views

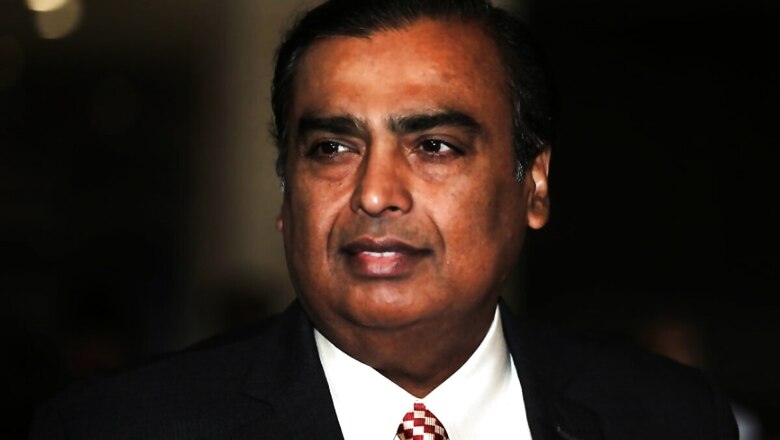

American buyout firm KKR & Co has said that it will invest Rs 5,550 crore in Reliance Retail, giving the unit a pre-money valuation of Rs 4.21 lakh crore, the Indian conglomerate said on Wednesday. KKR’s investment will translate to a 1.28% stake in Retail Ventures Ltd, according to Reliance.

This is the second big investment in Reliance Retail in a span of two weeks, after private equity giant Silver Lake Partners said that it will invest Rs 7,500 crore in the RIL unit. Reliance has been looking to expand rapidly online to take on the likes of Walmart Inc’s Flipkart and Amazon.com Inc’s Indian arm.

Here are five things to know about the deal:

1. The investment values Reliance Retail at a pre-money equity value of Rs 4.21 lakh crore, RIL said in an exchange filing on September 23.

2. KKR is investing Rs 5,500 crore in Reliance Retail in exchange for a 1.28 per cent stake.

3. This is the second investment that has been attracted by Reliance Retail in two weeks, earlier Private equity giant Silver Lake Partners picked up a 1.75 percent stake for Rs 7,500 crore.

4. This is the second investment by KKR in a Reliance enterprise. In May, 2020, KKR said it will invest Rs 11,367 crore in Jio Platforms, the digital services platform of RIL.

5. This deal will bolster Reliance Retail’s aim of expanding and getting hold of a larger chunk in India’s retail space and it follows the announcement in August to buy the retail and logistics businesses of Kishore Biyani’s Future Group in a deal valued at $3.38 billion, including debt.

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Comments

0 comment