views

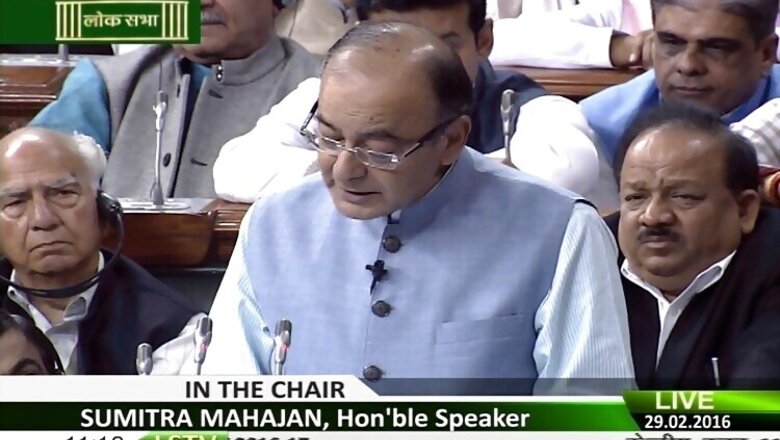

Shifting focus to farmers and rural poor, Finance Minister Arun Jaitley unveiled his third Budget which lays emphasis on agricltural and social sectors.

With distress in rural areas increasing, Jaitley went all out to woo the segment by promising a slew of welfare measures including electricity to all villages and road connectivity in the next couple of years.

No mention of Defence: Rural and agricultural sector was so much on the top of Jaitley's mind that he did not even mention the defence allocations in his Budget speech.

With rural infrastructure and tackling agrarian distress taking precedence, it is clear that the Narendra Modi government is going all out to remove the allegation of "suit-boot ki sarkar", more so following the drubbing Bharatiya Janata Party-led National Democratic Alliance received in Bihar Assembly elections.

Jaitley emphasised that the Budget will give an impetus to economic reforms by increased spending on infrastructure, increasing rural income and ensure overall development of the country.

Not much good news for salaried class: Much to the disappointment of the salaried class there has been no change in the personal income tax slabs with Jaitley saying the Budget attempts to increase the tax base and simplify tax structure.

The Budget had a big shocker -- breaking from the long-held practice of exemption at all stages, it seeks to impose a retirement tax at the time of final withdrawal on 60 per cent of contributions made after April 1, 2016, to EPF and other schemes.

It, however, proposes to raise the ceiling of tax rebate under Section 87(A) from Rs 2000 to Rs 5000 for incomes not exceeding Rs 5 lakh per annum. There are two crore tax payers in this category who would get a relief of Rs 3000 in their tax liability.

Other highlights of the Budget included: a marginal tax relief of upto Rs 6,600 for small tax payers, a 3 per cent hike in surcharge on

super-rich, new levies on cars and SUVs and a compliance window to domestic black money holders.

Krishi Kalyan cess: The Budget brought in a new 0.5 per cent Krishi Kalyan Cess on all taxable services to fund agriculture, which means a whole lot of things like your phone bills and restaurant bills will get slightly more expensive.

Jaitley decided to stick to a fiscal deficit target of 3.5% and unveiled a new policy for sale of PSUs to raise additional resources as well as tried to address lingering tax issues with one-time settlement offers.

As much as Rs 2.87 lakh crore will be given as grants in aid to panchayats and municipalities while allocation for social sector including education and healthcare has been pegged at Rs 1.51 lakh crore.

A total outlay of Rs 2.21 lakh crore has been made for infrastructure, of which Rs 97,000 crore will be in the road sector including on rural roads.

He proposed lowering corporate income tax rate for next financial year of relatively small enterprises with a turnover not exceeding Rs 5 crore in fiscal 2016 from 30 to 29 per cent plus surcharge and cess. New units incorporated on or after March 1, 2016 will be taxed at 25 per cent plus surcharge.

The 12 per cent surcharge on personal income above Rs 1 crore has been raised to 15 per cent.

Foreign investment eyed: As part of reforms, FDI policy will be liberalised in areas of insurance and pension, asset reconstruction companies and stock exchanges. 100 per cent FDI will be allowed through FIPB route in food products produced and manufactured in India.

Pointing out that Indian economy is growing at 7.6% in 2015-16 despite a slowing global economy, the Finance Minister credited the Modi government for the steps taken in the last 21 months which according to him are "very big".

In his almost 100-minute long speech, Jaitley highlighted the work of three of his ministerial colleagues - Surface Transport and Roads Minister Nitin Gadkari, Power Minister Piyush Goyal and Railway Minister Suresh Prabhu.

Breaking from the long-held practice of exemption at all stages, the Budget for 2016-17 seeks to impose a retirement tax at the time of final

withdrawal on 60 per cent of contributions made after April 1, 2016, to EPF and other schemes.

Comments

0 comment