views

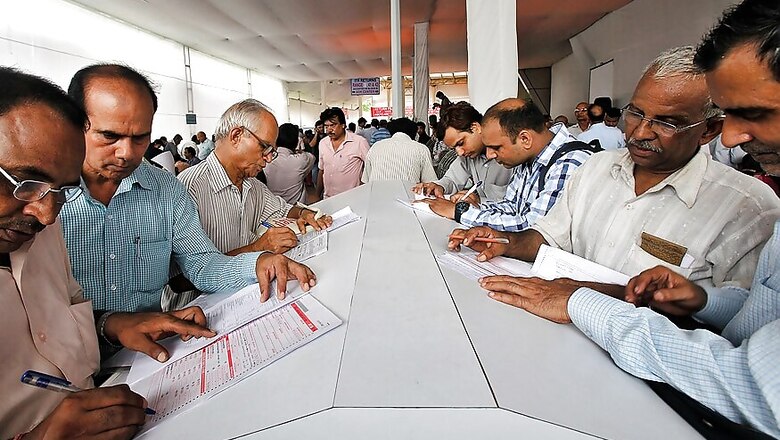

As the deadline to file income tax (I-T) inches closer, you may be rushing to collect all the required documents. Filing of taxes in India is often a last-minute process that may lead to taxpayers missing important information or committing trivial mistakes. In order to help you to avoid such a situation, listed below are six of the most common mistakes made by people while filing income tax returns:

1. Don’t pick the wrong ITR form

One of the most common mistakes is the taxpayer selecting the wrong I-T form. Whether you file online or offline, it is absolutely necessary to file details on the correct form. There are a total of nine types of forms that are used by taxpayers to file tax. According to the Central Board of Direct Taxes (CBDT), individual taxpayers need to file only 6 of the 9 ITR forms. These include: ITR-1, ITR-2, ITR-2A, ITR-3, ITR-4 and ITR-4S. The remaining three forms are to be filed by companies and firms alone: ITR-5, ITR-6 and ITR-7. Check your eligibility criteria carefully before picking up the form.

2. Not reporting all income sources

If you do not report all your income sources, the Income Tax department is likely to treat it as a violation of the I-T Act and send you a notice. Most individuals have a number of income sources apart from salaries, such as interest earned on bank savings account, fixed deposits (FDs), insurance and other savings schemes like PPF. You need to report all such income, even if it is tax-free.

In case you have changed your job, it is necessary to report income earned through both employers.

If you have any investment income under your child’s name, it should also be mentioned while filing tax returns.

3. Not declaring your real estate properties

Tax is not just payable for the house that you occupy, but for all the houses/properties you own. Many people assume that there is no income from multiple residential properties and thus there is no tax payable; however, this is a misconception. If you own more than one house, you are liable to pay a certain amount as tax, even if you have not earned any income from it or if it is unoccupied.

4. Mistakes in claiming deductions under section 80C

Many of us think that employer’s contribution to the Employee Provident Fund (EPF) has to be included in claiming Section 80C benefits. It’s incorrect. Similarly only the principal repaid on housing loan is eligible for Section 80C. Many other deductions are claimed under wrong heads leading to their rejection. So please cross-check before filling your form.

5. Discrepancy in TDS details

Many of us file returns without verifying Form-26 AS credit of TDS (tax deducted at source) held with I-T Department. If your employer or anyone else who has deducted TDS does not deposit the same with the I-T Department or fails to mention your PAN correctly, that amount will not reflect in Form-26 AS, leading to default. Hence do check that credit for TDS deducted has been mentioned in Form-26 AS. If there is a mismatch, take timely action to rectify the same.

To download your Form-26AS, you can login to your account on the e-filing website, www.incometaxindiaefiling.gov.in. Once logged in, click on ‘View 26AS (Tax Credit)’ under the ‘My Account’ tab. The website will redirect you to the TRACES website to download the form.

6. Not providing correct personal details

Many people face issues with income tax returns filing due to wrong postal address and email address. Since most of the communication with the tax department happens through post or email, it is absolutely important to provide accurate details. Otherwise you could end up missing important notifications.

Comments

0 comment