views

Many people are not fully aware of the various types of scams and frauds that exist, making them more susceptible to deception. Scammers prey on individuals’ lack of knowledge about these frauds. Also, as technology advances, some individuals may not keep up with the latest security measures or may not fully understand the risks associated with online activities, making them prone to cyber scams or offline risks involving the loss of their money.

The nature of scams and frauds changes rapidly, so it’s essential to stay updated with the latest news and warnings from official sources to protect yourself from emerging scams.

Also Read: ATM PIN Scam Alert! What Is ‘Shoulder Surfing’? Here’s How To Protect Debit Card PIN

Here are some of the most common financial frauds and scams;

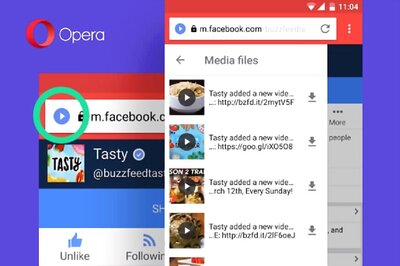

1. Online Phishing Scams: Scammers often send fake emails or messages that appear to be from banks, government agencies, or trusted organisations. They ask for personal or financial information, such as account numbers or PINs. Always verify the source of such messages before sharing any information.

2. Investment Frauds: Be cautious of investment opportunities that promise high returns with little to no risk. Ponzi schemes and fraudulent investment companies often target unsuspecting individuals looking to grow their savings.

3. Cryptocurrency Scams: Cryptocurrency is gaining popularity, but it’s also a target for scams. Be wary of initial coin offerings (ICOs) that promise guaranteed profits, fake cryptocurrency exchanges, and fraudulent trading bots.

4. ATM Skimming: Criminals install devices on ATMs to capture card information and PINs. Always inspect ATMs for any unusual attachments and cover the keypad when entering your PIN.

5. Identity Theft: Identity theft scams involve stealing personal information to commit fraud. This can lead to unauthorised credit card charges, loans taken out in your name, or other financial crimes. Protect your personal information and monitor your credit reports regularly.

6. Fake Job Offers: Scammers may offer fake job opportunities that require you to pay upfront fees for training or background checks. Legitimate employers do not ask for money upfront. The fake offers can come on social media platforms, personal messages etc..

7. Lottery and Prize Scams: You may receive messages claiming you’ve won a lottery or prize but need to pay fees or taxes to claim it. These are often scams designed to extract money from you.

8. Ransomware Attacks: Cybercriminals may target businesses and individuals, encrypting their data and demanding a ransom for decryption. Always keep your software up-to-date and back up your data regularly.

9. Real Estate Frauds: When buying property or land, be cautious of fake property documents, land disputes, and deals that seem too good to be true. Verify all documents with legal authorities. Sometimes, fraud property dealers sell a single property to multiple individuals by forging illegal papers and this creates a major problem for the buyers.

10. Credit Card Frauds: Monitor your credit card statements for unauthorised charges. Report any suspicious activity to your bank immediately.

To protect oneself from financial frauds and scams, it’s essential to stay informed, be sceptical of unsolicited offers or requests for money, conduct due diligence, verify the legitimacy of sources, and seek advice from trusted friends or family members when in doubt. Education and awareness play a crucial role in reducing the likelihood of falling victim to financial scams.

Comments

0 comment