views

X

Research source

In any case, you have to take the right steps to ensure that you are fully covered.

Assessing Your Insurance Needs

Determine if you need E&O insurance. Any company or individual that provides a service should consider obtaining errors and omissions insurance. In the event the service turns out poorly somehow, to the point where a customer incurs a loss from the service, any damages or liability costs will be covered by E&O insurance. However, some industries are able to avoid the need for E&O by having standard contracts that prevent the customer from suing the service provider. Before relying on contracts, discuss with a lawyer whether or not this is possible in your industry and if it would make potential customers shy away from you.

Consider your exposure to risk. Some professions and businesses are more exposed to risk than others and must make sure that risk is covered in an E&O policy. In addition, for some professions, the potential cost of lawsuits is much higher. For example, a training specialist bears some risk, but not nearly as much as a heart surgeon. Think about your exposure to risk when deciding to buy E&O insurance and when choosing a policy. Make sure all of your risk is covered by the policy you choose. It may also be possible that your industry is simply more likely to see claims filed against businesses. An insurance agent should be able to warn you about this issue if it affects your business.

Know what E&O doesn't cover. E&O is a policy specifically designed to protect you from honest business transactions that accidentally resulted in a financial loss for your customer. For liabilities outside this scope, you will have to get additional types of coverage (if available). For example, E&O insurance does not cover damaged properly or bodily harm on your business's property. This is instead covered by general liability insurance. In addition, E&O insurance does not include claims filed by your own business associates. For example, if your law firms partners decided to sue you for failing to manage the firm properly, you would need directors and officers liability (D&O) insurance to cover your legal costs. E&O insurance does not cover intentionally malicious, dishonest, or illegal acts.

Think about how much coverage to get. An insurance agent should be able to advise you on how coverage to get for your industry and specific business requirements. However, part of the reason you are buying insurance is for peace of mind. So, before buying insurance, consider other lawsuits you are aware of in your industry and what one against you might end up costing. Come up with a number so that you can negotiate a good coverage amount with your agent. You should also consider the potential risk of any new services you plan to provide over the course of your insurance plan.

Making Sure You're Covered

Get the right wording. There is no standard wording or generic E&O insurance coverage. Each company's E&O policy is specifically written to fit that particular company. It is important that the policy writer understands the area of your business in order to write the best policy. To get the best E&O policy, find an agent that specializes in your field. As you are presented with policy information, read over it thoroughly to make sure all the wording is correct.

Pay attention that all the services you offer are covered by the policy. You're never going to be able to find a perfect insurance policy for your business if you don't negotiate the terms. Make sure to assess your individual needs and make sure that each one is covered specifically in the policy. If you need to, have a lawyer look over the contract with you to make sure your needs are represented. In many cases, additional coverages are available for little or no cost, so be sure to ask the insurance provider about anything you think the policy is missing.

Consider the prior-acts coverage section. Some policies only cover claims made within the period of coverage. Other policies will cover claims made of allegations that occurred prior to the beginning date of coverage. These policies that cover you outside the dates of coverage can offer limited time coverage or protection for all prior acts. Under this type of policy, your business will be covered back to a "retro" or "retroactive" date. This only covers you for services provided before buying insurance when the claims on those services are made after you have bought insurance. In other words, you can't wait to buy insurance after the lawsuit has already been opened.

Make sure the policy covers all legal costs. Legal costs arising from a lawsuit can include judgments, settlements, and defense costs. Many E&O policies cover all of these costs, making the deductible on the policy the absolute limit to the expenses incurred by your business. However, some policies exclude defense expenses from the liability limit while others include them. Other policies may exclude punitive damages completely. Policies must be carefully examined to make sure that they cover these expenses.

Buying an Errors and Omissions Policy

Do not waste time getting E&O insurance. The best time to get insurance is when your business is first starting out. Dealing with even one customer puts you and your company in financial risk if something unplanned happens. If you are part of a company that has been fortunate enough not to have run into any problems like this yet and you do not have E&O insurance yet, it is not too late to get the insurance.

Consider hiring a broker. You can usually buy insurance on your own, however you can usually get better coverage by hiring an experienced insurance broker. This broker will use their knowledge of your industry and the insurance market to locate you a comprehensive policy at the best price. If you are not able to locate an insurance broker for your industry online, try asking business associates or the office of an industry group relevant to your business.

Inquire about E&O insurance. Contact your insurance company and begin the process of getting insurance. The insurance company will ask questions about your company and the services you provide. They will discuss with you the amount of coverage you would like to obtain. In the end, they will provide you with a price quote for you to have E&O insurance. Give the agent the best and most thorough information you can on your business to make him or her feel comfortable insuring you and giving you the best possible price quote. The insurance provider may ask you for a variety of documents, including previous contracts, standard documentation procedures, training documents, or other business process-related documents. Be sure to have these ready if they are needed.

Contact other insurance companies for quotes. Many industries have at least one specialized insurance provider that provides E&O insurance within that industry at a better price or with more comprehensive service than its competitors. Run a quick internet search and locate these insurance providers for your industry. Contact them about receiving an insurance quote. It's important to get several different quotes because prices may vary widely between providers. A specialized provider will also be better equipped to protect you because they know your industry well. In many cases, professional or trade organizations can give you good rates on E&O insurance. Consider checking out these sources in addition to independent insurers.

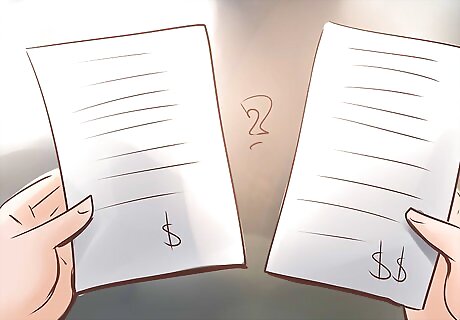

Compare policies and prices. Compare each quote you have received, making sure first of all that each one has all of the required coverages that you need for your business. Then, look at the annual cost of each one and their claim cost structures. For many businesses, it may be best to get the policy with a lower annual fee and higher deductible. Just make sure that the coverage limit also meets your needs.

Comments

0 comment