views

X

Research source

[2]

X

Research source

Making Arrangements for Joint Obligations

Remove your name from joint accounts. If you're planning to leave your spouse (which may be termed abandonment), separating finances as much as possible before you go is ideal. However, if you plan to leave secretly this may not be an option. Keep in mind that courts typically don't consider abandonment when dividing marital assets. However, if you removed large sums of money from joint accounts or ran up high credit card balances, you may end up having to pay your spouse at least some of that back. Ideally, you should set up your own separate accounts and keep your money there. For example, if your paycheck is direct-deposited into the joint bank account, open a separate account and change your direct deposit to that account. Whatever you do, avoid running up balances on credit cards are removing large sums from joint bank accounts. Although you typically are entitled to half the money in a joint bank account, a large withdrawal can look suspicious.

Gather financial documents and records. A spouse often is required to pay an abandoned spouse alimony because they left the abandoned spouse without making any arrangements to pay joint debts and other bills. This can put the abandoned spouse at a disadvantage, even if they were not dependent on you and would otherwise be able to take care of things. By leaving, however, you don't give them time to plan and adjust their standard of living so that they can pay the bills on their own. If you have a full understanding of all your joint accounts and obligations, you can work out arrangements to ensure your spouse isn't suddenly responsible for all the bills. For example, if you've opened a separate bank account, you can change the automatic billing for some of your bills so that it comes from your separate account rather than the joint account for the time being. All of this will be sorted out through the divorce, but in the meantime, making these arrangements can help you avoid alimony.

Evaluate and divide joint debts. Abandoning a marriage doesn't mean abandoning debts that are rightfully yours. You can reduce the chances that you'll be required to pay alimony by claiming those debts that are your responsibility and making arrangements to pay them. For example, if you have two joint credit cards, both of which have $5,000 balances, offer to take full responsibility for one of them. Remove your wife's name from that account, and remove your own name from the other one. If there is a joint debt that really is yours, take responsibility for the whole thing. For example, if you and your spouse bought a car jointly, but you're the only one who drives it, taking over the car payments can help you avoid alimony. The key is to leave your spouse with as little joint debt as possible, so they are only required to pay those debts that covered things that only truly benefited them.

Consider offering a lump sum to settle your interest. If you have the means to do so, you may consider making a lump-sum payment to your spouse instead of regular alimony payments. That money essentially buys out your interest in any joint debts accumulated during the marriage. Particularly if you and your spouse have large joint obligations, such as a mortgage, paying down some of those debts can relieve the burden on your spouse. This doesn't necessarily mean you have to pay off your mortgage, but if you have the ability to offer a good-sized lump sum, it can help you avoid alimony. Some courts still call these lump-sum payments "alimony" or "spousal support," because they're not payments made in the context of the division of assets. However, what you do avoid with a lump-sum payment is making regular periodic payments, such as once a month.

Arguing Against Spousal Dependency

Hire an attorney. If your spouse has filed for divorce and requested spousal report, an experienced family law attorney can help represent your interests and make the best possible case for you that your spouse is not entitled to alimony. This is especially true if your spouse already has an attorney. You can't expect your interests to be considered fairly when your spouse has an attorney but you don't. If you're not familiar with family law attorneys in your area, check your state or local bar association's website. You'll typically find a searchable directory of licensed attorneys that you can use to find some possibilities. Ideally, you want to find an attorney who is experienced at defending clients against claims for spousal support, and who has a record of defeating those requests.

Look at the factors the court considers. Each state considers different factors when making the decision whether a spouse is entitled to spousal support after a divorce. Go over these factors with your attorney and decide which ones lean in your favor and which don't. Many of these factors have nothing to do with finances specifically, but rather with your spouse's ability to rebuild after the divorce and take care of themselves without your assistance. The age and physical condition of your spouse can be an important factor. If you're both basically the same age, it won't come into play much. However, if your spouse is significantly older or significantly younger than you, age could turn out to be a major consideration. For example, if your spouse is 20 years younger than you, they have plenty of time to get back into a career – even if they took several years off of work. If your spouse is significantly older or disabled, on the other hand, theocrat likely will consider that you must pay them alimony. In their condition, it will be more difficult for them to find work and the work they do find likely won't pay very well.

Compare your spouse's education and earning potential to yours. Even if your spouse hasn't worked for a relatively brief period of time, if their education and earning potential exceeds yours, you can use this to argue that you should not be required to pay alimony. For example, if you never went to college but your spouse has an advanced degree, you generally shouldn't be required to pay them alimony – particularly if you put your own education on the back burner so they could complete theirs. On the other hand, if you're the one with the advanced degrees while your spouse only has a few years of community college under their belt, you may have more difficulty avoiding alimony. This is especially true if you were married when you got your degree. Your spouse will argue that they sacrificed their own education to support you with the idea that your advanced degree would benefit you both in the long run.

Review spousal contributions through the history of the marriage. If both you and your spouse have been contributing fairly equal amounts to the household throughout your marriage, this supports your argument that you shouldn't have to pay alimony. Generally, the judge or jury will look at your standard of living over the past few years you lived together as a couple. Your spouse will be considered dependent if you provided the majority of the money on which you and your spouse relied. However, if you and your spouse both contributed, the court will look at whether your spouse is capable of maintaining a similar standard of living on their own, including meeting all their basic financial needs. In most states, abandonment does play a role in how the court considers alimony – but all the other factors still come into play.

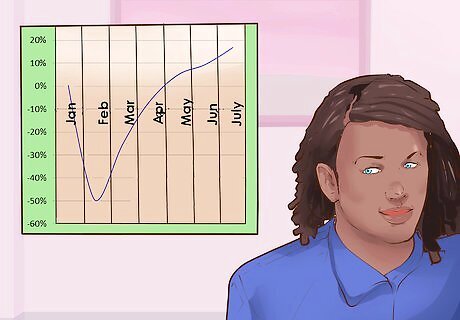

Assessing Financial Factors

Look at how long your spouse has been unemployed. If your spouse has been unemployed for any length of time during your marriage, calculate the length of those periods. Then look at what happened to your spouse's income when they returned to work. Generally, the longer your spouse has been unemployed, the more difficult it will be for them to return to work at a similar position to the one they had before they stopped working. In many professions, your spouse may have to acquire additional education before they are ready for the job market. This is particularly true in competitive, dynamic fields. However, if they've taken several months off at a time at previous points in your marriage, and returned to the same or similar work, you may be able to avoid alimony by arguing that the time they've been unemployed is of little to no consequence to their chances of employment. If your spouse has been unemployed for an extended period of time and you have been paying all of the household bills, it's unlikely you'll be able to avoid paying alimony.

Consider any reasons your spouse didn't work. Courts look more favorably at some reasons than others when deciding whether to award alimony to an unemployed spouse. Much of this plays into the assessment of whether your spouse can be considered dependent on you. For example, if your wife took a hiatus from work when she was pregnant with your child, and the two of you agreed that she would stay at home until the child started kindergarten, you probably will end up having to pay alimony. In that example, her decision not to work is considered a joint decision, and is something she would not have been able to do without your income there to support her and the child. However, if your spouse made a decision to quit work to pursue their own interests, a judge may consider that decision and lean more towards not requiring you to pay spousal support – or require only temporary support until your spouse can find a job again.

Analyze your spouse's income potential. Regardless of what your spouse made and how they contributed to the finances while you were married, the more important question is what they are capable of making now. Your spouse's education factors in to their income potential now. If they have an advanced degree, generally they should be able to support themselves – at least after a brief transitional period of time. Generally, you can avoid alimony by showing that your spouse has the ability to meet their financial needs on their own.

Evaluate why your spouse is not able to meet that potential. As with the reasons for your spouse's unemployment, the court also considers the reasons your spouse isn't fully employed. The less those reasons have anything to do with you, the less likely the court will award alimony. This can be particularly important if your spouse was underemployed during the marriage. For example, perhaps your spouse downgraded to part-time work so he could pursue his lifelong dream of painting. If your spouse was capable of making as much as you did during the marriage (or more) if he worked full time, and there's no reason he couldn't work full time now, you could potentially avoid alimony by pointing to this fact.

Comments

0 comment