views

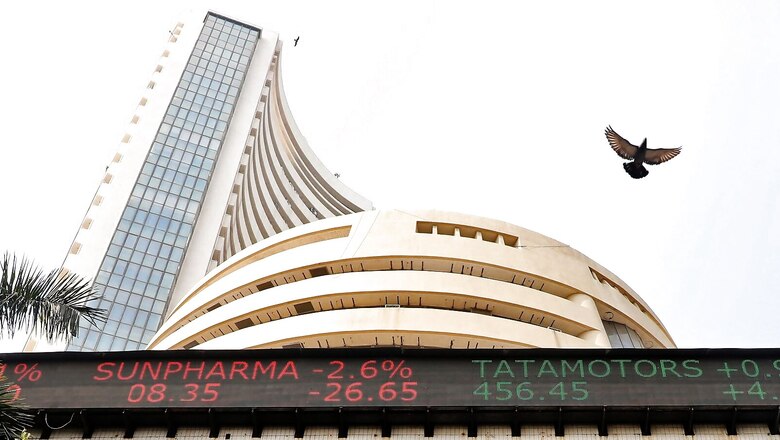

Indian stock market is closed on Friday on the account of public holiday for Good Friday. Further, the indices would be closed on April 14 next week to mark the birth anniversary of Dr BR Ambedkar.

The equity derivative segment, equity segment, the SLB (Security Lending and Borrowing) segment, the currency derivatives segment and the interest rate derivatives segment would also remain closed on these three mentioned days, as per the BSE website. Today, the Multi Commodity Exchange (MCX) would remain closed today during the morning session but it would open for the evening session at 5 pm.

On Thursday, equity markets cheered the surprise pause of rate hike by the Reserve Bank of India (RBI) with both Sensex and Nifty ending in green.

Sensex and Nifty rose 0.39 per cent each led by gains in banking and financial stocks. Bajaj Finance advanced 2.1 per cent, State Bank of India and Indusind Bank gained 1.8 per cent each, Bajaj Finserv climbed 1.4 per cent. L&T advanced 1 per cent after Jefferies India maintained buy rating and increased its target price by 22 per cent.

The Reserve Bank of India (RBI) has kept rates unchanged and revised its inflation projections, estimating that the Consumer Price Index (CPI) will average 5.2 per cent in FY24, which is a slight improvement from the earlier estimate of 5.3 per cent. The RBI also highlighted the economy’s resilience and projected that the Gross Domestic Product (GDP) for FY24 will grow at a rate of 6.5 per cent, which is slightly higher than the earlier estimate of 6.4 per cent.

“In our view, this reflects a forward-looking monetary policy that takes into cognizance elevated global growth risks, under-control inflation trajectory, and the need to wait-and-watch and assess the impact of the sharp policy tightening already delivered. However, the RBI has kept the door open to further action if macro conditions change, also in line with our expectations. We maintain our view of a policy pause hereon and 75bps of rate cuts, starting from October,” said Aurodeep Nandi, India Economist and Vice President at Nomura.

Read all the Latest Business News here

Comments

0 comment