views

Kolkata: Calling the Rs 2.56 lakh crore state budget which the Mamata Banerjee government tabled before the West Bengal Assembly on Monday “populist” is no doubt an understatement.

It was the last full budget ahead of the 2021 Assembly Polls and there are civic body polls across the state in a couple of months. Banerjee, certainly, isn’t taking chances.

“Did (Prime Minister) Narendra Modi not table a full budget before elections in 2019? If he can set a precedent, why can’t we follow? Who had stopped the Left, who ruled this state for 34 years, from making a populist budget?” Banerjee said during her interaction with the media after the budget was tabled.

The budgetary allocations for the upcoming fiscal have increased 3.13 times compared to 2010-11, which was the final budget tabled by the erstwhile Left Front government, Banerjee said, adding capital outlay over the same period has increased 13.9 times.

In fact, state Finance Minister Amit Mitra has increased the plan outlay in the current budget by around Rs 50,000 crore compared to his previous budget, a whopping 10 per cent of which would be used to fund new schemes.

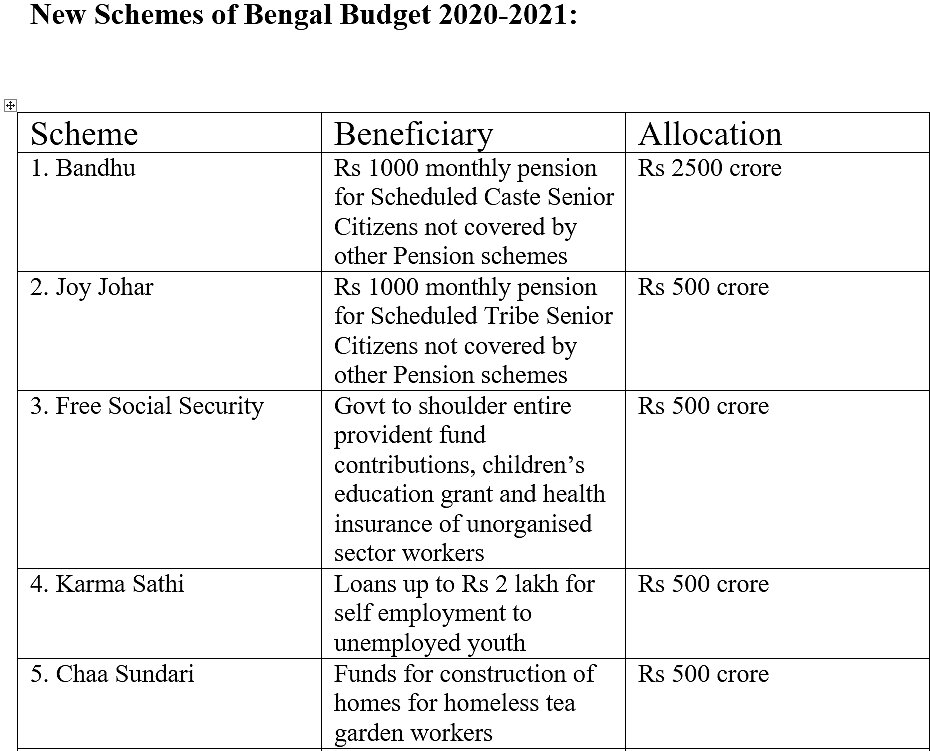

The state has proposed 11 new consumer-centric social welfare schemes in this budget that would cost the exchequer over Rs 5,000 crore. The targeted beneficiaries are citizens belonging to the SC/ST and OBC communities, a sizeable chunk of who have of late perceptively shifted their political allegiance from the ruling Trinanool Congress to the Bharatiya Janata Party (BJP), as also the economically weaker sections.

However, given the depleting status of the state coffers, one cannot help but wonder where all this money would come from. Banerjee has herself announced that the state is spending over Rs 50,000 crore annually on service debts.

The total outstanding debt burden, which was a little over Rs 2 lakh crore in 2011 when Banerjee assumed power, would be currently touching the Rs 4.75 lakh crore mark —an average Rs 47,000 burden on the shoulder of every citizen of Bengal.

Budget figures for this year revealed that projected fiscal deficit for 2020-21 is Rs 31,483 crore and the state’s loan repayment burden for the same period stands at Rs 51,047.34 crore. The provision for raising loans from market for the current fiscal stands at Rs 48,734 crore. It is evident from these figures that the entire amount of fresh borrowing would be used up for loan repayment.

A sneak peek into the figures tabled by Mitra over the last five years throws up an interesting statistic. The compounded annual rate of growth of the state’s total indebtedness between 2015-16 (outstanding debt - Rs 3,06,042.58 crore) and 2019-20 (outstanding debt - Rs 4,31,786.12 crore) is 7.13 per cent.

The state’s debt-servicing liability over the same period of time (Rs 32,457.76 crore in 2015-16 to Rs 56,541.76 crore in 2019-20) has grown at a staggering rate of 11.74 per cent. However, while the same budget figures show the Trinamool Congress government’s propensity to borrow between this year and the next is pitched at a nearly 10 per cent hike, the debt-servicing obligation during this period of time is projected to fall by 9.72 per cent.

While the obligation to fund the existing and new social schemes this election year would force the government to get into the proposed borrowing overdrive, it is not quite clear how it would manage to drastically cut down the principal amount repayment that, as the budget papers say they would, account for the sharp fall in loan repayment.

In any case, Mitra’s challenges up ahead are spectacular. Banerjee could be crying hoarse over the Centre’s step-motherly attitude towards Bengal in terms of loosening up purse strings, but things are unlikely to change on that front in the wake of deepening political animosity. In the end, it’s the citizens of Bengal who stand at the receiving end of the worrying prospect of getting sucked into a debt-trap.

“This is a pro-people budget, a budget made by a friendly government for its people,” Banerjee said. However, the larger picture may not supplement that claim.

Comments

0 comment