views

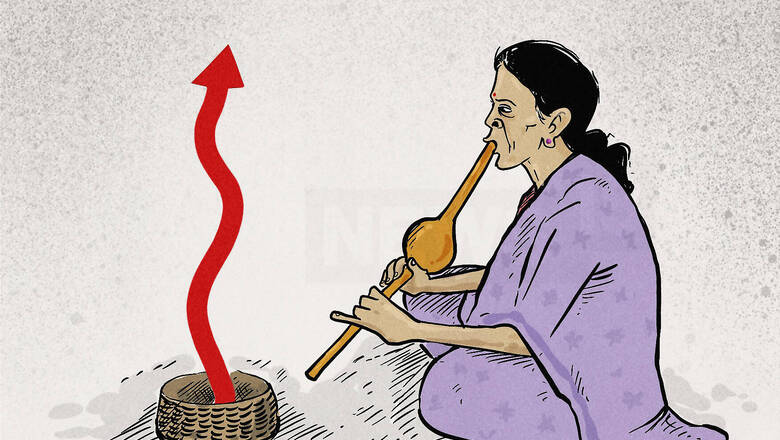

The decision to cut effective corporate tax to 25.17%, inclusive of all cess and surcharges, for domestic companies couldn’t have come at a better time for India Inc. The slew of measures to help the beleaguered business class and boost the sagging economy in general show that the Narendra Modi government is responsive to the feedback from the ground.

Finance & Corporate Affairs Nirmala Sitharaman announced the measures at a press conference in Goa on Friday. In order to attract fresh investment in manufacturing and thereby provide boost to the Make in India programme, the government has inserted a new provision in the Income-Tax Act with effect from April 1, 2019, an official press release said.

Any new domestic manufacturing company incorporated on or after October 1, 2019, will have the option to pay income-tax at the rate of 15%. This benefit is available to companies which do not avail any exemption/incentive and commences their production on or before March 31, 2023.

The effective tax rate for these companies shall be 17.01% inclusive of surcharge and cess. Also, such companies shall not be required to pay Minimum Alternate Tax, the release said.

The companies which do not opt for the concessional tax regime and avail the tax exemptions and incentives shall continue to pay tax at the pre-amended rate. However, these companies can opt for the concessional tax regime after expiry of their tax holiday/exemption period.

The government has also withdrawn the enhanced surcharge on capital gains that was announced in the last Budget. This has been done “in order to stabilise the flow of funds into the capital markets”. The enhanced surcharge shall also not apply to capital gains arising on sale of any security including derivatives, in the hands of foreign portfolio investors or FPIs.

Further, for the listed companies which made a public announcement of buyback before July 5, 2019, it is provided that tax on buyback of shares in case of such companies shall not be charged.

The capital market responded jubilantly to the new announcements, with the benchmark BSE shooting over 1,700 points; the Nifty too jumped around 4.8%.

The corporate social responsibility (CSR) regime, violations of which were earlier decriminalised, was further relaxed, with the government allowing the funds to be spent on the incubators funded by Central or state government, public sector undertaking, contributions to public funded universities, IITs, etc.

This is a very bold move, for the total revenue foregone as a result of the rate cuts is in the region of Rs 145,000 crore — a big number against the backdrop of dropping gross domestic product (GDP), low revenue mop-up, a looming oil crisis, and a tight fiscal situation.

But boldness is beautiful, for it is based on a sound economic principle: lower tax rates result in higher revenue collection. On the face of it, this appears mathematically impossible, but in the real economy a lower tax incidence boosts people to invest more which, in turn, increases economic activity, augments production, and creates jobs.

More jobs mean more people spending more money and generating more profit for businesspersons, further boosting investment, production, and employment. Hence, the virtuous circle.

However, we should temper our optimism with caution. While the steps announced are indeed welcome, we should not forget that these are part of a firefighting exercise, not the consequence of some systemised thinking with a vision for the future and with clearly defined short-, middle-, and long-term goals. Neither do they reflect any (newly-found) predilection for structural reforms, which are the need of the hour, on the part of the government. At best, the exercise is an economic reaction, though very good; it is certainly not the dawn of economic philosophy.

Further, the announced measures exemplify the adage that economic reforms happen in India only under duress. In 1991, there was an unprecedented crisis of mammoth proportions, so the policy and decision makers scrambled to fix the system. The result was liberalisation, a watershed moment in the economic history of India.

The point to be emphasised here is that 1991 was also economic reaction (albeit very appropriate), not the commencement of a system untouched by the pathologies of socialism. Unsurprisingly, the grammar of political economy and phraseology of public discourse continued to be infected with the germs of discredited ideologies like socialism and statism.

Yet, the Modi government should be lauded for being responsive to the needs of India Inc and coming up with measures to help it recover.

(The author is a senior journalist. Views expressed are personal.)

Comments

0 comment