views

The Indian markets will mainly be influenced by factors such as macroeconomic data, February auto sales numbers, along with global cues in the next week, according to several analysts. They also believe foreign investors’ flow, the rupee’s movement against the US dollar, and Brent crude oil trend may also impact the domestic equities in the coming week.

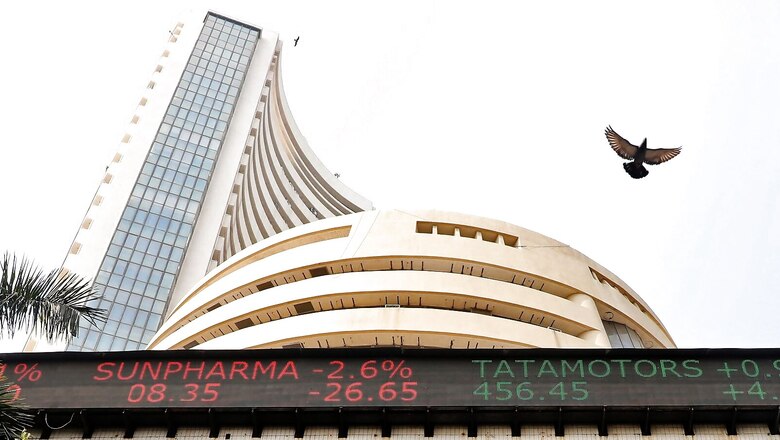

Dalal Street ended in the red for the sixth straight day on Friday. The BSE companies have seen investor wealth of over Rs 8 lakh crore wiped out in the last six trading days. The PSU Bank Nifty fell 5.50 percent this week and it is noteworthy that this has been a leading sector in the Indian market till recently. In the week gone by, the advanced decline every single day was negative and this is now the longest losing streak for the market since June of last year.

“Even though there are no clear visible positive triggers for the market now, a mild reversal is possible, going forward, culminating in positive returns in March,” said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Key Factors to Focus on-

Q3 GDP

India’s economic growth likely slowed to 4.7% in the December quarter from 6.3% in the preceding three months, as per a Mint poll. The GDP number, scheduled to be released on 28 February, will be a key factor to decide on how emerging-market growth held up in the final stretch of 2022.

Global Cues

While Santosh Meena, Head of Research, Swastika Investmart said, “The market will continue to keep an eye on the direction of global markets along with the movement of US bond yields and the dollar index in the near term as the interest rate scenario in the US will remain a dominating factor in the first half of 2023.”

He added that the market isn’t currently responding to the geopolitical situation all that much, but any unexpected development—positive or negative—could cause the market to move significantly.

FII Flows

The selling by foreign institutional investors continued last week, but the pace has slowed down from January.

Concerns around interest rate hikes in the US saw bond yields rising and the dollar strengthening. So far in February, the dollar index has gained 3%.

“Rising rates in the US might lead to more capital outflows from emerging markets. South Korea and Taiwan witnessed good capital inflows this month,” said V K Vijayakumar, chief investment strategist at Geojit Financial Services.

Corporate Action

On Monday, the board of Marico will meet to consider and approve dividend payment, which will keep its stock in the limelight.

Rain Industries and Unitech will be in focus as the companies will declare their December quarter earnings next week.

Nifty Technical

Given that the Nifty 50 is trading closer to its key support level, it’s a make-or-break situation for the market next week, analysts said.

The index on the weekly chart has formed a tall red candle that has engulfed its previous three weeks’ candles, which indicates that currently, bears are having an upper hand in the market, said Rohan Patil, technical analyst at SAMCO Securities.

“The structure is shifting its momentum towards the bears, and the immediate support for the Nifty is placed at around 17,350 levels which is the Budget day’s low,” Patil said, adding that if prices drift below this level, then 17,050–17,000 will be on the cards.

Only a sustained close above the 17,750-17,800 zones is likely to trigger a bullish momentum towards 18,100-18,200 levels.

Read all the Latest Business News here

Comments

0 comment