views

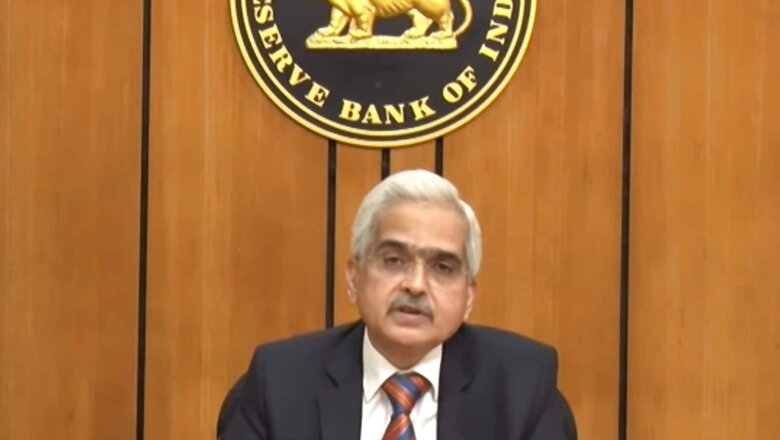

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) will announce its policy decision tomorrow, i.e. Friday, April 8, 2022. The market watchers will be eyeing the governor’s revised economic projections and the interest rate trajectory. It is widely agreed that this is going to be one of the most crucial policies of recent times amid uncertainties caused by the Russia-Ukraine conflict, commodity prices have gone through the roof, oil is on the boil and perhaps for the first time since the pandemic, inflation has emerged as a bigger concern than growth for the Monetary Policy Committee (MPC).

Upside Inflation Risks, Downside Risks to Growth

There are upside risks to inflation, downside risks to growth, and an uneasy Balance of Payment scenario staring India in the eye. Thus, it’s the commentary of the governor that will be watched by Dalal Street on Friday.

“We expect the RBI MPC to revise up their FY23 average CPI inflation forecast from 4.5 percent year-on-year (YoY) and sight downside risks to their real GDP growth forecast of 7.8 percent YoY. We ourselves see FY23 average CPI inflation at 5.5 percent YoY (with a 30bp upside risk) and real GDP growth at 7.9 percent YoY (with risk to the downside),” BofA securities report.

In February 2022, the retail inflation in India hardened to an eight-month high of 6.07 per cent from 6.01 per cent in Jan 2022, exceeding the 6.0 per cent upper threshold of the MPC’s forecast range of 2.0-6.0 per cent for the second straight month.

Nomura in a note by Aurodeep Nandi and Sonal Varma said that the RBI is being overly optimistic on inflation and that a course correction in monetary policy is warranted. It now expects a policy pivot only in June and is building in 100 bps in cumulative repo rate hikes in 2022.

D-Street in For Negative Surprise?

But, the Street could be in for a negative surprise if the RBI’s revised projections are worse than what the market expects.

Vinod Nair, Head of Research at Geojit Financial Services, said: “Yes, it will be a surprise for the market as the RBI is expected to hold on the rates on this policy meet and increase inflation forecast for FY23. It will have a negative effect as the market assesses the change in stance since war and high commodity prices refrain from a hawkish policy. We feel it will be on a short-term basis since rates are expected to increase by a minimum 2 to 3 times in FY23.”

Meanwhile, bond markets are pinning their hopes on the central bank stepping in to manage bond-market liquidity at this week’s policy review.

Overall, the RBI is expected to extend its unwavering support to growth during its first bi-monthly monetary policy of FY23. But, if the global backdrop continues to be challenging, domestic policy-setting would involve trade-offs.

Read all the Latest Business News and Breaking News here

Comments

0 comment