views

Cultivating Good Spending Habits

Do not buy things just because they are expensive. In marketing they call this a surrogate indicator – it is the idea that because something is expensive it is of higher quality. This often has no bearing on the reality of the product. Many times a product is simply expensive because people are willing to pay a lot of money for it – not because the product is of high quality.

Value your money. Many people lose money simply because they do not value it. You are very easily going to give up that which you do not value and money is no exception to that rule. Many people think that having no money is a noble thing but there is no nobility in poverty alone and it is definitely not a noble thing to lose all of your money simply because you do not value it.

Don’t spend more than you earn. This is the key to financial stability. The moment you start spending more than you earn is the moment you begin to become financially complacent. Such a habit can be difficult to recover from.

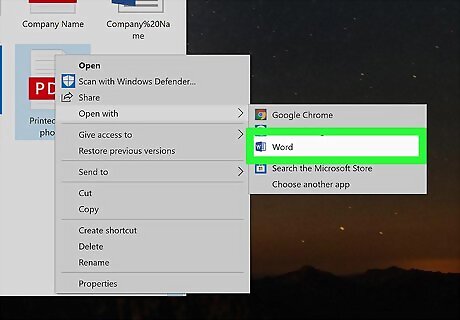

Budget your money. Budgeting is a tried and tested way to remain on to of your finances and stop yourself from losing out. There are numerous ways to budget your money and many of them are on this website. (insert page link) Budget your time. Your time is more precious than money therefore it is imperative that you budget it well. Budget your week, your days, even Look at where you have five minutes, ten minutes, half an hour to spare, what habits and routines can you place in these times that will benefit you in the long run?

Be able to see through the sales ploys of others. Some people are exceptionally good at pushing a product onto you that you do not really want or need. One of the only ways to make sure this does not happen is by being able to see through the sales ploys of others.

Making Lifestyle Choices

Be mindful of debauchery. Debauchery can mean living in a self destructive way but is often the squandering of wealth put into habits. There is nothing wrong with having fun or living a lifestyle with filled with parties or good times so long as you are very mindful of the effect this will have on your finances. Moderation and understanding is the way to proceed. Be very mindful of debauchery and the effects it is having on you.

Be mindful of bad company. Whether its gold diggers or just enemies pretending to be friends, there are people who will stay with you just for your money and people who will make sure that you remain broke on the basis alone that it benefits them for you to be broke. Such people may discourage you from doing anything that will definitely result in financial gain. So be very wary around these people.

Be mindful of your consumption of alcohol and drugs. Obviously refraining from these things completely is the most beneficial thing and will aid significantly but even just becoming mindful of your consumption is useful.

Refrain from gambling. Gambling is virtually a guaranteed way to lose money and even destroy your life. Think to yourself – if gambling was really geared in your favour, could casino’s and betting shops make a profit?

Find ways to enhance your intelligence. All enhancements of intelligence will contribute somewhat to the ability to arise and maintain wealth as intelligence is more than just knowledge. Intelligence with regards to wealth, possessions and finance is useful directly.

Appreciate what you have. Through appreciating of what you already have you lose a lot of the need to acquire things that are of absolute no benefit to you. A lot of your desires become more healthy and you stop wasting money on regretful things.

Know what makes your mind clear. The more clarity of mind you have, the easier it will be to take care of your finances. One of the reasons many people do not take care of their finances is simply because their minds are all over the place.

Get into good routines – routines bring us from one point to the other. The more you perform them the easier they are to slip back into. Laziness is often found simply when we have bad routines that work against us – it is important to be mindful of these routines and be able to transform them into good routines once more.

Improve your personality with regards to laziness. Without this your personality can gradually change into a lazy one. This a slow process and can be difficult to notice until it is very bad and you don’t know what happened to your life. But the moment that you become aware that you have allowed your personality to become a lazy one is the moment that you begin to improve it for the better.

Observe those people who lose money and speculate the reasons why they are losing money. Through doing this you keep developing your knowledge into saving and spending. this knowledge should not be underestimated, it is actively through developing knowledge of losing money that a person avoids losing it. Observation can aid with this.

Study money. Those people who have knowledge of money, who study things like accounting, business and so on are far less likely to lose money.

Avoid hating rich people for the simple fact of their wealth. It has become a recent trend to hate rich people for no other reason than they are wealthy. This makes a person want to prevent themselves from becoming rich and therefore works against them. Upon analysis it reveals that being rich alone does not make someone unpleasant or in compassionate, and so this hatred is often unfounded and even pointless.

Comments

0 comment