views

Writing a Letter of Interest

Learn when a letter of interest can benefit you. You can use a letter of interest to set yourself apart as a potential buyer for a particular property. In essence, the letter gives you the chance to describe yourself, your family, your situation, and any other aspects you’d like to make a lasting impression on the home’s seller. You can maximize the effectiveness of a letter of interest in particular situations. For example, in a “seller’s market” situation, you can face competition from a crowded market of buyers all seeking the same house. A letter of interest is a tool you can use to make you stick out from the crowd. Letters of interest are less common when both parties involved are using a REALTOR. If the seller uses a REALTOR, he or she may want to minimize any part in the selling process, and the seller’s REALTOR is more likely concerned with which potential buyer can close on the house quickly and for the largest percentage of the asking price. If you wish to submit a letter of interest, the best time to do it is when you make an offer on the house. A well-crafted letter of interest can make your offer more attractive to the seller.

Form a connection. Learn what you can about the current owners of the house and highlight similarities with your own life in your letter. For example, if both you and the seller work as teachers, you can write something like, "What would be better than to have a teacher taking care of your old house?" If you (or your partner, spouse, or children) attended the same school, work in the same sector, volunteer for the same charity, or share any other significant connections to the owners, be sure to make note of this in your letter. Don't sound too formal: “I am a 30-year-old alumnus of University Xyz with a degree in chemistry.” Do sound approachable: “The U Xyz banner at open house brought back memories — I didn't expect to meet another alumnus out here!”

Tell the buyer why you love the home. Clearly express why you love this specific home and neighborhood. Write something along the lines of, "My family and I love the beautiful backyard and look forward to many afternoons relaxing beside the pool." Focus on specific features of the home and neighborhood that you love, such as the sunroom, yard, surrounding walking trails, etc. People are often still attached to the houses they’re selling. Use this section to show the seller that you have the proper appreciation for the house. Show the seller that selling to you would leave the house in good hands.

Write emotionally but authentically. An emotional connection between buyer and seller can be crucial to purchasing a home, so don't be afraid to use emotional language. However, honesty and authenticity always go a long way, so avoid coming across as saccharine or desperate. Don't mention sad stories: “...turned down from several houses . . . looking to escape an awful neighborhood...” Do tug on heartstrings in an upbeat way: “...kids loved running down the beach . . . couldn't stop smiling when I looked at the view...” This also means you shouldn’t exaggerate what you love about the house. The current owner will know the house better than anyone, including the work it needs. Overselling how perfect the house is can easily come across as inauthentic. Don’t be afraid to mention that you’d repaint, finish the basement, etc. This also tells the seller that you’re willing to invest in the upkeep of the house.

Paint a positive picture of yourself. Focus on your strengths, financial stability, and other positive characteristics that would make you the perfect homeowner. Highlight why you would make a great owner. Don't brag (e.g., “I have an outstanding work ethic” or “I am a pillar of the community”), but do mention positive traits in a straightforward and honest way. Support your statements with examples and evidence. For example, “I am community-minded and volunteer at my local school.”

Save the best for last. Reiterate your excitement to purchase the house, as well as your most salient qualities. The closing paragraph of a letter of interest can be the most crucial, and thus it is important to close on a positive note. A closing paragraph might also imagine the future you and your family will enjoy in the home. You might write, “I would be so excited to raise my family here, and would enjoy many years creating memories in this home.” Express your sincere appreciation for the owner's time. Include a warm thank you at the end of the letter, such as, “Your consideration is greatly appreciated,” or similar wording.

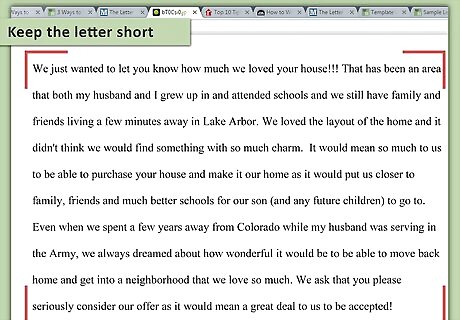

Keep the letter short. Outline a few important reasons why you would love to (and should) live in the house. Definitely keep it under 1 page, however. Try to avoid including too much detail about your own life story, and avoid complaining about the difficulties you might be experiencing in finding a home.

Writing a Formal Letter of Intent

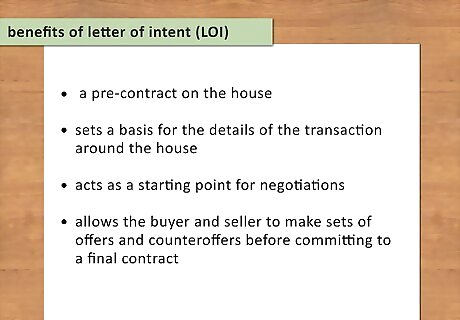

Learn how a letter of intent (LOI) can benefit you. A letter of intent is completely different from a letter of interest. However, these types of letters are sometimes confused. While letters of interest attempt to set you apart from other buyers in the market, you can think of a letter of intent more like a pre-contract on the house. It sets a basis for the details of the transaction around the house and acts as a starting point for negotiations. This allows the buyer and seller to make sets of offers and counteroffers before committing to a final contract. One of the most important aspects of an LOI is that it isn’t binding, meaning either party can walk away at any point in the process. Like letters of interests, letters of intent aren’t common when REALTORS are involved in the process. REALTORS usually hash out the details on behalf of their clients with the implicit knowledge that nothing is binding until a final contract is agreed to and signed. If you aren’t experienced in this sort of writing, it may be best to work from a template or have a real estate professional draft an LOI for you.

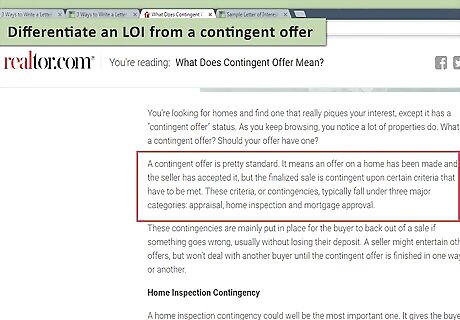

Differentiate an LOI from a contingent offer. You should also be aware of contingent offers and how they differ from LOIs. A contingent offer constitutes a very real offer on the house, but one for which contingencies must be accepted by the seller. If the seller accepts the contingent offer, all parties will need to complete any appropriate tasks within the time specified in the offer. These tasks might include the inspection, any necessary work on the property that is mutually agreed upon, or any other contingent action that is needed before the sale can be finalized.Write a Letter of Interest for a House Step 9.jpg You can include contingent items in your letter of intent, but the scope of an LOI is larger and less official than an actual contingent offer. You shouldn’t make any offer on the home—contingent or otherwise—until both parties have agreed upon all of the specifics of an LOI.

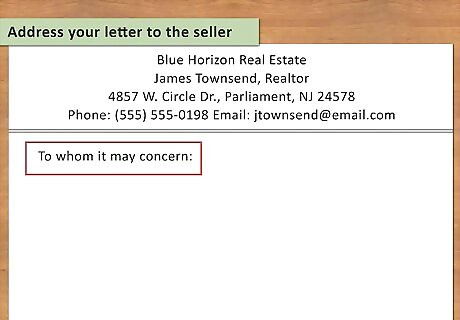

Address your letter to the seller. Use the seller’s full personal or company name, main address, and contact information, and date the letter.

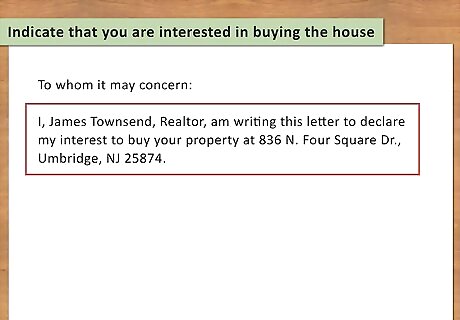

Indicate that you are interested in buying the house. Include the property address and any details about what will be included in the purchase, including furnishings, land, or other items. Formal language is most common. You can write, “This letter describes the intent of (your name) to purchase the real estate located at (location) owned by (seller's name).” Ensure that the name and address of each party, as well as that of the property, are included. You may choose to begin this sentence in a semi-formal manner, such as, “I, (your name), am writing this letter to declare my interest to buy.”

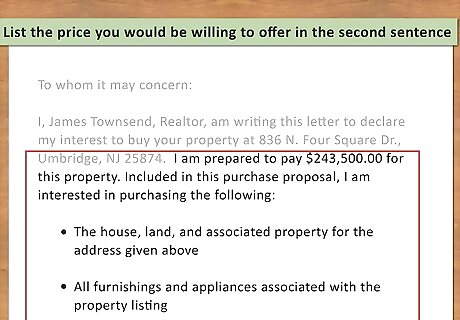

List the price you would be willing to offer in the second sentence. Use a phrase such as “The proposed purchase price is...,” or, “The purchase price proposed is,” or similar wording. Remember that as a basis for negotiation, the seller can choose to counter at a higher percentage of the full asking price than what you offer here. The offer should also indicate that the purchase price will be paid to the seller at the closing of the deal. If you are proposing to rent or lease, indicate whether you are proposing a weekly, monthly, yearly, or multi-year rent, and in what installments the rent will be made (e.g., every month, every year, etc.). Also include any pro-rated portions of rent if the home is to be inhabited in the middle of a month.

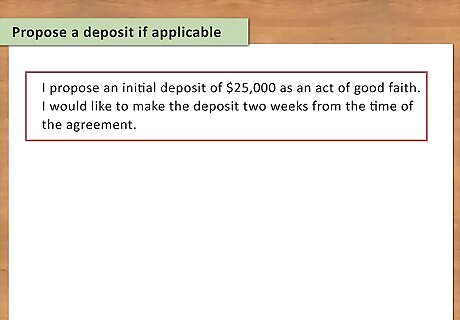

Propose a deposit, if applicable. To show that you’re serious about the intent to purchase the house (contingent upon good faith negotiations), you can choose to offer a deposit in your LOI. Rather than actually exchanging hands, this deposit is typically held in escrow for the duration of negotiations. Ensure that you clearly spell out the terms under which the deposit will be returned to you, such as by a certain date or if no agreement on the house can be reached. This type of deposit is typically called “earnest money.” Earnest money usually goes to escrow once you sign the purchase and sale agreement, but this agreement will stipulate when exactly it should be deposited into an escrow account. Earnest money is not usually deposited into escrow until the contract is executed, but in some cases it may be contingent on other factors, such as a successful inspection of the property. This amount may be approximately 1-3% of the purchase price. When a final agreement is signed, the money typically goes toward the down payment. Higher deposits are riskier for you, and may make your offer more attractive to the seller. A typical deposit is around 1% of the purchase price, which minimizes your risk as a buyer.

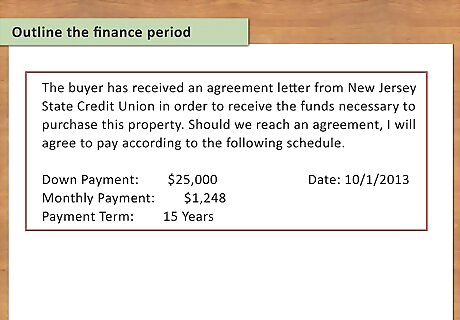

Outline the finance period. Indicate the expected period of time you will require to secure the necessary funds. While you do not have to include any specific banking information, you should include the soonest you can expect to secure financing, as well as the soonest date you might be willing to close on the sale. You can include other dates in this section, such as a date on which the negotiations automatically expire. Placing an expiration date in the LOI can help push a seller into making a decision more quickly. An expiration date can also put pressure on you, as the buyer, to respond to any counter-offers by the seller. If you are represented by a broker, you can also clarify how the broker's fees will be paid.

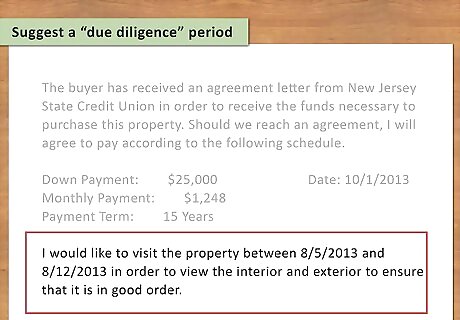

Suggest a “due diligence” period. If you would like to take additional time to inspect the home, review property tax records, examine building permits, or anything else, you can also suggest a period for you to perform your due diligence on the house. Use this period to discover anything about the house on which your eventual offer might be contingent. Be specific about the nature of your inspection: an independent tour, for example, or investigation of tax or other records. You may also specify what types of information or disclosures you will require during an inspection.

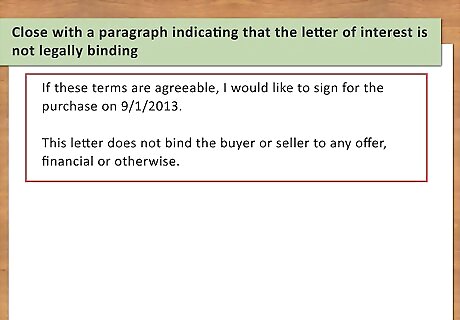

Close by stating that the letter of interest is not legally binding. Make sure this clause is carefully worded and explicitly clarifies that neither party is legally bound to the letter of intent. Make sure there is a clause that states explicitly that “this letter does not bind the buyer or seller to any offer, financial or otherwise,” or use similar wording that clearly communicates that neither the buyer nor seller is legally bound to the letter of intent and may walk away at any time. A seller who is both a novice to the selling process and working without a REALTOR can interpret such a clause as a lack of seriousness about the property, but you don’t want to risk leaving the letter of intent worded in such a way that a court could find it a legal, enforceable document.

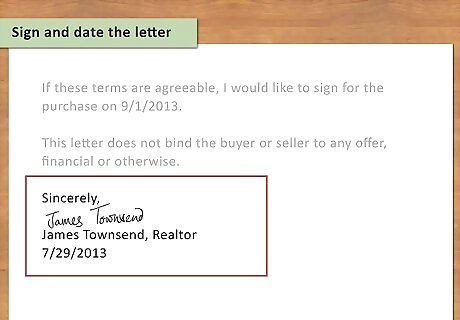

Sign and date the letter. Use a formal sign-off, such as “Sincerely,” or similar wording. The letter should also include phrasing such as “Agreed to and Accepted by,” or similar wording, followed by the signatures of both the buyer and seller.

Comments

0 comment