views

As many Americans face months on end stuck indoors, some are using their time (and money) to create a change of scenery or upgrade their surroundings. Office equipment purchases are on the rise, and people are tackling more renovation projects than usual.

But expensive new stuff and significant home improvements can leave you underinsured. If youre considering making changes to your home or if you already have its smart to revisit your homeowners or renters policy. Heres how to ensure it covers the new additions.

TELL YOUR INSURER ABOUT YOUR PLANS

Theres a good chance youre underinsured before you even make changes, according to Don Griffin, vice president of personal lines at American Property Casualty Insurance Association. Talk to your insurer before making any expensive purchases or changes to your home to inform the company of your plans and clarify your policys current coverages and limits. If your home costs more to replace after youve improved it, some insurers will pay the new expense to rebuild, but thats not every policy, and it may not cover everything you need, Griffin says. He also recommends once a year reviewing what your home insurance policy covers.

In some cases, you may need to change carriers to get the coverage you need. Frank Jones, an independent agent and partner at Mints Insurance Agency in Millville, New Jersey, has seen clients switch insurers because an addition wasnt covered. Its in your best interest to have these conversations now rather than to have a claim denied, he says.

A new desk and computer for remote learning, plus that monitor and chair in your home office will add up and could exceed your personal property coverage limit.

Renters insurance policies cover your stuff, but they have limits too. If you have new electronics or office equipment, check with your insurer to make sure you have enough coverage for them.

MAKE AN INVENTORY OF YOUR PROPERTY

To help you know if youve exceeded your policy limits, keep records of what you buy. In fact, Griffin recommends taking inventory of your belongings every year a written inventory is best, but even a simple smartphone video tour of your home will suffice.

Losing a home is an emotional time, Griffin says. When its time to file a claim, you dont always remember what you have. An inventory will clearly show what you had before a disaster and will make the claims process easier.

ADD SUFFICIENT COVERAGE

Structural changes, such as a full kitchen replacement or adding an in-ground pool, will have the greatest impact on your homeowners insurance. But even something as simple as adding a fence can change the value of your house, and if your homes value increases, so should its dwelling coverage, Griffin says. Otherwise, in the event of a claim, your insurance policy wont be enough to rebuild, according to Griffin.

When adding coverage, pay attention to how much it would cost to rebuild your home, not how much you spent to upgrade the house, according to Jones. These are two different numbers, he explains. If an addition costs $20,000 to put on, the insurance company looks at the rebuild construction cost, and you might not get that back.

AVOID PITFALLS

On top of ensuring coverage, a proactive conversation with your agent could help you avoid potential renovation pitfalls. For example, he or she may advise adding building ordinance coverage to protect you from having to pay out of pocket for any expenses that keep your home compliant with local laws and regulations.

For renovation projects that are too big to take on yourself, hire a licensed and bonded contractor who carries builders risk coverage to protect expensive construction materials from theft or damage while they are on your property. You can find one through a building trade association.

And when youre doing a home renovation project, take plenty of photos before, after, and along the way, if youre able. These could come in handy if you file a claim and need to redo the work.

__________________________

This article was provided to The Associated Press by the personal finance website NerdWallet. Ben Moore is a writer at NerdWallet. Email: [email protected].

RELATED LINKS:

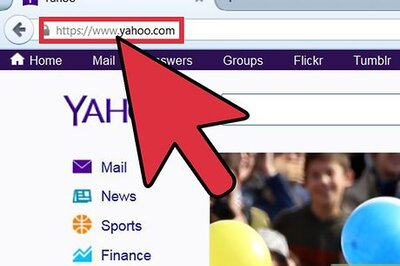

NerdWallet: Homeowners insurance: What it is and what it covers http://bit.ly/nerdwallet-homeowner-insurance

Building Trades Association https://www.buildingtrades.com/

Disclaimer: This post has been auto-published from an agency feed without any modifications to the text and has not been reviewed by an editor

Comments

0 comment