views

Choosing a New Bank

Make a list of the features you want in a bank. Consider the types of accounts you’ll be using - you may simply need a checking account, or you may want a bank with checking, savings, and money market accounts. You might also want to use your bank for credit cards or loans. If online banking is important to you, make sure the bank you use has a user-friendly app with all of the features you need. If you need to do a lot of business at a physical location, make sure to look for a bank that has branches close to your home and office.

Compare fees and interest rates. Banks may charge fees for monthly maintenance, taking money out of ATMs, overdrafting your account, and transferring money, so read the fine print carefully. You should also compare the interest rates on loans and credit cards, as well as the annual percentage yield (APY) on savings accounts. Smaller banks and credit unions often have lower fees and higher APYs than national banks, but a larger bank will likely have the most features available. Some banks advertise “no fees," but they may require that you maintain a minimum balance in your account. Most banks list their rates on their website, but if you can’t find them, you can call the bank to ask.

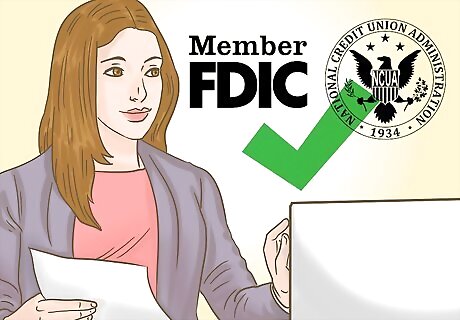

Make sure your new bank is backed by the FDIC or NCUA. Major banks insure their deposits with either the Federal Deposit Insurance Corp (FDIC) or, for credit unions, the National Credit Union Administration (NCUA). This means that even if the bank or credit union fails, the money that you have deposited will be protected by the U.S. government.

Setting up Your New Bank Account

Open your new account before closing the old one. You don’t want to move all of your money to your new account until you are sure that all activity is ceased on the old one. Transferring your bills and paychecks to your new account can take a little time, so make sure you leave both accounts open for up to a month. You’ll need a government-issued photo ID to open a new bank account. If you don’t have this, you may be able to use 2 official forms of non-photo ID instead, such as your social security card, voter registration card, or birth certificate. If possible, set up an electronic link between the 2 accounts so you can easily transfer money back and forth as needed.

Stop activity at your old bank. Some transactions can take a few days to go through, so stop using any checks or debit/credit cards associated with your old account at least a week before you close it. Take out enough money to live on while you are in the process of changing banks, as well as the money for any fees needed to open your new account. Fees to open a new account can vary widely, so make sure you know what these will be beforehand.

Change your direct deposit information. Contact the payroll department at your job and give them the direct deposit information for your new account. Changes to direct deposit can sometimes take more than one pay cycle, so be sure not to close your old account until you are sure the transfer has taken effect.

Reschedule any recurring payments. If you have any payments which are automatically withdrawn from your old account, make sure you set these up to come out of your new account instead. Look through your statements for at least 4 months to make sure you don’t forget about any payments you make quarterly, like insurance.

Close your account after you are sure all activity has been transferred. If possible, close your old account in person and get paperwork documenting the closure. This will protect you in case your bank tries to charge you additional fees later on. If you have any pending checks which bounce after the account is closed, you will still be liable for any penalties and fees associated with insufficient funds.

Comments

0 comment