views

Talk to the parents first if you’re worried they'll be upset.

Bypassing them to give money to their child may cause friction. Particularly since one of those parents is your child, they may feel disrespected or resentful if you give money (especially larger sums) to your grandkid. This is especially true if you’re giving the money in a way that prevents them from having any custodial control over it—such as by funding a savings account for your grandchild with you as the custodian. Be sensitive to their concerns while explaining your position. Emphasize, for example, that you’re trying to give your grandchild (their child) a head start in life by specifically supporting their education, housing, etc. Or, if you’re gifting money without restrictions, explain that you’d really like to see your grandchild be able to enjoy spending the money on something they want.

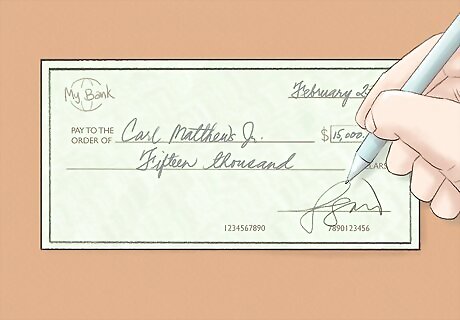

Gift up to $15K USD per year per grandkid with no tax liability.

You can legally gift money up to this amount to anyone, tax-free. So, unless you’ve been extremely generous, the IRS won’t care about the cash you stuck in your grandchild’s birthday card! If you have a spouse, they can also gift $15,000 per grandkid, or you can jointly gift $30,000 with zero federal tax liability. So long as you stay under this gift limit per grandchild, you also don’t have to worry about filling out any IRS forms—another bonus! If you do plan on gifting money above this amount, check out the relevant items near the end of this wikiHow article. Here’s the IRS definition of a gift, if you’re interested: “Any transfer to an individual, either directly or indirectly, where full consideration (measured in money or money's worth) is not received in return.”

Avoid all taxes by paying directly for tuition or medical bills.

Direct payments to the provider (not your grandkid) are fully exempt. So, say that you want to provide $20K USD towards your grandchild’s college tuition. Instead of gifting the money to them, give it directly to the university as a tuition payment. This way, it has zero impact on both the annual ($15K) and lifetime ($11.4M) gifting limits. The same is true for medical payments. If you want to take care of your grandkid’s $20K medical bill, pay the provider directly instead of giving the money to your grandchild.

Give to a 529 Plan to ensure your gifts are used for education.

Consider this option if you’re worried how your gifts will be spent. Here’s the thing about a monetary gift, both morally and legally speaking: you have no say over how the person spends it! If you’re worried that cash gifts to your younger grandkid (not yet in college) won’t be spent on educational expenses, set up a 529 savings plan for them instead. That way, the money is protected for use toward qualified educational expenses. If you have a grandkid already in college, contribute to their tuition payment (directly to the school) to relieve your concern about how the money will be spent. A 529 isn’t a total lockbox—either your or your grandchild (when they’re of age) can withdraw funds from the plan by paying a tax penalty, or the money can be transferred to another 529 tax-free if your grandchild doesn’t end up using it for educational expenses.

Use a custodial savings or brokerage account if they’re under 18.

You’ll retain control of the funds (with limits) until they’re 18 or 21. If you set up a custodial savings account in your grandchild’s name, for example, you (the custodian) will be the only person able to access the funds until your grandkid turns 18 or 21 (depending on the state). At that point they take over complete control. A custodial brokerage account works in much the same way. Here are some pros and cons of custodial accounts: Pros: You can be sure that your grandchild (as well as their parents or anyone else) cannot access the funds until your grandkid is an adult. Only you can withdraw funds before then, but only so long as the withdrawal benefits your grandchild in some way. Cons: The funds in the account may end up reducing the amount of student aid that your grandchild is eligible to receive for college. Also, if you’re worried how the money will be spent, remember that it’s completely out of your control once your grandkid reaches either 18 or 21.

Contribute to an IRA to give them a head start on retirement.

So long as they’re earning income, you can gift money to their IRA. There’s no minimum age requirement for opening an IRA, so long as your grandchild is earning income—even jobs like mowing lawns or babysitting will do! The IRA has to be a custodial account if they’re under 18 (with you, a parent, or other adult as the custodian), and they’ll gain full control over the IRA when they turn 18. A Roth IRA is generally a better choice than a traditional IRA in this situation, since the funds you put in will remain tax-free for your grandchild. The 2021 IRA contribution limit is the lesser of the following: $6,000 per year or the amount the person (your grandchild) earns during the year. So, if they only earn $1,500 mowing lawns, you can only contribute $1,500 to their IRA.

Contribute to housing payments if they’re a young adult.

Help with their rent or mortgage while managing your risk. Yes, helping out with sky-high housing costs is a great way to improve a grandchild’s financial situation. But there are more risky and less risky ways to do it. Consider the following options: Gifting them money directly. This is the most straightforward way, but may not be the best option if you’re worried how the money will be spent. Paying their landlord or mortgage lender directly. This is still considered a gift, but you know the money is going toward housing. Note that, especially in the case of a mortgage, you have to send in a letter confirming that you’re gifting, not lending, the money. Co-signing a rental or loan agreement with them. This is the highest-risk option and should usually be avoided. If they stop making their share of the payments for whatever reason, you’re on the hook for the entire amount.

Offer up your accumulated money wisdom as a gift.

Combine your money gift with insights you’ve picked up over the years. While many kids hate the idea of getting money lessons from their parents, they’re often more open to getting such advice from grandparents. To get the ball rolling, you might write them a check instead of putting cash in their birthday card, then take them on a “field trip” to set up a bank account to put that check into. Here are some other ideas: Take them out to lunch, then give them a quick primer on how credit cards work when it’s time to pay the bill. Talk about the summer jobs you had as a kid and encourage them to seek out a part-time job that interests them. Be ready to answer questions they may have on financial topics like investing, charitable giving, making a budget, and so on.

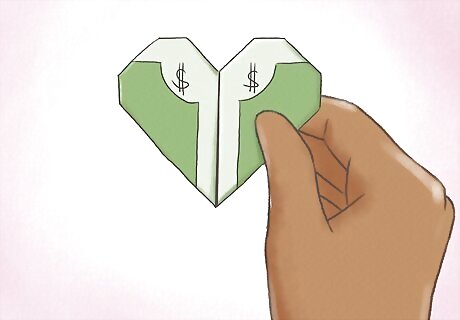

Choose fun and creative ways to gift cash to grandkids.

Sliding money into a card isn’t the only option you have. Even though money makes an excellent gift, it isn’t always the most exciting gift. But a little creativity can help ramp up the fun factor! Here are a few ideas to get your creativity flowing: Fill an empty box of chocolates with cash and wrap it up as a fake-out gift. Try your hand at origami and fold the individual bills into fun shapes. Combine the fake-out box and origami ideas: use a clothing box and fold the bills to look like a shirt and tie. Layer folded bills and/or coins in a glass jar with different colors of candies. Stuff rolled up bills into balloons, blow up the balloons, and have your grandkid pop them for a fun surprise! Create a fun e-gift card and transfer cash digitally through a payment app like PayPal. Or, send a prepaid debit card (such as from Visa or Mastercard) with a fun design on it. Check out How to Give Money As a Gift for some more fun ideas.

Fill out IRS Form 709 if your gift exceeds the $15K limit.

Take this step even though you still probably won’t owe any taxes. If you exceed the individual annual gift limit, you’ll then start chipping away at your lifetime total tax-free gift limit—which is a whopping $11.4 million USD! Very few people ever exceed this lifetime limit, but you’re still legally required to fill out IRS Form 709 if you exceed the individual annual limit. The minor annoyance of filling out the form can save you from the possibility of dealing with a major legal hassle and hefty fines. Just to clarify: the $15K limit is per person per year—if you have 10 grandkids, you can give each of them $15K per year ($150K total) without having to worry about taxes or Form 709. The $11.4M figure is a lifetime total for all gifts (that aren’t otherwise exempted) given to all persons—including the gifting of your estate. Get IRS Form 709 here: https://www.irs.gov/pub/irs-pdf/f709.pdf

Work with a pro if your gift plans may approach $11.4M USD.

Expert help can save you or your grandkids a great deal of money. If you’re gifting a substantial estate that ends up exceeding the gift limit, seemingly minor decisions you make today could end up costing your grandchild millions in taxes down the road. So, if you know your gift exceeds $11.4 million, or even if you just think there’s a chance it might, it’s absolutely worth it to work with a tax advisor who is well-versed in estate planning.

Comments

0 comment