views

Discussing the Benefits of Saving Money

Discuss the importance of an emergency fund. You should also note the importance of saving for a “rainy day fund”. Remind the person that they may develop a serious health issue or have to pay unexpected expenses like car repair. They may then need to stop working for a period of time due to the health issue. Having a “rainy day fund” will ensure they are able to pay their bills even when they cannot work or can be used to cover unexpected costs. For example, you may say, "You should have some money put aside for emergencies. This will make life less stressful for you and ensure you have financial support when you need it." Having a “rainy day fund” where you save money in the event of an emergency can also come in handy if you have a family issue or problem that you need to address in the future. If a family member becomes gravely ill, for example, and you would like to spend time with them, having money set aside will ensure you can take time off work to do this. A “rainy day fund” will also come in handy if you need to pay for an expensive medical procedure or operation due to an accident that is not covered by your insurance company. You should remind the person that having some money to fall back on can allow them to be independent and self-sufficient, even in the event of an emergency.

Outline the benefits of saving for retirement. You should discuss one of the major benefits of saving money now, while you are still working and able to work: saving for retirement. You should explain that saving money now means you can start a retirement fund and be prepared to enjoy your free time once you reach the age of retirement. Saving for retirement from a young age allows you to take advantage of the benefits of compound interest on your savings and/or investments. Compound interest allows your investments to increase at an increasing rate over time, as interest is earned on both the original amount and the interest earned to that point. For example, if you deposit $300 per month into an account earning an average of 8 percent per year for 40 years, you will have contributed $144,000 but the account balance will be over $1,000,000. Some jobs will offer a retirement savings plan as part of their benefits for employees, which means employees can put a portion of their paycheck towards a 401K or a retirement pension fund. You should ask the person to consider contributing to their company’s retirement plan, if possible, to save money later. Some employers may even match contributions to retirement plans, essentially offering the employee free retirement money. Retirement plan contributions to some accounts, including traditional IRAs and 401(k)s, may be tax-deductible.

Note how saving money expands your options. Saving money can also help the person achieve their career goals and invest in their future. Saved money can then be used for major purchases like a car or home. It can also be used to achieve financial independence, which gives them the freedom to live without relying on others for income. Saving is especially important if the person does not enjoy their current job and has future career plans. They may need to pay to go back to school or to get training in a certain field. Having savings will ensure they are able to do this to better themselves and achieve their career goals. You may get the person thinking about how money can affect their career goals by asking them, “Are you happy at your current job?” or “Do you have plans to work in another job or field in the future?” If they tell you they may want a career change at some point, you should remind them this will cost money to achieve.

Helping the Person Create a Budget

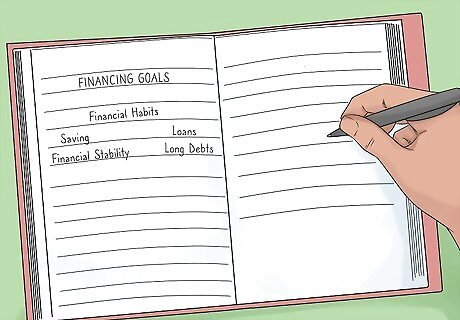

Determine the person’s financial goals. Identifying their financial goals can help them create a budget that fits their needs. Start by asking, “What are you immediate financial goals?” Immediate financial goals focus on how they want to spend their money today and address any pressing financial issues, such as paying off student debt or credit card debt. Immediate financial goals could also be saving up to move out and get their own place or being able to afford a new car. You should also ask, “What are your long term financial goals?” These goals are all about how they want to spend their money in the future. This could be having enough money for retirement one day or putting money in a travel fund for a future trip. Financial goals should be expressed in specific dollar amounts with schedules. For example, retirement may be 30 years away, buying a house may be in 3 years, and buying a car may be in 9 months. Figure out how much is needed for each goal so that specific savings schedules can be created.

Help them analyze their current expenditures. Work with them to review the last 12 months of of their actual expenditures, including credit card purchases. You can make a strong point before analyzing by asking them how they think they spend their income, then comparing this with how they actually spend it. Break expenditures into categories to show them how much they are spending on different expense types each month. For example, you can split their spending into non-discretionary (living expenses like rent, utilities, transportation, and food) and discretionary expenses (like eating out and entertainment).

Illustrate the gap between their financial goals and their financial habits. Showing them that their goals are not compatible with their spending habits can inspire them to change. This may require calculating their debt in a number of years if they continue spending the way that they do. Or, you could show them that they will never be able to buy a home or a new car if they don't change their spending habits.

Help them develop a budget to reach their financial goals. The next step in creating a budget is to help them identify their income and expenses. They may break down their income and expenses on a monthly basis, as most bills are due by the end of the month. They should list their income and expenses so it is clear what they earn and what they owe every month. Start with their monthly income. This could be a salary, paychecks, any bonus income, and any child support or alimony payments. Then, have them calculate their total monthly expenses. You can then create the final budget together. You should sit down with the person and work on their budget with them. You should show them how to determine their income and their expenses. You should also help them calculate how much money they can save every month if they change their spending habits. This will allow them to see how saving money can benefit them in the long run. You may decide to use a spreadsheet to create the budget using a computer program. This may make it easier for the person to add and subtract expenses from the budget as necessary. You could also show the person how to use budgeting Apps, where they can use an App on their smartphone to keep track of their budget.

Reinforcing the Benefits of Saving

Help them change their financial habits. You can convince the person that saving money is worthwhile by showing them how to find deals on items they buy everyday. Once they see how easy it is to save money, they may be convinced to embrace a more thrifty lifestyle. Savings on every day items is an easy way to stick to a budget and save for larger purchases or an emergency fund. You should show them how to shop for money-saving deals online and in stores. You may also show them how to use coupons and look up promo codes for certain retailers. You may also recommend that they sign up for email notifications from their favorite retailers about deals and special prices. You should recommend that they go shopping for certain items on special deal days like Black Friday so they get a good price on an item and save money that they can then put towards other expenses. You can also teach them how to save their money day to day so they are not going over budget or over spending all the time. Try to teach the person the value of being thrifty and money conscious so they do not waste their hard earned dollars. You may have them identify where they are spending too much money on a daily basis and then brainstorm ways to spend less. For example, maybe they could be bring their own lunch to work instead of going out all the time to eat. Or they could prepare their own coffee at home so they do not have to go to Starbuck’s every day. They could also save money on transportation by taking public transit or biking instead of driving every day. Doing this could help them save money on gas and parking.

Have them open up a savings account. You should recommend that the person go to their bank and open a savings account so they have somewhere to deposit all the money they are saving. A savings account is a good way to protect their savings as well, as it will deter them from spending all of their money every month and put some of it away instead. You may recommend that they go for a savings account at their bank that gives them benefits for having a balance in their savings account. For example, they could set up a savings account, where they earn interest on the balance in their account.

Encourage new financial habits. You should also discuss different ways they can invest their savings so they can earn money back on their savings. Doing this will allow them to maximize their savings and learn how to invest their money rather than spend it. You may suggest that they speak to a financial advisor about investing their money smartly and then encourage them to continue to invest in the future. Educate them about possibilities for saving more easily, like taking payroll deductions that are automatically placed into savings or paying off their credit card in full each month. For example, you may say, "Investing your money now means you will have more money for retirement later. You should speak to a financial advisor and find out how you can invest your money smartly."

Comments

0 comment