views

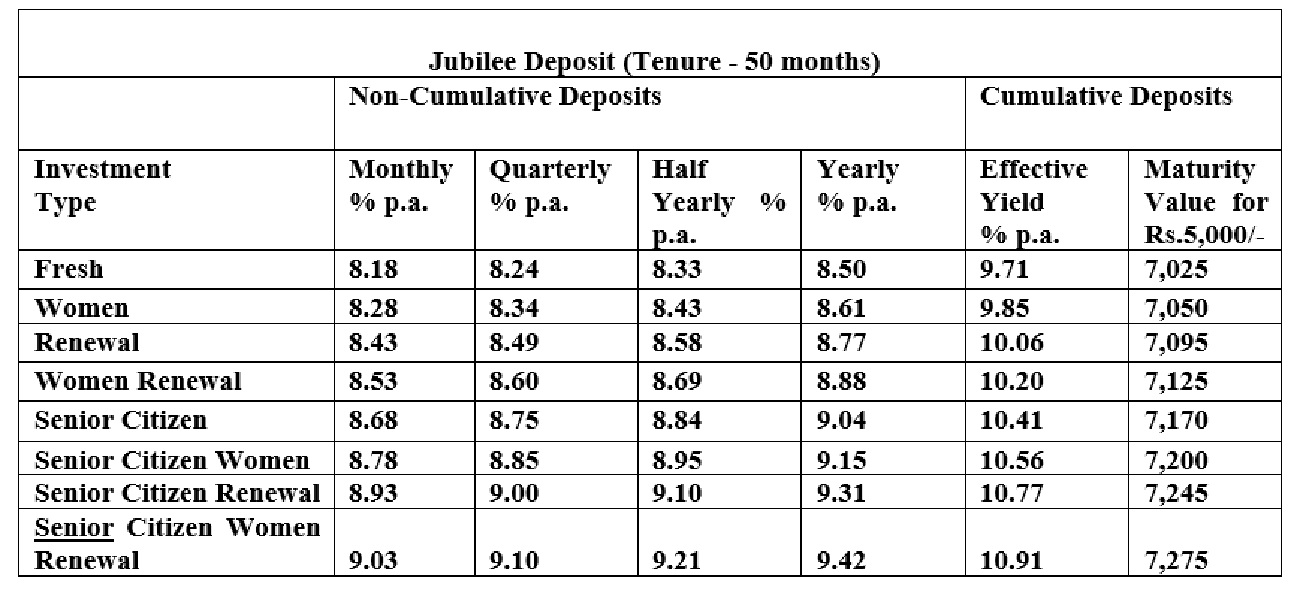

Shriram Finance Limited (SFL), India’s largest retail NBFC, on Wednesday announced a special fixed deposit rate under Jubilee Deposit (Shriram Unnati Deposits), to coincide with the Group’s golden jubilee celebrations. Under the FD scheme, investors can earn interest up to 9.15 per cent on fixed deposits (FDs). The rates will be effective from April 5, 2023.

“The company will accept applications for fresh and renewal of fixed deposits of 50 months’ tenure with interests,” Shriram Finance said in a statement.

It also said women investors will receive an extra 0.10 per cent per annum interest. Senior citizens will receive an additional interest of 0.50 per cent p.a. Senior citizen women will receive an additional interest of 0.60 per cent p.a. All the above tenures will be available for both offline and online investments.

The RBI has been continuously increasing the key repo rate in order to control inflation in the country. It has raised the repo rate six times by 250 basis points in total since May 2022 in order to control inflation. In the last MPC meet in February, the RBI raised the key repo rate by 25 basis points to 6.50 per cent.

Comparison With Bank FDs

Currently, HDFC Bank offers up to 7.1 per cent interest rates for the general public and up to 7.6 per cent rates for senior citizens (above 60 years of age). PNB offers up to 7.25 per cent for the general public and 7.75 per cent for senior citizens. ICICI Bank offers up to 7.1 per cent to the general public and 7.6 per cent to senior citizens.

Bank FDs are time deposits wherein depositors keep their money for a fixed time, let’s say, 6 months, 1 year, 3 years or 5 years. The bank offers fixed annual interest rates on this fixed deposit, and the rates vary based on FD tenure and the depositor’s age.

Comparison With Small Savings Schemes

These are savings instruments managed by the government to encourage citizens to save regularly. The small savings schemes have three categories — savings deposits, social security schemes and monthly income plan.

Saving deposits include 1-3-year time deposits and 5-year recurring deposits. These also include saving certificates such as National Saving Certificates (NSC) and Kisan Vikas Patra (KVP). Social security schemes include Public Provident Fund (PPF), Sukanya Samriddhi Account and Senior Citizens Savings Scheme. The monthly income plan includes the Monthly Income Account.

Sukanya Samriddhi Account is currently offering 8.0 per cent interest rate, followed by National Saving Certificates (7.7 per cent), 5-year post office time deposits & Kisan Vikas Patra (7.5 per cent each) and Public Provident Fund (7.1 per cent).

Read all the Latest Business News here

Comments

0 comment