views

Obtaining a Federal Firearms License

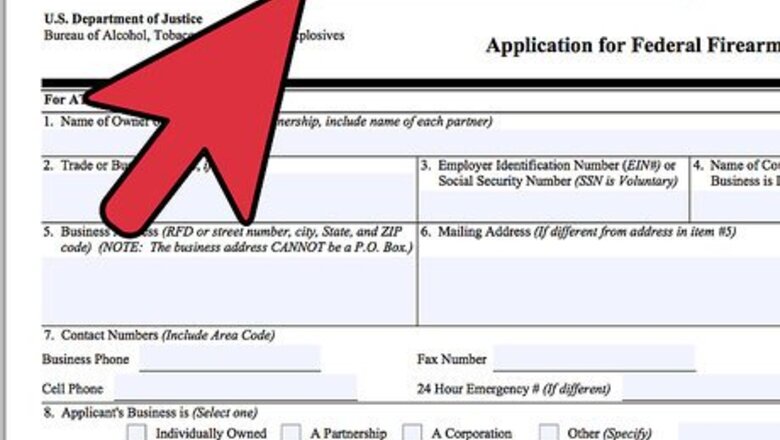

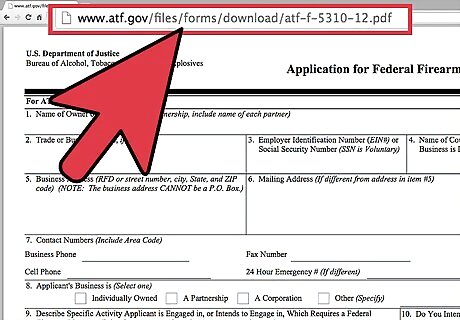

Complete ATF Form 5310.12. Commonly referred to as ATF Form 7, this form is the actual application for your Federal Firearm License. ATF Form 5310.12 is an eighteen-page form covering a variety of topics related to your and how you plan to operate your sale of firearms business. The form will require a wide array of information, including personal information for every owner or partner in the business, prior criminal record information, and business details ranging from hours of operation to an Employer Identification Number (as proof of the business). You can find the form online at: http://www.atf.gov/files/forms/download/atf-f-5310-12.pdf The fee associated with the application will depend upon the FFL Type for which you are applying. In order to eventually obtain your Class 3 Special Occupational Tax license—which expands the FFL scope to include National Firearms Act (NFA) items—you want to apply for a Type 1 FFL, which has a fee of $200.

Complete ATF Form 5330.20. This form is a certification of compliance attesting to the status of the applicant as a U.S. citizen or permanent resident alien.

Complete two FD-258 cards for each responsible person. These are fingerprint identification cards that you must take down to a local law enforcement agency to have prepared. Two cards must be completed for each responsible person in your business. Responsible people according to the ATF include, "a sole proprietor, partner, or anyone having the power to direct the management, policies, and practices of the business as it pertains to firearms. In a corporation this includes corporate officers, shareholders, board members, or any other employee with the legal authority.”

Submit two 2”x2” photos for each responsible person. In addition to two fingerprint cards, the ATF also requires two 2”x2” photos of each person completing the fingerprint identification cards. You can obtain these photos anywhere that passport photos are taken.

Interview with an Industry Operations Investigator. Once your forms have been filed and your fees processed, the ATF field office with jurisdiction over your location will schedule an in-person interview with an Industry Operations Investigator (IOI). The IOI will thoroughly cover your application with you ensuring all information is current and correct, and he or she will also cover state and local requirements based on your area. The IOI will need to speak with all owners, partners, and responsible parties listed on the application. The IOI will verify that all parties are at least twenty-one years of age, that they have truthfully provided accurate information, and that the business details are correct, including EIN and business license information. The IOI will also personally follow up with proper authorities to verify the criminal record information described in the application. Some of the most common reasons an IOI may report to deny the FFL include failure to comply with state or local law (such as zoning ordinances for your business), evidence of previous willful violations of the Gun Control Act of 1968, or evidence of willful falsification on the submitted application.

Wait approximately sixty days. Assuming the background check of all of the responsible parties in your business check out and the appropriate forms were submitted correctly, the entire process before receiving your license will take roughly sixty days to complete.

Obtaining a Class 3 Special Occupational Tax

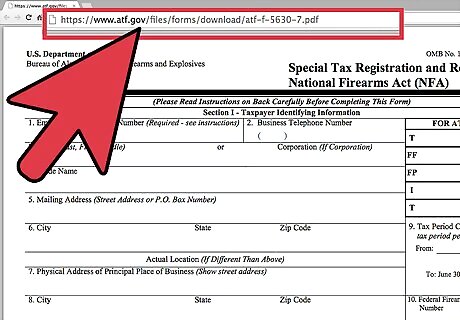

Complete ATF Form 5630.7. This form is for special taxes levied against dealers, importers, and manufacturers of NFA items. You can find the form online at: https://www.atf.gov/files/forms/download/atf-f-5630-7.pdf The form will require owner information, information to verify the business such as the Employer Identification Number, and physical business registration information.

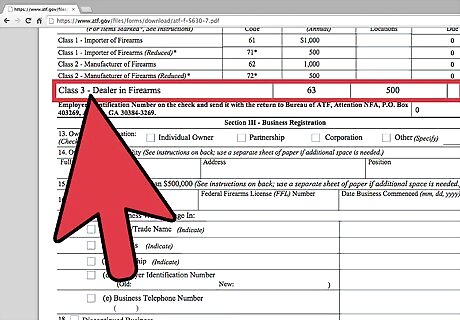

Choose Tax Class 3 on the form. The Class 3 designation refers to Tax Class 3 on ATF Form 5630.7. This designation applies specifically to entities dealing in firearms without importing or manufacturing them.

Submit the $500 annual fee along with the completed form. Tax Class 3 is subject to an annual $500 tax per business location for any locations dealing in NFA items.

Resubmit by July 1st each year. Since this is an annual occupational tax, your business must remain current on its yearly dues. The ATF calendar for the tax begins on July 1st and ends on June 30th, so you must pay before this deadline each year to avoid interest and possible penalties.

Comments

0 comment