views

New Delhi: Indian Railways is considering ending state-owned Steel Authority of India Ltd's (SAIL) virtual monopoly on supplying steel for standard rail tracks, opening up annual purchases worth up to $700 million to the private sector, people close to the matter told Reuters.

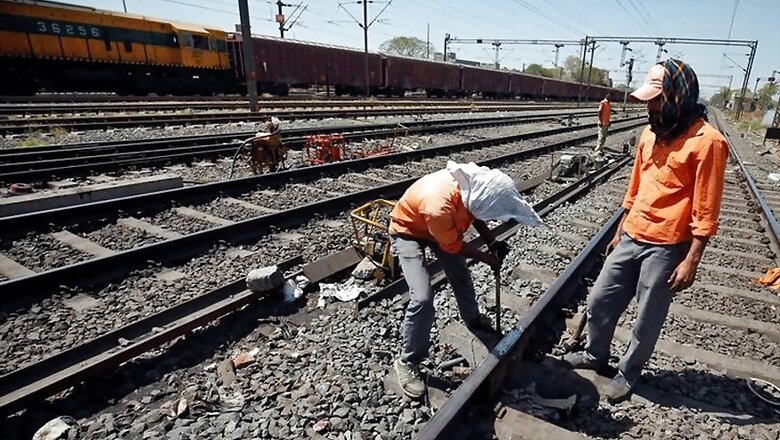

The vast state rail operator is undergoing a $130 billion, five-year overhaul to modernise the world's fourth-largest network, which is blighted by ageing track and saturated capacity.

The government has also launched a $15 billion fund to improve rail safety. Train accidents due to track defects have risen 25 percent in the last two years, the railway ministry told parliament last week. (http://bit.ly/2nk5uZb)

SAIL executives said a sudden jump in demand for steel - up 45 percent since 2015 - to replace old tracks and lay new ones meant it was struggling to meet production targets. The company said the launch this year of a long-delayed new rolling mill at its main plant at Bhilai, in eastern India, would boost its capacity by around 100,000 tonnes.

Losing even a small part of its sales to the railways - its top customer - would be a blow to SAIL, which has lost money in seven straight quarters.

"SAIL's performance has been very poor and given that we have a MoU (Memorandum of Understanding), any failure will not be appreciated," a government official said, quoting from a Jan. 11 letter from the railways to the steel ministry that oversees SAIL, threatening to sever a deal to buy rails almost exclusively from the company.

Two other government officials confirmed the railways' threat. All three officials declined to be identified because of the sensitivity of the matter.

The biggest likely winner from opening up to private suppliers is Jindal Steel and Power Ltd, which has already exported rails to Iran and has tried for years to muscle in on SAIL's business.

Jindal Steel wrote to Indian Railways on March 6, offering to step in, according to a letter reviewed by Reuters. A spokesman for Jindal Steel said the firm was keen to help the railways with steel for its modernisation.

INFRASTRUCTURE RAMP-UP

The railways are already looking at bringing in alternative suppliers gradually by issuing new tenders for rails.

"Even after giving sufficient time to SAIL if the shortfall continues, the ministry of railways may explore the possibility of outsourcing some supplies," Indian Railways spokesman Anil Kumar Saxena said.

Modi has made increased infrastructure spending a key part of his economic plans since coming to power in 2014. State expenditure on roads and rails is at a record high.

Two steel ministry officials said SAIL has offered to import 150,000-200,000 tonnes of rails to fill this year's shortfall. But ministry officials had noted there was nothing to stop the railways themselves importing, and cutting out SAIL, one of the two officials said.

Comments

0 comment