views

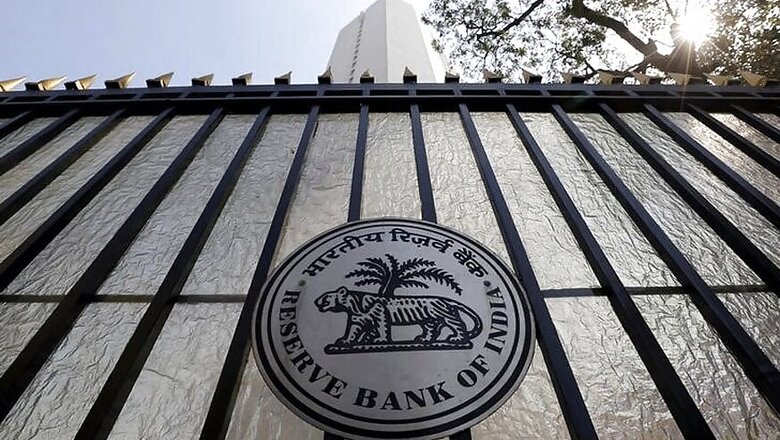

New Delhi: Terming the exit of Urjit Patel as credit negative, S&P Global Ratings said the increasing involvement of the government in the affairs of the RBI could undermine the hard-fought improvements in the banking system over the past few years.

"In particular, S&P Global Ratings views as credit negative the circumstances leading to the recent resignation of Urjit Patel, governor of the Reserve Bank of India (RBI). We await any changes to banking system regulation at the next RBI board meeting in January 2019," it said.

The report said it does not anticipate any material change in the central bank's level of independence, especially with regards to its adoption and implementation of prudent policy.

The RBI has traditionally shown greater independence than many regional peers, and a robust institutional culture but sustained and intense external pressure from the Indian government risks eroding these settings over time, and could also undermine the long-term financial stability in the country, it said.

"In our opinion, the RBI's actions in recent years have materially improved accountability and transparency in the banking system, since asset quality reviews were introduced by former governor Raghuram Rajan. However, this is off a low base and continues to face headwinds," it said.

"Our assessment of India's banking system continues to factor in its relatively weak governance and transparency," it said.

Observing that the recognition of stressed assets significantly improved following the RBI's circular on February 12, 2018, the report said, this simplified recognition and associated provisioning for stressed assets.

It emphasised that more needs to be done to recapitalize public sector banks in general.

"In our view, the RBI's Prompt Corrective Action to rebuild capitalisation at distressed banks is appropriate given the fundamental issues these banks face," it said.

Resolution of stressed assets is likely to occur within the next 12-18 months, particularly given the new bankruptcy framework and courts, it said.

However, it said, restrictions on the RBI's authority to reform governance of public sector banks as a weakness in its mandate.

The central bank has demonstrated a willingness and ability to reform governance at private sector banks, which we see as a healthy check-and-balance that supports accountability and renewal of leadership, it said.

Comments

0 comment