views

Shopping for a Bank Account Without Fees

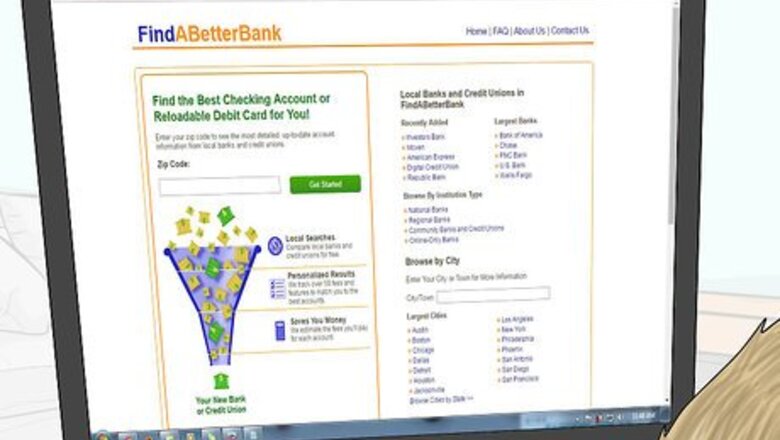

Use an online search engine. The first way to avoid paying minimum balance fees on any account you have is to put your money into a bank that does not charge any such fees. You can search for banks, locally or nationally, using any of a variety of online search engines. You can enter certain criteria that are important to you and receive information about banks that meet those conditions. For example, at FindABetterBank.com, you can use their search feature to search for banks with no fees or limited fees. The search feature will ask you a series of questions to establish which features are most important to you. Based on your answers, it will generate a list of banks you may consider.

Compare banks with similar features. Whenever you are considering a new bank, you should make sure that you are looking at the same group of features. If you are considering two or more banks, and the features they offer are different, then you should consider the value of those features. For example, you may be willing to pay some small fees for features that are important to you, such as unlimited ATM use. You should consider all the ways in which you use your bank before you begin your search. Then rank the features in order of importance.

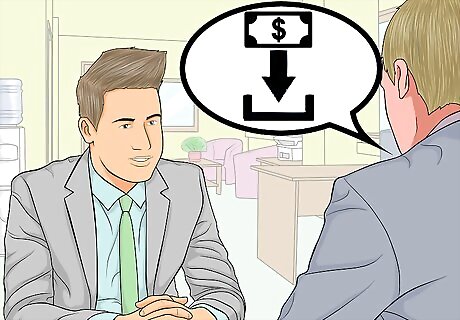

Visit banks in your area. In addition to searching online, which will consider hundreds of banks across the country, you should search locally. Either call or walk in to a local bank and ask to speak with an accounts manager. In many cases, small local banks will offer better deals with fewer fees because they want to generate local business.

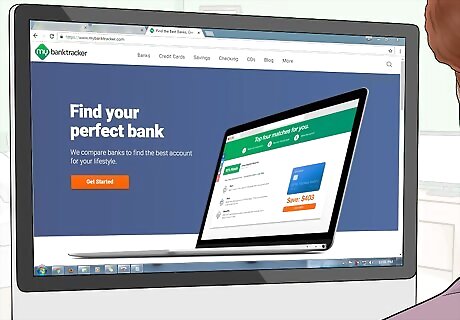

Consider using an online bank. Online banks are institutions that do not exist in a physical building. They still offer many of the same services, such as storing your money, check writing, and even ATM use. Because they do not have the same overhead costs as a physical bank, they can afford to charge fewer fees for the same services. The website MyBankTracker.com provides a list of online banks and reviews of their services.

Negotiate to eliminate fees. When you open an account with a bank, you should speak with an account manager about eliminating minimum balance fees. At a smaller bank, that is trying to attract your business, the manager may be able to help you with these fees. If you have a good credit record, without a history of overdrawing your accounts, you may be able to encourage the bank to do away with these fees.

Monitoring Your Accounts to Avoid Minimum Balance Fees

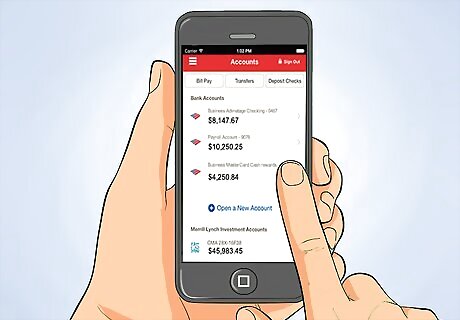

Find reliable methods to check your account balances. Most banks now offer the ability to check your account records online or even by telephone. Many banks provide an app for use on most smartphones, so you can check your balance in the palm of your hand. Apps will also provide a daily update of your balance as well as deposits and withdrawals.

Know when and how your account balances are measured. Banks can use one of two different methods to determine whether to apply a minimum balance charge to your account. If you are aware of these methods and keep track of your accounts, you should be able to stay a step ahead of the bank and avoid incurring any minimum balance fees. Banks commonly assess fees based on either your daily or monthly balances. You should ask the bank officer which system is used when you set up your account: A daily balance system checks your account balance at the end of each day. An average monthly balance system measures your account balance each day, and calculates the average balance at the end of the month.

Make adjustments to your balances as necessary to avoid fees. When you know your bank's system for measuring your balances and assessing fees, you can correct your balance to avoid those fees. If your bank applies the daily balance system checks, you will need to be aware of your balance each day. If you know that you have dropped below the minimum balance with some transaction during the day, you should add money to your account by the end of the day to avoid the fee. Using online banking or your cell phone app should help with regular daily balance checks. If your bank applies the average monthly balance system, then as the end of the month nears, you will need to check your average balance. You can either get a printout of the month's activity, and then calculate the average yourself, or see if your account report will include a running monthly average.

Managing Your Accounts to Avoid Fees

Link multiple accounts together. If a bank measures a combined balance of multiple accounts, then it is already using a system of linking your accounts together. If this has not been suggested, you may wish to ask about it when setting up your account. Find out if you can link a savings or retirement account to your checking account, and thereby avoid paying maintenance fees. Some banks will even let you avoid paying fees if you have your mortgage or other significant loan with them.

Set up direct deposit. Ultimately, banks make money by holding your savings. If you set up a direct deposit for your paycheck, the bank will be able to count on that regular source of income. Many banks offer programs that eliminate fees if you establish a direct deposit account with them. You may need to ask about the direct deposit feature for avoiding fees when you open your account. It may not be evident unless you ask about it.

Pay your bills online. If you use your bank’s online bill paying features, you can often avoid minimum balance fees. Even if you use the online bill paying as infrequently as once a month, many banks will credit this and will not charge the maintenance fees.

Combine resources with a trusted friend. Find someone you can trust to share an account with. If the two of you combine your money, you will each have an easier time maintaining a minimum balance. The bank will consider the account to be a single account. You and your friend will need to develop a system of managing the account between yourselves, so you each know how much of the money belongs to each of you. If you can do this, you should have an easier time meeting the minimum balance.

Comments

0 comment