views

Withdrawing Money from the ATM

Visit an approved ATM. Use your prepaid credit card at an ATM operated by the bank that issued it. You can also visit any ATM that displays one of the network brands displayed on the back of your card. Enter your PIN, and complete your transaction. Look at your card and the ATM to determine if the network brand matches. For example, if you have a Visa prepaid card, you would look for ATMs that accept Visa or have the same Visa logo that is on your prepaid card. Many cards have a limit on the amount of money you can withdraw each day. Check your Cardholder Agreement to see what the limit is. Visiting ATMs associated with your card will also cut down on the amount of withdrawal fees.

Insert your card. Insert your card into the ATM and enter your PIN. The machine will then tell you how much the withdrawal fee is. At this point, you can decide to continue or cancel your transaction. Select “checking” when asked what account you wish to use. If you are withdrawing $20, but are required to pay a $3.50 fee, your withdrawal amount is $23.50.

Be aware of additional fees. Avoid using the ATM to check your card's balance. Use online banking or your card issuer’s app to check the balance on your card. Some cards will charge a balance inquiry fee if you check your card balance at the ATM. In addition to the withdrawal fee you pay to your card issuer, the ATM owner may also charge a fee for using the ATM. If your prepaid card has in-network ATMs, you will not have to pay the additional ATM owner fee if you use one of them. If you use an out-of-network ATM, you will have to pay the fee.

Getting a Prepaid Card

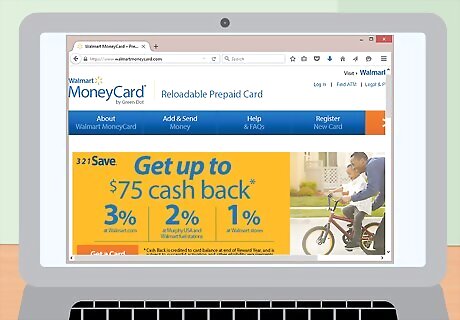

Shop around for a card. Prepaid cards come with various fees, withdrawal options, and funding options. Research different cards and find out which one works best for you. Because you want to use your card at an ATM, find a card that gives you access to many ATMs and has free withdrawals or small withdrawal fees. You do not want to have to pay money every time you use your card at the ATM. Some of the best prepaid debit cards are the Walmart MoneyCard, PayPal Prepaid Mastercard, Direct Express, upside Visa, Green Dot, and American Express Serve. Some of the lowest rated prepaid debit cards are the NetSpend Fee Advantage Plan, NetSpend Pay-As-you-Go Plan, and the AccountNow Gold Visa Prepaid card. These cards have higher fees compared to other cards.

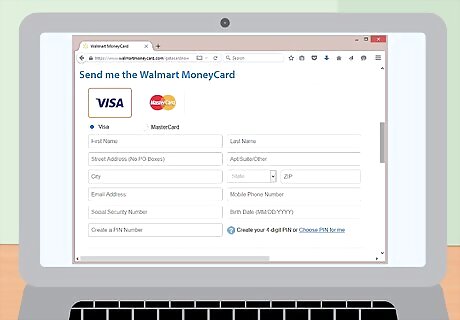

Apply for a card. Once you find a card that fits your needs, go to the card issuer’s website and fill out an application. You should be instantly approved. The card issuer will then mail you your card. If your card does not arrive when you expect it, contact the company to be sure that the card was sent and did not go to the wrong person. Activate your new prepaid credit card when it comes in the mail. You will not be able to use it until it is activated. Follow the instructions to activate your card. Typically, you will just call the number found on the sticker on the front of the card to activate it.

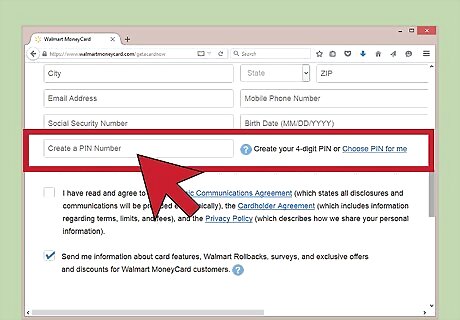

Choose a 4-digit PIN. When you activate your card, you need to choose a PIN. The PIN will allow you to use your card at the ATM. A PIN will also provide extra security if you ever lose your card. No one will be able to use your card at an ATM if they do not know the PIN. For some cards, you may not enter a PIN until you make your first transaction. Whatever PIN you enter will be used for future transactions as well. Make sure your PIN is a 4-digit number you can easily remember but cannot be easily guessed by others. Sequential PINs such as 1234 or 1111 can make you an easy target for identity theft if someone obtains access to your card.

Adding Money to Your Card

Use direct deposit. Your employer likely has an option for your paychecks to be directly deposited into your bank account. Get a direct deposit form from your employer and provide your bank routing number and credit card number to your employer. You will be able to receive your money much faster than waiting for a check to come in the mail. Your funds should be available the same day your employer deposits them. Check with your employer and prepaid card issuer to be sure that you have completed all of the necessary paperwork. There usually are no fees for loading money through direct deposit. Direct deposit can also be used for government benefits and tax refunds.

Put cash to your card. You can add cash to your card by visiting a loading location. Common locations include MoneyGram, Western Union, Reloadit, Rapid Reload at Walmart, or GreenDot Reload. For some locations, you will need to fill out a service form and give the form and the cash to the agent. At some locations, you can give the cash and your card to the cashier, and the cashier will load your money. There is usually a fee for loading cash to your card. Fees are typically between $3 and $5. Your funds should be available within minutes.

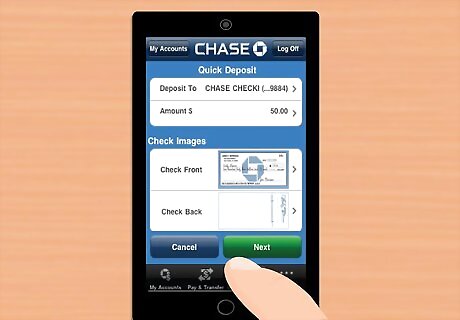

Add checks to your card. You can use your mobile phone to add checks to your card. You will typically use some sort of phone app to do this. Take a picture of the check with your phone to load the check to your card. Ask your card issuer which app is compatible with your card. There may be a fee depending on how quickly you want access to your check. If you want your check available within minutes, you are more likely to pay a fee. There may not be a fee if you are willing to wait a few days. Always check the fees before you use this option.

Comments

0 comment