views

Women may not yet have taken the lead in making critical family financial decisions such as investing. Nonetheless, they are acclaimed for managing household money, which entails careful planning in drafting a budget, keeping to it despite all difficulties, and finding ways to save even when strapped for cash. With such ingenuity in handling finances, they can do wonders by creating significant wealth out of their small saving using power compounding.

Also Read: Viksit Bharat’s Working Women Want To Start Own Business, Survey Reveals Big Aspirations

In India, where women have traditionally faced challenges in achieving financial independence, compounding can pave the way for long-term wealth accumulation and prosperity.

What is the power of compounding?

Compounding is a process whereby an investment’s value grows exponentially over time, with the initial principal and accumulated interest or gains generating further earnings. The power of compounding can have a magical effect on wealth creation. Albert Einstein called it the world’s eighth wonder with a good reason.

Using the power of compounding

Two things play a crucial role in harnessing the power of compounding – an early start and long-term financial commitment. Often, women save small amounts from their daily expenses. Instead of tucking it away in cupboards, if they invest it in instruments like mutual funds, they can harness the power of compounding in the long run.

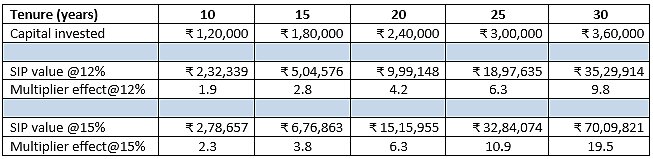

The table below shows how compounding works using SIP to invest Rs 1,000 per month in a diversified equity fund.

Take a closer look at the multiplier effect for 15 years and above. The power of compounding needs time to create a base, which is typically ten years. Once the base is built, the power of compounding takes over. After 15 years, the growth is exponential.

A SIP of Rs 1,000 per month can easily create a corpus of Rs 10 lakh in 20 years, sufficient to partly fund a child’s education/marriage goal. Imagine if the SIP amount is increased to Rs 2,000. The contribution can be substantial! This can be a woman’s contribution to the family’s financial goals. Don’t worry if the investible surplus is small.

With the power of compounding, even a small beginning can help you take giant strides toward accomplishing your objectives.

Key considerations to harness the power of compounding:

While an early start and staying committed for the long haul are critical in realising the potential of compounding, you must also keep a few other things in mind. These include:

- Adopting patience: Rome wasn’t built in a day. Similarly, wealth creation is not an overnight journey. It warrants patience. Don’t get caught in your web of biases or market noises and stop investments. Adopting patience and guarding against market noises goes a long way in leveraging the power of compounding.

- Being disciplined: Practicing discipline yields fruitful results in every sphere of life, and investing is no different. Once you commit to an amount, stay true to it. Being resolute by nature, discipline comes naturally to women. Regular investments with prudence go a long way in optimising the benefits of compounding.

This Women’s Day, embark on your journey towards financial freedom. Break all the mental barriers, use the power of compounding, and take the leap of faith.

-The author is President and Head, Nuvama Wealth. Views expressed are personal.

Comments

0 comment