views

Finding Banking and Personal Information

Look for the name of the bank. You can find the name of the bank on the check. You might need to know this information if there's any issue with the check going through. The name of the bank can appear in a variety of places on a check but is usually recognizable as a bank name. It may be the name of a major bank, like Chase or Bank of America, or a local credit union. Look for a name that is of a business or institution and not an individual. Banks usually have words like "bank" or "credit union" in the name.

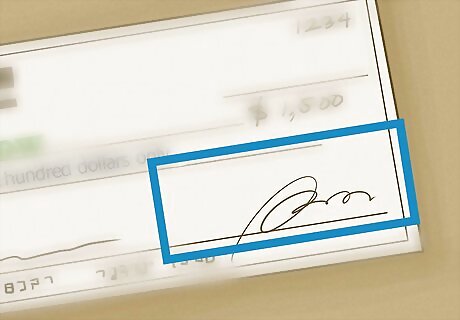

Find the payor signature. The payor signature is what authorizes you to deposit or cash the check. The signature should be written on a line in the lower right corner of the check.

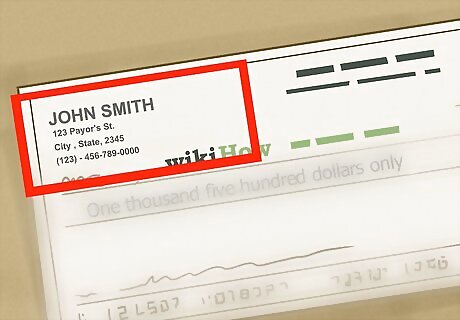

Read the payor's information. Most checks include information on the payor in the top left corner. This usually includes the payor's name and might include her address. If you want to make sure the signature matches the owner of the checks and bank account, you can look for payor information on the check.

Reading the Writing on a Check

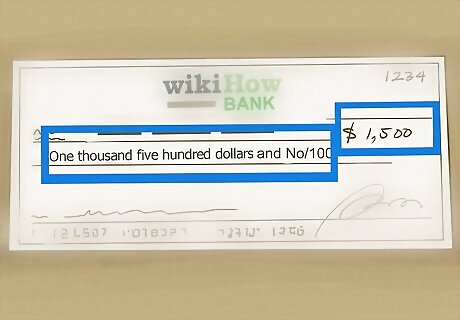

Read the check amount. The check amount appears twice on the check, once in words and once in digits. First, read the amount as written in words. Towards the center of a check, there should be a line below the recipient's name with a numerical amount written out in words. The payor writes the amount a check is for to make sure there's no confusion at the bank. They also include the amount of change, if any, as a fraction. For example, say the check is for $400.00. In the line, the payor would write, "Four hundred dollars and No/100."

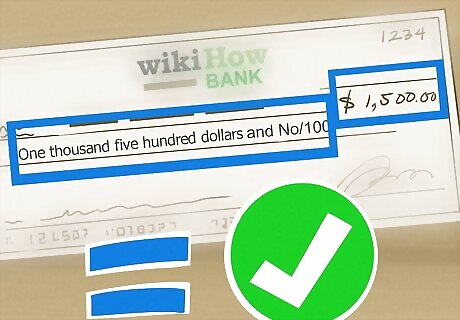

Make sure the written amount matches up with the numerical amount. Once you've read the amount the check is for, make sure this matches up with the numbers written on the check. Just to the right of where the amount is written out, there will be a small box with a currency sign next to it. The recipient will have written the amount the check is worth, in numerals, in this box. Returning to the above example, this box should contain the numbers "$400.00." If the two amounts are not the same, the amount written out in words is the amount that will be honored. For example, if the amount written out is "Four hundred dollars and No/100" and the amount in digits is "$400.99," the check will be redeemed for $400 in cash(the amount written out in words).

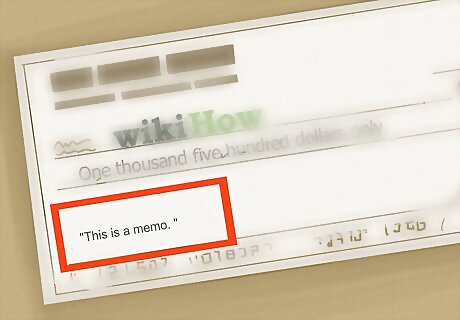

See if the check includes a memo. Some checks include memos. These can be found on a line on the bottom left corner of a check. The memo usually includes information on why the check was written. For example, a rent check may include a memo that says something like "For December Rent." Language in the memo field is legally binding on the person cashing the check in rare instances.

Reading the Numbers on a Check

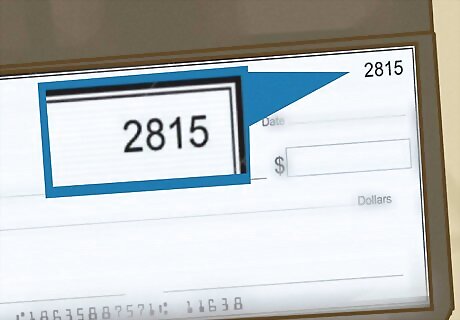

Find the check number. Most checks come with a check number. Checks come in books and are all numbered. The check number indicates which number check the recipient was on when he wrote the check. The check number is usually in the upper righthand corner of a check. It also reappears along the bottom, the last in a series of number sequences you'll find on a check.

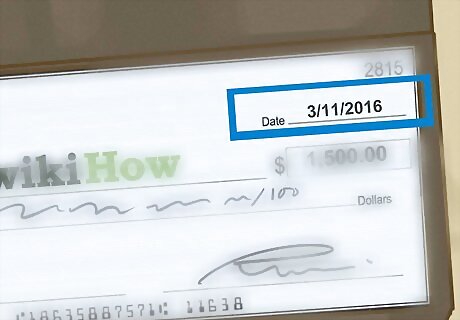

Locate the date. Near the top of the check and to the right, you will find the date. This is the date the check was written by the payor. It usually appears in a small box labeled "Date." The date of the check is important. While banks can honor checks older than six months, they are not legally required to do so.

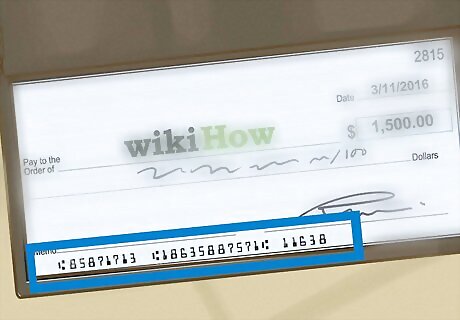

Differentiate between the routing number and account number. Along the bottom of the check, you will see two numbers. These numbers are the routing number and the account number. The first number, which will be nine digits long, is the routing number. Routing numbers are numbers assigned to individual banks. Their purpose is to track where money that is exchanged in a transaction comes from and goes to. The next number, which ranges in length, is the account number. This is the number associated with the payor's individual bank account.

Comments

0 comment