views

Preparing to Get Your Check Certified

Ensure that you have sufficient funds before you plan to write the check. You cannot write a certified check for a given amount unless you currently have sufficient funds in your account. Before a bank issues a certified check, it will verify this information. Say you currently have $1,000 in your account and want to write a certified check for $1,100. The bank will not verify the check even if you are scheduled to get paid $3,000 in a few days.

Locate a bank or credit union to certify your check. Try to go to a bank where you already hold an account. It will be easier for them to verify your information, and many banks will not certify checks to non-account holders. If you use a smaller bank and are out of town, you'll have to search online to find a bank or credit union that will certify a check to non-account holders.

Look up your bank's certification fee. The cost to have a check certified varies quite a bit between financial institutions. Some banks offer the service to account holders for free while others will charge $15 or more. Look online or call your bank to figure out the fee ahead of time. Sometimes credit unions and smaller banks offer lower fees, so you can choose to shop around and compare prices. But if you don't already bank there, you may not be able to get a check certified at that location anyway.

Schedule a time to go to the bank in person. Choose a time go to the bank in person, as this service cannot be performed online. You will not need an appointment to get a check certified. Just make sure that you have enough time to stand in line and wait. Depending on your institution, you may be able to order cashier's checks online or over the phone, but you will need to go to a bank for a certified check. If you anticipate a lot of problems or have questions, you can call the bank ahead of time to schedule an appointment.

Pack your identification and checkbook to take with you. In order to get a check certified you will need photo ID such as your driver's license, passport, or other official government ID card. Student ID cards or any other unofficial picture IDs will not work. You will also need your checkbook to write the check.

Verify that you have the correct information for your check. Check to make sure you have the correct spelling of the payee's name and the right amount to be paid. Since most institutions charge a fee to certify a check, you don't want to make a mistake and repeat the process.

Visiting a Bank for Certification

Go to the financial institution you selected. When you enter the bank, stand in line and wait to see a teller at the window. When you approach the window, explain that you would like to have a check certified and give the teller your identification.

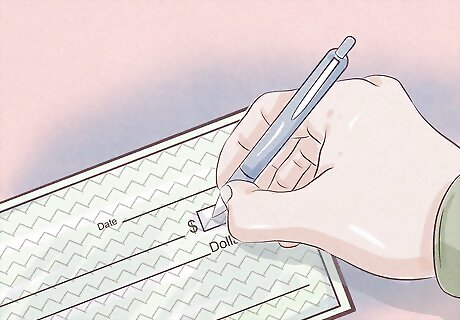

Write the check as you normally would. Make sure to write all the information down correctly. And go ahead and sign the check in the usual place at the bottom.

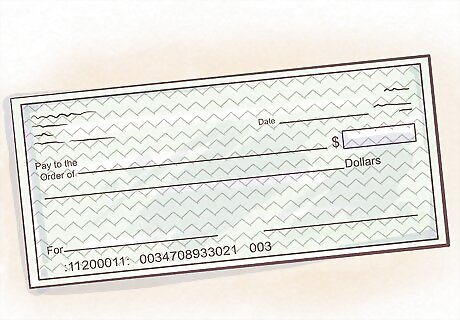

Wait while the bank verifies your information. The bank will need to check your ID to verify your signature, and they will also review your account to make sure that you have sufficient funds. If you have sufficient funds, the amount included on your check will become frozen in your account, so you will not be able to spend this money. By preventing you from spending that amount, the bank certifies that the funds will be available to the recipient of your check. When you leave the bank, your balance may appear as $20,000, but if you just certified a check for $5,000, only $15,000 will be available for your use.

Pay your bank's certification fee. Once the bank verifies your information, it will ask you to pay your fee if you have one. Pay the fee using a means that your bank accepts.

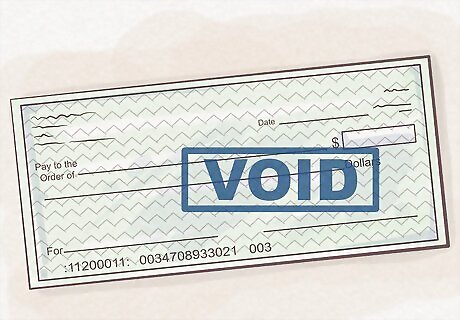

Make sure the bank stamps your check. After collecting your fee payment, the teller should stamp your check with rubber stamp. It should be visible on the front of your check.

Delivering and Monitoring Your Certified Check

Verify your goods or services before sending the check. Certified checks are extremely difficult to cancel. Do sufficient research before giving your check to someone—particularly if it's somebody or some organization that you do not know well. Even if you researched the person or organization when you initially agreed to the transaction, follow up again before parting with your certified check.

Deliver your certified check. The best way to send your check is by certified mail. Put the check in an envelope, go to the Post Office, and have it certified before sending. This approach requires an extra step, but it will help you guarantee that your check was delivered since you will receive both a receipt for sending it as well as notification after it was received. Alternatively, you can deliver your check by hand or mail it using standard mail, but you won't have a written record of its receipt if you use these methods.

Trace your certified check to ensure that it's deposited. Make sure the payee deposits your check. Your bank will have a record of when the check is cashed. You can call your bank or check online for this information. You can also call the payee to confirm, but this method is less reliable.

Report any suspected fraud if necessary. If you discover that your payee is not reputable, or if they do not perform the agreed upon service after you send the check, report fraud to your bank. Your bank may be able to stop payment on the check, but because the check was certified this is highly unlikely. You will probably be asked to file a police report, and you may have to take legal action to recover your money.

File a "declaration of loss" report if necessary. If your payee doesn't deposit the check within 90 days, you can contact your bank to file a “declaration of loss.” Talk with your bank to discuss how to proceed because you may be able to get the money back. If you trust the payee, and they inform you that they lost the certified check, you will also need to report this to your bank before writing them a new check.

Comments

0 comment