views

X

Trustworthy Source

Internal Revenue Service

U.S. government agency in charge of managing the Federal Tax Code

Go to source

You would then submit that form to your client or employer, who will use the information contained in the form to report your earnings to the IRS and to provide you with a 1099 to calculate your income taxes. Keep reading to learn how to properly complete a W-9 tax form.

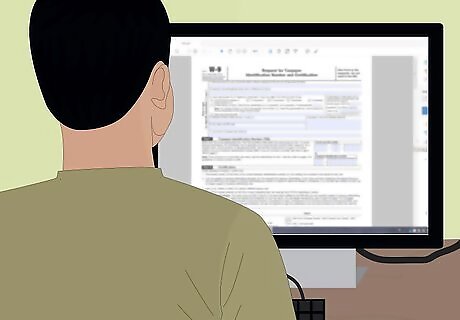

Filling Out the W-9

Make sure you've got the right form. You may receive the form from the client or company that hired you. Any entity who hires freelancers or independent contractors to do work needs to provide a W-9. You can access the correct W-9 form on the IRS website.

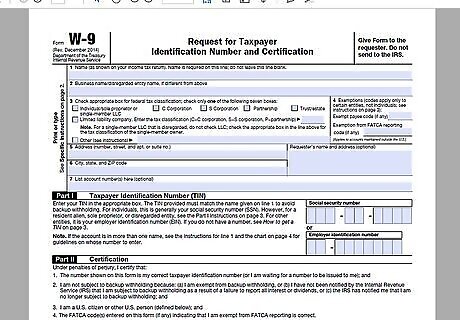

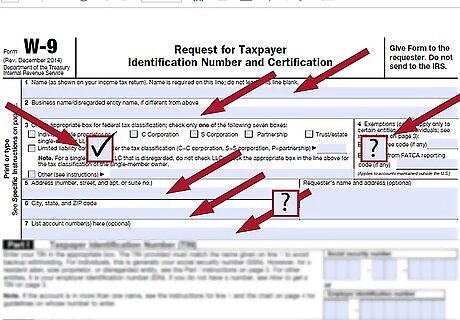

Complete the basic information in section one. Section one of the W-9 is where you will need to fill in your name, and address. For box 1, type or write your full name. For box 2, type or write your business's name (if you have one). If not, leave it blank. For box 3, check the box that describes you or the legal status of your business. If you are filling the form out for yourself and you are not being contracted through a company that you own or work for, check the “Individual” box. For box 4, only complete if you have an exemption code. Leave it blank if you are an individual. For box 5, type or write your street address. For box 6, type or write your city, state, and zip code. Box 7 is optional, only fill in this section if you have an account number that your employer will need.

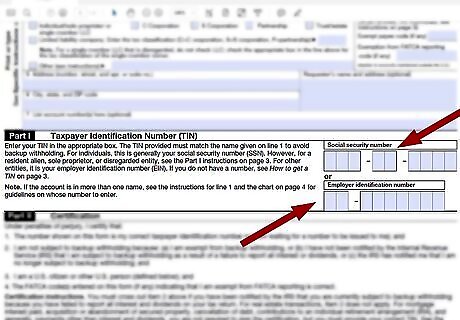

Move on to Part I. Fill in your Social Security Number or Taxpayer Identification Number or Employer Identification Number. Fill in the section that applies to you and make sure to only put one number in each box If you are an individual, type or write your social security number in the appropriate space. If you are a resident alien, sole proprietor, or disregarded entity, type or write your Taxpayer Identification Number. You can get a Taxpayer Identification Number if you don't have one. For all other entities, you will need to fill in your Employer Identification Number. If you have a TIN/EIN/SSN but cannot remember it, you can call the IRS at (800) 829-1040 or the Social Security Administration at 800-772-1213.

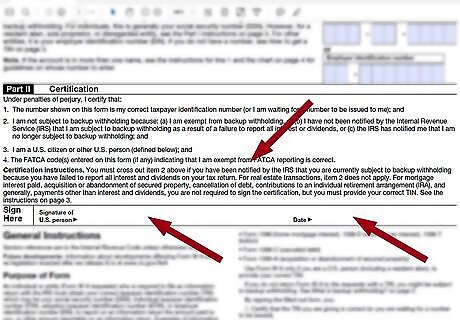

Sign and date the form in Part II. Before your sign and date the form, make sure that you read over the completed form and check to see if everything is correct. Read through the “Certification” information in Part II as well, so that you know what you are signing off on. Only sign if everything is accurate. If everything is correct and you have finished reading the certification information, sign your legal name and include the date. By signing Part II of the W-9, you are stating that: the TIN you provided is correct you are not required to have 28% of your income withheld for tax purposes you are either a US citizen, resident alien, or business entity registered or recognized in the US, or a legal non-business entity recognized in the US you have provided correct information regarding your FATCA (Foreign Accounts Tax Compliance Act) requirements If you sign and one or more of these statements is false, you could face criminal charges, including perjury.

Turn the completed form into your client. The person or company that gave you the W-9 will use it at tax time. The W-9 is for whoever will be paying you for the services rendered. It is unnecessary to send a copy of the form to the IRS yourself.

Keep copies of the completed W-9 form. It's good to be on the safe side and make a copy for your own records. You can use it to compare to your 1099s and to contact a company or client if you are missing a 1099. Always contact clients if you haven't received a 1099-MISC come tax time.

Using the W-9 Correctly

Fill out a W-9 for every client for whom you complete work. If you hire out your services to a business, they will need to have your information on file to help prepare their returns. Businesses will file a 1099-MISC for freelance or contracting work that totals more than $600 over the course of the year. Clients use your W-9 to put the information you provide on the 1099-MISC, which will be sent to the IRS and to you, for your tax purposes, usually in late January.

Fill out a W-9 for investment purposes. The W-9 form is also used in certain other less common circumstances, related to investment and debt-collection. You may also need to fill out a W-9 in the following circumstances: Real estate transactions Payment of mortgage interest Acquisition or loss of secure property Cancelled debts Individual retirement arrangement (IRA) investments

Understand what "backup withholding" means. While the form is super-straightforward, the discussion of "backup withholding" on the second page throws most people for a loop. In general, if you're not involved with any investment opportunities with the client for whom you're filling out a W-9, and if you're filling it out in the capacity of an independent contractor or freelancer, you don't need to worry about this part. Backup withholding allows the IRS to claim income tax from investors' earnings, in the event that an investor attempts to claim this money before tax has been levied on it. The payment owed is called "backup withholding." Again, in most cases, you're exempt and it will be your client who owes the 28% income charge, not you. If your clients choose not to collect information from you with a W-9, or if you include incorrect information on your form, your clients be liable to furnish backup withholding fees to the IRS. If you fill out the form and furnish it to the requesters, you won't be liable for making these payments under any circumstances. Keep track of your records and you'll be fine.

Comments

0 comment