views

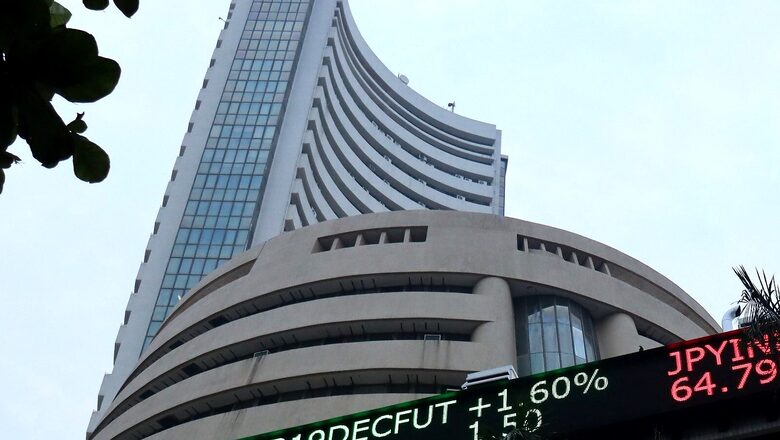

The benchmark Indian indices closed at fresh record on Friday- thanks to Reliance for driving the indices up. The BSE Sensex ended in the green at 58,129.95, up 277.41 points, or 0.48 per cent. However, the broader Nifty was up 89.40 points, or 0.52 per cent at 17,323.60. India’s volatility gauge VIX rose to 1.36 point.

“Despite mixed global cues, domestic equities continued to raise their bar, recording fresh highs as India continued reporting strong economic numbers. European stocks traded mixed ahead of US jobs data while concerns over economic slowdown in China fanned investor worries. The Indian Service PMI data rose to 56.7 in August from 45.4 in July on account of reopening of several establishments and improving demand that boosted sales,” Vinod Nair, head of research at Geojit Financial Services:

On NSE, Reliance Industries is the top gainer which is up 4.07 per cent, followed by ONGC, Coal India, Titan and Hero Moto Corp while HDFC Life, Cipla, Hindustan Unilever, HDFC Bank were among the losers etc. Sectorally, barring Nifty Bank, Nifty Financial Services and Nifty FMCG, Nifty Private Bank, all indices were trading in the red. Nifty Bank shed 0.19 per cent, Nifty Financial Services was down 0.26 per cent. However, Nifty Oil and gas was the biggest gainer, up 2.8 per cent. The market breadth remained positive as 23 shares advanced and 17 declined.

“Large caps are playing a catch-up rally in the last one month, which is driving the benchmark to higher levels. We believe that the style rotation holds the key, moving forwards. We are in a very interesting phase of the market where benchmark indices are touching to all-time high levels in which the market positioning has slowly shifted towards high quality large cap names. The market breadth has narrowed in the last one month and the high quality large cap stocks outperformed the broader market,” Neeraj Chadawar, head-quantitative equity research, Axis Securities said.

On BSE, Hindustan Oil Exploration with 9.9 per cent gain was the top performer, followed by Linde India with 7.70 per cent, Bluedart. On the flip side, Sonofi India, Alembic Ltd, IEX were among the laggards. Sectorally, BSE MidCap rose by 0.24 per cent, BSE SmallCapwas up 0.24 per cent. The market breadth remained positive as 18 shares advanced and 12 shares declined.

“Domestic equities extended gains mainly led by rebound in metal and automobile stocks. Further, a sharp rise in RIL supported the Nifty. Notably, barring financials and FMCG, most key sectoral indices ended in green today. Further, buying remained visible in midcap and smallcap stocks, while volatility index inched up ~2%. Notably, Nifty gained ~3.5% this week mainly led by revival in FIIs flow following dovish commentary from Fed chairman Powell in Jackson Hole Symposium last week and sustained domestic flows, while around Rs10 lakh crore was accumulated in investors’ wealth during the week.” Binod Modi, head strategy Reliance Securities said.

However, in early trade, taking mixed cues from US and Asian stock markets, Indian key benchmark indices opened in green and touched an all-time high. On Friday, the BSE Sensex opened at 58,070.12, up 217.58 points, or up 0.38 per cent for the first time and the broader market Nifty was up 61.80 points or 0.36 per cent at 17,296.

Read all the Latest News, Breaking News and Assembly Elections Live Updates here.

Comments

0 comment