a tough time convincing the trading community of the need to revive the RSE network and building volumes on them.

The second element of the plan is to attract investors and traders by offering something that NSE doesn’t have -- stock futures that end in delivery of shares. Now, derivatives on NSE are settled in cash; there is no actual exchange of shares. But in MCX-SX contracts, unless squared off or rolled over, the seller must deliver the shares and the buyer must take delivery. A futures writer who has no shares must therefore borrow it from an investor in the cash market and make delivery. He must pay a charge for the duration before he buys the shares again and returns them. Thus long-term investors will be able to earn some sort of a rent on their shareholdings. It will also put the massive promoter holdings and the stakes held by institutions into market action.

Here too, MCX-SX will be trying out a failed system. Stock lending and borrowing has not developed in India despite repeated attempts. Authorities had said at the time of introducing derivatives in India that physical settlement would be introduced in two years. It took ten years because of the lack of a lending market.

Not settled yet

Will physical settlement work in India? It is difficult to say. There are merits and demerits in both forms. Physical settlements connect the markets to the real economy, reduce chances of manipulation and keeps out non-serious players. However, those who own shares can hold futures sellers to ransom because without their lending or selling, delivery cannot be effected. Cash settlement is easier to administer, imposes lower costs and is understood in the market very well.

The third part of the strategy is to undertake training programmes on investing across India. People in second and third tier locations, who learn about stocks and currency and commodities from the FT group’s exchanges, are likely to trade on them too.

The fourth element, of course, is fighting on price. Shah says MCX-SX will reduce transaction fees by 50 percent. NSE charges Rs. 2 per contract value of Rs. 1 lakh in the derivative market. The new exchange will charge only Rs. 1. Shah saw NSE enjoy nearly 70 percent EBITDA margin on the current transaction charges. He decided to settle for a lower fee. He insists that this will not be a price war but only “price rationalisation.” There is scope for cutting price down to “reasonable” levels, corresponding to an EBITDA margin of around 30-35 percent.

With the business model in place, the only hurdle for MCX-SX to start the equity platform was the regulatory requirement that no single entity which is not a financial institution can hold more than 5 percent stake in an exchange. FT and MCX, which had together held 70 percent stake, had to reduce the stake to 5 percent each. In the third week of April, Shah announced that 18 banks and two financial institutions have bought the shares and thus MCX-SX has complied with the norm. The equity capital that FT and MCX earlier held was converted into warrants that they will seek to sell later. The group can then move on to the newer exchanges.

The business plan of MCX-SX, true to Shah’s style, is going into perilous territory where success has eluded bigger players. Many market watchers are sceptical about his success, but those who know him say he understands the risks very well. “Most people feel that MCX-SX will not take off because of the bottom-of-the-pyramid approach. Everyone feels that financial markets are the bastion of the cities,” says an ex-banker who has worked with FT group closely. But “Jignesh will get into the non-urban markets and find out those people who will help him penetrate. He will reach to areas that the bigger exchanges have not even dreamed of going. It might take him time but he will do it.”

A fortress called Nifty

There is one thing common to both Jignesh Shah and Ravi Narain, managing director and CEO of NSE. They both gave up potentially big careers in the United States to come back and work in India. Shah passed up an offer from Merrill Lynch when BSE had sent him to study foreign markets, and Narain left a lucrative career as an economic and policy consultant in Washington to join the public sector IDBI, from where he was later chosen to join the founding team of NSE.

But the similarity ends there. Shah is a very visible, media-savvy entrepreneur who can engage journalists in chit-chat for hours together. He also actively networks with those in the corridors of power. All this, and the billionaire tag, has made him a unique brand in the market circles.

On the other hand, Narain is media-shy and self-effacing. Hardly anything is known about his personal life beyond the fact that he is an economics graduate from Cambridge and a Wharton School MBA. Despite running the country’s biggest exchange, he rarely meets journalists. Even path-breaking initiatives from NSE merit little beyond a press release. Over time, this reticence has even earned NSE a bad name of being arrogant.

So it was on a sunny afternoon in April that Forbes India caught up with Narain and his joint MD Chitra Ramkrishna to understand NSE’s game plan in an era of intensifying competition from both home and abroad. The two top executives have been busy giving shape to NSE’s third big leap in its 15-year-long history; one as big as its introduction of electronic trading in India and its launch of stock derivatives.

The timing couldn’t have been more urgent. As the leading stock market in India with 95 percent market share in derivatives, NSE will be the primary target of attack from not just the new players like MCX-SX but also foreign stock exchanges wanting a piece of the India pie. “The threat can be from any side if we fall asleep at the wheel,” says Narayan. “It is important for us to be up and about.”

The stock exchange business was caught in a whirlwind of consolidation a decade ago. The advent of electronic trading shrunk distances and investors grew interested in foreign assets to protect themselves from home-country risk. This drove exchanges such as New York, London, Tokyo and Frankfurt to merge with other exchanges or strike alliances.

That action is now shifting to developing countries, especially fast-growing large economies such as China and India, thanks to the economic crisis in 2008-09. Basically stock markets follow where capital formation goes. Asia has risen as the world’s premier marketplace, accounting for 34 percent of global market capitalisation ahead of America (33 percent) and Europe (27 percent). Among the seven largest stock exchanges in the world by volume, five are in Asia; of them, two are in India and two in China.

Already NYSE-Euronext, the world’s largest stock market, has turned its attention towards India and bought a 5 percent stake each in NSE and MCX. By all indications, a wave of global exchanges will come to sweep away NSE’s market share.

Merging markets

Narain’s reponse to this inevitable globalisation is to convert some of those exchanges to partners. He says he doesn’t want to go the merger route because mergers rarely work. Cross-listing alliances, on the other hand, expand the market for investors from both sides without having to integrate. So, Narain & co. decided to take NSE’s benchmark index, Nifty, for trading in the global markets.

But the Indian investor, too, is looking for diversification. A string of brokerages have sensed an opportunity in helping him invest in foreign stocks and opened offices in places like London and Singapore. NSE can’t afford to let its customer migrate to foreign stock exchanges even for a small portion of his investments. So, Narain decided to bring foreign indices to India. (Though he readily admits, “It is easy to describe. It is a little painful to execute.”)

NSE took a leap in this direction a couple of months ago when it tied up with Chicago Mercantile Exchange for a product-swapping deal. Under this, Nifty will be traded as dollar-denominated futures in the US, getting NSE revenue from American investors looking for India exposure. The deal will also enable indices such as S&P 500 and Dow Jones Industrial Average to be traded in India in rupees.

Nifty’s going to the US is part of Narain’s strategy to build revenue streams based on this flagship index as well other supporting indices such as Nifty Junior and CNX 100. His experiment with Singapore Stock Exchange (SGX) has been a huge success. In 2009, as many as 7.1 million contracts on Nifty were traded on SGX. Further, total traded value of India-based ETFs on SGX rose 48 percent to $ 2.6 billion.

Exchange-traded funds based on NSE’s index are already traded in seven other global exchanges including Tokyo and London. Typically, NSE charges one basis point (0.01 percent) fee allowing the use of an index in an ETF. “The approach is really about value creation by extending businesses and partnerships by what we can share on products and customers between markets,” says Chitra.

An exchange-traded fund based on Hong Kong’s Hang Seng index went on stream recently. This index has 60 percent exposure to mainland China companies. Hong Kong is just 2:30 hours ahead of Mumbai and there is a significant window when both markets are active.

NSE must also nudge its derivatives market to the next level. This segment has reached a tipping point. Derivative trading value on NSE increased 87 percent in 2009, with options alone more than doubling. Now, the derivative market is 5.2 times the size of the cash market. This has given the critical mass for the introduction of newer products. Narain says complex derivative products are on the anvil. “These products will be slightly more sophisticated than the basic products,” he says.

To give a sense of what these products could be, Narain cites the example of volatility. India is among the more volatile markets and investors would like to take a view on the extent of price changes than their direction. “The market is craving for a volatility product,” says Narain. Already, traders are using a complex web of options to trade volatility by proxy because NSE doesn’t have a defined product. The exchange does publish a volatility index at the end of each trading day and plans to make it live intra-day shortly. Once investors fully understand the new animal, Narain will launch a tradable contract.

Given that investors and brokers are moving to multiple asset classes, NSE is also following suit. It already offers currency and interest rate futures, though it has faced pain in building volumes on them. “On currency, we have a very long way to go and the surface [has been] barely scratched,” says Narain. Exporters and importers deal with banks directly and are yet to take to trading forex on the exchanges in a big way. This over-the-counter market is worth $ 40 billion that has the potential to move to exchanges over time.

But interest rate futures have been a bigger problem. Two attempts and NSE hasn’t yet succeeded in cracking this market. Narain cites the legal requirement that all interest rate futures (future contracts on bond values) must end in physical delivery is driving away buyers because the underlying bond market is illiquid. “Till we crack the design problem, the IRF market will be like this,” he says. Again, the potential is huge. There are about one million exporters and importers that could get on to that platform.

Narain and Chitra see technology as a critical competitive tool for NSE. Large investors are installing powerful computers to execute orders more quickly than competition. They demand shorter and shorter response time from stock exchanges. Narain is also working on reducing the round-trip time for each order through the system. “Today, the exchange takes about five milliseconds for the roundtrip. We have already targeted one millisecond.”

Home truths

Narain also has a specific recipe for fighting MCX-SX. Even as Jignesh Shah prepares to woo regional stock exchanges, NSE has begun bringing select companies from such exchanges on its platform. The case in point is its deal with Madras Stock Exchange, which has high-quality but conservative companies such as Amrutanjan, IP Rings, Bimetal Bearings and TTK Pharma. NSE did due diligence on 29 such companies and put them on its trading floor. Within two months, Chitra says, the volumes on these stocks doubled.

While many RSEs are moribund, there are some where there is still life left. High-quality companies -- conservative and inward-looking but having a lot of investment potential -- are listed on these exchanges with little trading. Sooner or later, some exchange will tap this forgotten segment of India’s capital market. NSE might as well do it.

Getting enough market attention for these companies is quite a challenge, given that their performance is hardly tracked by analysts. To get around this problem, NSE has tied up with Crisil for a quarterly review of their performance.

The second area where NSE will hit back at MCX-SX is the small and medium companies sector. The regulator has allowed setting up separate exchanges for SMEs with liberal eligibility norms. Both the warring sides have spoken about setting up exclusive SME exchanges.

Narain points out that the experiment has not worked anywhere in the world and NSE must proceed cautiously in creating one. “A lot of quiet work is happening on the SME platform. But we have a long way to go before we can launch it.”

What about the agenda that MCX-SX will seek to set for the industry -- like physical settlement of derivatives or reducing transaction charges on stock futures? Both Narain and Chitra assert they have the capability to match any such move if it comes to that. Only recently did the regulator allow physical settlement in stock futures and NSE has been following the earlier stipulation of cash settlement. But NSE is a huge stock delivery platform. As much as 28 percent of its trades end in delivery. Compare this with the commodities market in the country, where deliveries are just 1 percent.

Narain says NSE has the muscle to adopt a delivery-based system, though whether it will feel the need to do so is uncertain. He argues the cash-settled market mimics the physical market quite well and is also a simpler, easier system.

On pricing, too, NSE is gearing up to take up the gauntlet. “If there is a price war and we have to reduce [charges], we will reduce. It is a non-issue,” he says. However, he also points out that NSE has reduced transaction fees eight times in its history, bringing it to just 1 percent of the total cost of transaction.

NSE has certainly been quite nimble in the recent months to respond to the changing milieu. Call it the competition effect, but members say they see a new dynamism in the exchange’s approach. It is more than a fighting chance that the great exchange rivalry of circa 2010 will go down in financial markets history as the most defining event of the era.

A Backdoor That Leads Nowhere

Does Your Company Have Good Innovation Governance?

Comments

0 comment