views

The year 2020, because of the circumstances as they unfolded, gave digital payments the sort of push that couldn’t have been expected in just less than 12 months. Mobile wallets, credit cards, debit cards and unified payments interface (UPI) became the preferred modes of payment for many, be it for a quick and socially distanced run to the nearby shops to buy groceries and essentials, be it online shopping, bill payments and prepaid mobile recharges, or be it a nice meal at a restaurant in the world of social distancing. Lesser cash transactions meant lesser interaction with fellow humans, quicker checkouts and less risk of the virus and germs touching your skin. The numbers have their own story to tell to corroborate the robust growth that digital payments have seen through the year, and we have equally seen the implementation of policies and decisions by the government and the regulators as well as the addition of new features by mobile payment platforms, to make things simpler for users.

The UPI, or unified payments interface, transactions have been consistently growing month on month. The latest data by the National Payments Corporation of India (NPCI) indicates that UPI transactions for November 2020 clocked in at 2.21 billion, which is 6.7% more than the 2.07 billion in October. In September, the UPI transactions clocked in with 1.8 billion. Credit card transactions have also seen a spike in the past few months, as the coronavirus pandemic has fast-tracked the transition to digital payments. According to the RBI data, credit card transactions in India were clocked at around Rs 127,129 million in April this year when the lockdown was in place due to the COVID pandemic. However, as of September this year, the monthly transaction value had increased to around Rs 291,481 million. Similar growth has also been seen with debit card usage, in the same period.

The most recent development has to be the launch of WhatsApp Payments for 20 million WhatsApp users in India, with expansion to enable the option for more users happening in a phased manner. WhatsApp is by far the most popular instant messaging app in India and indeed the world, and the potential convenience on offer by adding a payments option should attract users. WhatsApp Pay goes into battle against the likes of Google Pay, PhonePe and Paytm. At this time, more than 160 banks are part of the UPI payment system in India. Chances are that your bank will very much be a part of this list. A quick glance through the WhatsApp Pay list of bank accounts shows us that the likes of Axis Bank, HDFC Bank, ICICI Bank, State Bank of India, Allahabad Bank, Airtel Payments Bank, Andhra Bank, Punjab National Bank, Paytm Payments Bank, RBL, Punjab and Sind Bank, Union Bank of India, United Bank of India, UCO Bank, Yes Bank and more.

WhatsApp Pay had received the National Payments Council of India (NPCI) nod in November to make the service available to 20 million users in the first rollout stage. WhatsApp has more than 400 million active users in India, as per last count.

It was in November that the NPCI made it official that a new cap will be applicable from January 1, 2021 which mandates that no Third-Party App Providers (TPAPs) can exceed more than 30% of the total volume of UPI, or Unified Payments Interface, transactions. the cap of 30% will be calculated on the basis of the total volume of UPI transactions that were processed in the preceding three months. This will be done on a rolling basis. New players such as WhatsApp Pay have to comply now itself, while existing players have two years to comply, in a phased manner. PhonePe and Google Pay will be the most impacted, since both players are completing closely with each other with around 40% each of the total UPI transactions.

Around the same time, digital payments platform PhonePe confirmed that they had now crossed the 250 million user mark, with 100 million monthly active users and clocked 2.3 billion app session in October. This comes at a time when digital transactions are at an all-time high. PhonePe says that in October, they registered 925 million transactions on the app while September saw 750 million transactions. The digital platform is seeing strong numbers from Tier II and Tier III towns in India, with more than 70% transactions coming from users in those towns.

With digital payments gaining popularity, the Reserve Bank of India (RBI) stepped in with the Reserve Bank of India (Digital Payment Security Controls) Directions, 2020 and will cover multiple instruments and methods including internet banking, mobile banking, UPI payments, mobile wallets and credit as well as debit card transactions. RBI says the new rules will make digital payments safer and more secure.

The one big change that stands out, and it will have an impact heading into the new year, is the new limit for contactless credit card transactions. Users will be able to make contactless payments and not have to enter a transaction PIN for transactions up to Rs 5,000 at physical stores. Earlier, the limit for non-PIN required contactless transactions was Rs 2,000. “These are also well-suited to make payments in a safe and secure manner, especially during the current pandemic. The recent instructions on disablement of contactless feature on cards and empowering customers to control the limits on their cards have also brought in added safety for users,” says RBI. This rule will be applicable from January 1, 2021.

The NPCI also confirmed around the same time the RuPay credit and debit cards will now support the RuPay contactless payments feature at retail stores across India—much like how it works with Visa and Mastercard credit and debit cards, for instance.

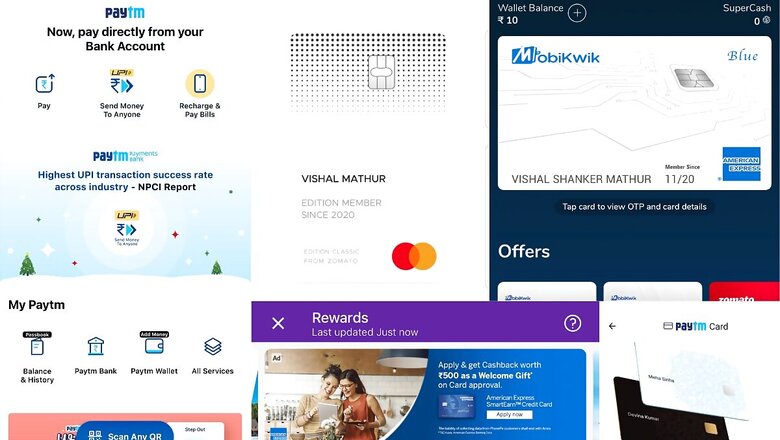

Leading payments platform Paytm made it free for Paytm merchants to receive unlimited payments through Paytm Wallet, UPI and RuPay cards at zero percent fee. This should benefit more than 17 million merchants in the country. Paytm also rolled out the Flexible EMI options for Paytm Postpaid users, making it easier to make purchases by converting them into EMIs. Paytm says that Paytm Postpaid has more than 7 million users and hopes to clock 15 million by the end of the financial year. If you happen to use the Uber app, the Paytm Postpaid payment option should now also be available for you.

At a time when UPI transactions are at an all-time high, and payment platforms requiring robust tech solutions to handle the volume, Paytm has recorded the highest UPI payments success rate in India. The latest report by the National Payments Corporation of India (NPCI) says that the Paytm Payments Bank has the best tech for UPI payments. Data suggests that the Paytm Payments Bank users have been at the receiving end of the lowest UPI, or unified payments interface, transaction failures—just 0.02% among all UPI remitter banks and 0.04% among all UPI beneficiary banks. The report suggests that most other banks have a UPI transaction failure or decline rate of 1% instead.

The credit cards business also saw a renewed push, with banks and digital platforms investing heavily in the co-branded cards space. This, at a time when UPI is becoming popular with leading digital payments platforms such as PhonePe, Google Pay and Amazon Pay pushing for UPI usage. Leading restaurant aggregator and food delivery platform Zomato has tied up with RBL Bank to offer the Edition Classic and Edition credit cards with bundled benefits including cashbacks. Paytm partnered with SBI Cards to offer The Paytm SBI Card Select and the Paytm SBI Card to users, again with extra cashbacks and benefits for using it within the Paytm ecosystem. Mobikwik has partnered with American Express for the MobiKwik Blue American Express Card prepaid card—this makes MobiKwik the first non-bank Indian company to become a part of the American Express network and issue cards in India.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment