views

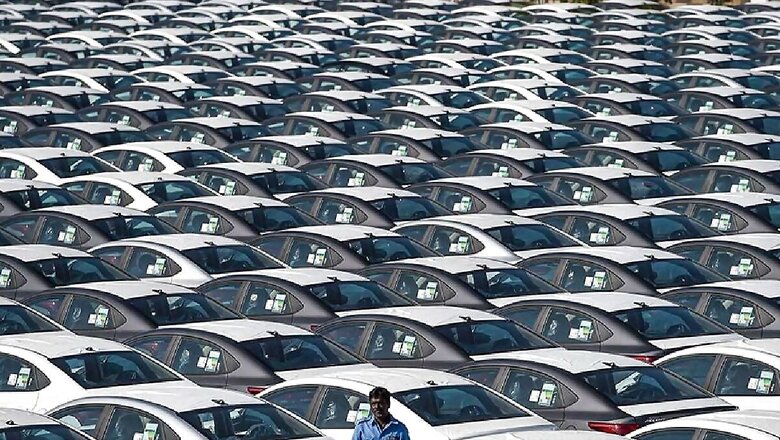

Purchasing a car is a big and costly decision. Even though many Indians still consider owning a car to be a dream, in the past fifteen years, the number of first-time car buyers has increased dramatically.

This is majorly due to factors like easy car buying processes, a variety of car loan options, and rising per-capita income.

A change in consumer preferences within India’s automotive industry has been revealed by Deloitte’s 2024 Global Automotive Consumer Study (GACS). According to the study, nearly half of Indian consumers are considering switching away from Internal Combustion Engine (ICE) technology, which poses a short-term challenge. Furthermore, 24 per cent of Indian consumers are considering purchasing a Hybrid Electric Vehicle (HEV) as their next vehicle.

An important consideration when making a purchase is affordability, as 80 per cent of buyers choose cars between the price range of Rs 5 lakh and Rs 25 lakh. Notably, preferences are 59 per cent and 58 per cent, respectively, for both ICE and EV engines in the Rs 10 lakh to Rs 25 lakh range. Additionally, it was found that 23 per cent and 22 per cent of consumers preferred ICE and EV cars under Rs 10 lakh, respectively, as reported by HT Auto.

Further the study stated that environmental consciousness motivates 68 per cent of respondents, while 63 per cent are concerned about lower fuel costs. The availability of charging infrastructure is critical, with 66 per cent planning to charge at home and 22 per cent at public charging stations. To simplify the experience, customers prefer fast charging and simple traditional credit/debit card payments.

The study places a strong emphasis on responsible battery management, with consumers anticipating that car dealers, EV battery manufacturers, and specialised recycling businesses will take the lead in gathering, storing, and recycling EV batteries. The survey shows that consumers generally prefer hybrid technology, despite ongoing issues with infrastructure availability, battery safety, and charging times.

As per Rajeev Singh, Partner and Consumer Industry Leader at Deloitte Asia Pacific, the booming economy and changing consumer preferences point to a shift towards new cars over used cars, with consumers willing to invest more in connected vehicles. This provides OEMs with an opportunity to improve customer retention services, emphasising the importance of transparency, he explained further.

The study also emphasises how consumers are becoming more informed and tech-savvy, prioritising environmentally friendly options and high-quality features over those that are only economical. This is evident in the growing maturity of the automotive brand adoption market.

Meanwhile, original equipment manufacturers (OEMs) are looking to offer in-house insurance products, and 83 per cent of consumers prefer to buy insurance directly from the manufacturer for convenience and cost savings. Additionally, consumers are willing to share data with manufacturers to improve their driving experiences, indicating that safety remains a top priority. Furthermore, younger consumers are increasingly preferring vehicle subscriptions, owing to cost savings, convenience, and greater flexibility.

Comments

0 comment