views

Reporting an Unauthorized Credit Card Charge

Identify the unauthorized charges. An unauthorized charge is any purchase on your credit card that you did not make or authorize. Take out your credit card statement and identify the dates, amount, and merchant of any unauthorized charges. You will need this information to report to your credit card company. If your credit card statement does not arrive on time, call your credit card company.

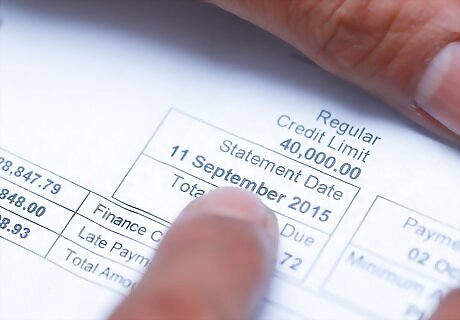

Do not delay. The federal Fair Credit Billing Act states that consumers must report unauthorized charges to their credit card issuer within 60 days that the statement containing the error was mailed. If you learn of the unauthorized purchase sooner, however, you should report the error as soon as possible. One way to detect fraud early is to enroll in your credit card's bank website. You can then monitor charges at your own convenience without waiting for a monthly statement.

Call the phone number on the back of the card. You should immediately report any unauthorized charges as soon as you discover it. Additionally, you may also want to cancel your card and ask the credit card company to issue a new one.

Follow up in writing. Although you should certainly call as soon as possible, you should also follow up with your credit card company in writing. Be sure to send the letter certified mail, return receipt requested. Send the letter to the department authorized to handle billing disputes, which should be listed on your most recent credit card statement. The letter should include: a copy of the billing statement with the questionable charge highlighted your name your account number an explanation of why you believe the charge is incorrect The Federal Trade Commission has a sample letter available at their website for you to use. Revise it to fit your circumstances. Keep a copy of all correspondence for your records.

Understand your liability. Under the Fair Credit Billing Act, consumers are not liable for more than $50.00 in fraudulent charges. Furthermore, major credit card companies like Visa, MasterCard, Discover, and American Express often have zero liability policies, which means that you will not be held liable for any portion of the fraudulent charges.

Wait for a response. Once you have disputed a charge, the credit card company will credit your account for an amount equal to the disputed charge. This means that any payment you make on the card will not include the disputed amount. The credit card company must acknowledge receiving your dispute within 30 days. If you do not hear within 30 days, call the credit card company again.

Complete required forms. The credit card company may send you forms to fill out. Complete them quickly and mail them back as soon as possible. The company has 90 days to perform an investigation and get back to you.

Receive a decision. The credit card company must inform you in writing of the results of its investigation. If the company agrees the charge was a mistake, then your account will be credited and all finance charges, late fees, and other charges must be removed. If the credit card company finds that some or all of the disputed charge was legitimate, then you can request whatever documents the card company has proving that you really owe the money. You have 10 days to write the credit card company and telling them that you will not pay the disputed amount. Once you refuse to pay, the credit card company has the choice to bring a collections action to recover the amount. Also, the company may report you to a credit reporting company as delinquent, though it must also state that you don't agree that you owe money.

Reporting a Merchant Error

Identify the type of complaint. Be clear about what your grievance is: Goods not received i.e. The merchant charged you for an item you did not purchase Overcharge i.e. charged you more for an item than you agreed to You can also dispute a charge if you have a complaint about the quality of goods or services that you received. Technically, this is not a “billing complaint.” Nevertheless, you may request a “charge back” from the credit card company. A “chargeback” is effectively a refund. To request a chargeback for goods or services, you must have spent more than $50 and the purchase must have been in your home state or within 100 miles of your home. Dispute a Credit Card Charge Step 9.jpg

Keep a record of all correspondence with the business. Store all of the following together in an easily accessible place: receipts invoices texts notifications emails faxes tickets calls forms pictures of the product Dispute a Credit Card Charge Step 10.jpg

Contact the merchant's customer support. After you realize that the charge has been caused by a merchant's error, you can contact the merchant immediately to inform them of the mistake. Although you are not required to contact the merchant, merchants will often address your complaint in a satisfactory manner.. Call them/ email them or post a request ticket on their website with as much information as possible in the order of the time it occurred. Remember, you want to build a clear case of how you did everything in your capacity to communicate the type and quality of service you requested but your expectation was not met. Keep a record of the complaint number or ID in a safe place. Include the following in your complain: Date and time of the purchase Order number Amount and currency Date, time, quality and quantity of the product and service received if any Date, time, quality and quantity of the product and service you expected Any previous effort you made to get the quality, type, product or service you expected How you want them to resolve the issue e.g. get a full refund or ship you the item again or refund you only for the faulty item or give you a gift coupon Your contact information for them to get back to you Thank them for their anticipated support

Follow up with the business. Any established business will tell you exactly how long you need to wait for a resolution. Wait patiently till that time has passed. In the meantime, make sure you are available at the phone number/ email address you mentioned. If they ask for more information, look it up from your previous steps or tell them you don’t have it. Call them again if they don't respond in 48 hours otherwise with your complaint ID pulled up.

Contact your credit card company. If you are unable to reach an immediate resolution with the merchant, then you should immediately contact the credit card issuer by calling the phone number on the back of the card or on your billing statement. Don't wait too long for the merchant to issue a refund. If the refund isn't immediate, then move on to your credit card company. Once contacted, your credit card company will contact the merchant on your behalf in order to reach a resolution.

Follow up with a letter. You should follow up your phone call with the credit card company by writing a letter. If you are challenging the quality of goods or services, then you should make sure that your letter includes: the request for a chargeback your account number the specific amount on the statement that you decline to pay the steps you have already taken to try and settle the dispute

Approach a consumer rights organization. If a dispute with the credit card company is past due, normally after 60 days, approach a consumer rights organization. In USA, for example, Better Business Bureau is an organization that holds businesses accountable. Sign up and post a ticket with the same information you gave the business. You may have a time window to do this as well, longer than filing a dispute with the credit card company.

Comments

0 comment