views

Gathering Evidence for Your Defense

Document the repossession. When the lender comes to repossess your car, you should document the repossession. Your car must be repossessed without “breaching the peace.” If it is not, then you can raise breach of peace as a counterclaim to the deficiency lawsuit. “Breach the peace” has no clear definition; however, there are some common examples: the lender broke into your garage to take the car the lender physically removed you from the car from repossessing it the lender confronted you and tried to intimidate you Be sure to document the repossession. Videotape it, if possible. You should also take pictures of any broken locks or damage done to your property during the repossession. At a minimum, write down your memories of the repossession. Did the lender confront you? What was said? Were threats made? These notes, written soon after the repossession, can help you later at trial.

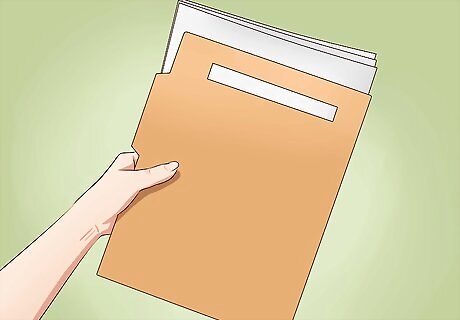

Read the notice of sale from the creditor. After the creditor sells the car, you should receive a letter explaining how much the car sold for and the amount that remains on your loan. The letter should also outline what costs the creditor incurred to sell your car. These costs can include advertising fees and storage fees. You should receive this letter within 10 days of the sale. The letter might threaten you with further action, such as a lawsuit. You should take this letter seriously. Double check to make sure that the loan balance amount is right. Look through your own paperwork to see how much money you owe.

Look for mistakes in the loan paperwork. Because the creditor might sue you for the loan deficiency, you should begin thinking about what defenses to bring. Sometimes the loan paperwork might be faulty. In that situation, you can claim that the faulty paperwork prevents the creditor from suing you. Check for the following as you read the loan papers: The loan paperwork might not have granted the creditor a security interest in the car. Read your loan documents. If the lender does not have a security interest, then it was not entitled to repossess your car. The loan paperwork didn’t give the creditor the right to sue you for the deficiency. The creditor who wants to sue you is not the same creditor on the loan document. Furthermore, it has no document showing that the loan was validly assigned to it. In this situation, the plaintiff has no standing to sue you because you don’t owe it money.

Make sure your notices contain all required information. State law requires that the creditor give you proper notice of your deficiency. You should have received these notices before the creditor sells the car. Take them out and look to see that all of your rights were included. If not, you could challenge the deficiency judgment in court. The notices typically must inform you of: your right to redeem the car and when you could do that your right to reinstate the loan (if allowed by state law) and when you could do that the date of the car sale, if it was a private sale the date, time, and location of the auction, if the car was sold at auction a calculation of the deficiency balance

Argue that the car’s sale was not commercially reasonable. The creditor must also sell the car in a “commercially reasonable manner.” This is a vague standard, but it essentially means that the creditor must use good faith in getting full value for the car. Accordingly, you can defend against a deficiency claim by challenging how the creditor sold the car. Look for the following, which is generally not commercially reasonable activity: The creditor sold the car to friends or family. This is not commercially reasonable. The creditor didn’t sell the car. If the creditor decides to keep the car, then your debt is fully satisfied and you can’t be sued. The creditor made a private sale when most repossession sales in your area are handled by auction. The creditor did not get the car appraised before selling it for junk. The creditor did not advertise the sale and did not let interested buyers inspect the vehicle. The advertisements did not describe the car accurately (make, model, mileage, general condition). The creditor waited too long to sell, allowing the car to depreciate in value as it sat in a lot.

Meet with an attorney. At a minimum, you should meet with a lawyer for a half-hour consultation. Many attorneys now provide free or reduced-price consultations. At the consultation, you can describe your situation and get the lawyer’s advice about what defenses are best to bring. To find a lawyer, you can visit your state’s bar association, which should have information on finding a lawyer in your state. The bar association may also run a referral program. If costs are a concern, understand that most states allow you to hire a lawyer to do only discrete tasks. This is called “limited scope representation.” For example, you could hire a lawyer to draft court documents for you or to coach you about how to handle a trial. Ask during your consultation whether the attorney offers this service.

Resolving the Dispute outside of Court

Negotiate a settlement. You can try to negotiate a settlement with the creditor. If you succeed, then you can avoid going to court. Settlement negotiations are beneficial because you can resolve the dispute faster, thus giving you peace of mind. However, you will probably have to pay the creditor something in order to settle. If you think you have a strong defense, you might want to decline to negotiate.

Participate in mediation. Alternately, you might want to use mediation. In mediation, you and the creditor will meet with a neutral third party. This person is called the mediator, and his or her job is to listen to both you and the creditor describe the dispute. Like settlement negotiations, mediation is voluntary. You or the creditor can walk away at any time. The mediator is not a judge. Instead, the mediator helps the parties come up with creative, workable solutions that both parties can agree to. If you are interested in mediation, then you should check whether your local courthouse offers a mediation program. Also, you can call your local or state bar association to check if there is a mediation program you can use.

Arbitrate your dispute. Arbitration is like a trial. You and the creditor will present your dispute to a neutral third party, the arbitrator, who acts like a judge. The arbitrator’s decision is usually binding, which means you agree to abide by the arbitrator’s decision at the outset. Arbitration has some benefits over a trial: it is private and usually goes much faster. If you want to arbitrate, then you should think about hiring a lawyer to represent you. Unfortunately, you might waive your right to appeal if you arbitrate. For this reason, you should think carefully before agreeing to arbitration. Although a trial may be slower, you would still keep your ability to appeal should you lose.

Defending Yourself from a Lawsuit

Read the complaint. If the creditor does decide to sue you, then you will need to respond to the lawsuit in a timely manner. The creditor begins the lawsuit by filing a complaint. This document will describe the facts surrounding the lawsuit. You will receive a copy of the complaint and a summons. The summons will tell you how much time you have to respond. Make note of the date.

Draft your answer. In your answer, you respond to each allegation made in the complaint. Many courts now have “fill in the blank” answer forms for you to use. Ask the court clerk or check the court’s website. Alternately, you might need to draft your answer using a CD or book of legal forms.

Raise affirmative defenses in your answer. In your answer, you can raise any affirmative defenses which would allow you to win. With an affirmative defense, you win even if everything the plaintiff says in the complaint is true. There are some common affirmative defenses: The lender waited too long to sue. Each state gives people only a limited amount of time to bring a lawsuit. This is called the “statute of limitations.” To find your statute of limitations, search for “repossession deficiency statute of limitations” and “your state” on the Internet. Your state doesn’t allow deficiency judgments. Some states don’t allow creditors to get deficiency judgments. In this situation, you can get the case tossed out of court. Deficiencies in the loan paperwork (see above).

Make counterclaims. You can also raise counterclaims in your answer. Although these are not affirmative defenses, they might induce the creditor to enter into settlement negotiations with you if they are true. As counterclaims, you can raise any deficiency in the repossession process. For example, if the lender breached the peace in retrieving your car, then raise that as a counterclaim. Also point out any deficiencies in the notices you were given or in the manner of sale of the car.

File your answer. After you finish your answer, you should take it to the court where the creditor filed suit. Tell the court clerk that you want to file your answer. The clerk will stamp all of the copies with the date. One copy is for your records. Another copy is for the creditor. You must send a copy of your answer to the creditor’s attorney (if one is listed on the complaint) or to the creditor (if no attorney is listed). Ask the court clerk for acceptable methods of service.

Participate in discovery. Discovery is the fact-finding phase of a lawsuit. You and the creditor can request information from each other. The most common discovery techniques include: Requests for production. Here, you request relevant documents in the plaintiff’s custody and control. To defend against the deficiency judgment, you should seek any paperwork related to the sale of the car. Interrogatories. These are written questions the creditor must answer under oath. Interrogatories are helpful for getting basic information. For example, you could get the name of the auctioneer (if the car was sold at auction) or the name of the private party the car was sold to (if sold to a private party). Depositions. In a deposition, you ask witnesses questions in person. A court reporter will record the testimony, which can sometimes be used later at trial. Depositions typically take place in an attorney’s office.

File a motion for summary judgment. At the close of discovery, either you or the plaintiff can bring a motion for summary judgment. The purpose of the motion is to argue that a trial is unnecessary because there are no issues of material fact for a jury to resolve. You also argue that the law favors you so much that it would be impossible for the creditor to win at trial. Summary judgment motions are technical and require extensive familiarity with the law. If you want to bring one, then you should think about hiring an attorney to draft it for you.

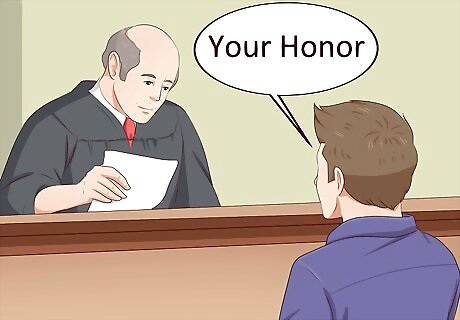

Defend yourself at trial. If you lose the motion for summary judgment, you will probably have to go to trial. At trial, you will pick a jury, cross-examine the creditor’s witnesses, and present witnesses of your own. If your creditor has a lawyer, then you should try to have a lawyer defend you in court as well. If you can’t afford a lawyer, then see Represent Yourself in Court (U.S.) for tips on how to defend yourself in court.

Appeal, if necessary. If you lose at trial, you might be able to bring an appeal. Talk to a lawyer about whether it is worth the time and effort. Appeals generally take a year or longer to resolve. You also might have to pay the creditor or purchase a bond to cover the judgment against you.

Comments

0 comment