views

Learning the Basics

Start early. If you want to accumulate wealth, time is the most important factor. The longer you save and invest, the more likely you are to reach your goals and build sizable wealth. You can set aside more money to invest over a long period of time than over a short one. That may seem obvious, but many people don’t fully appreciate how powerful the effect of time can be on accumulating wealth. For example, if you can afford to save $50 per month, starting at age 5 (assuming someone begins setting aside money for you), by age 65 you will have saved $36,000. ($50 per month x 12 months per year x 60 years) or ($50 x 12 x 60 = $36,000.) That doesn't include any earnings on the dollars you invest. If you were to begin saving at age 50, you'd have to save $200 a month in order to arrive at that same $36,000 by age 65 ($200 x 12 x 15 years). If you start investing early, you have more time to make up for any investment losses that will occur in some years. Investors that start later have less time to make up for any investment losses. Time will permit your investments to rebound in value. The Standard and Poor's (S and P) 500 is an index of 500 large stocks. From 1928 to 2014, the average annual return has been about 10%. While there have been negative returns in some years, people who invest over the long term have profited from owning this index of stocks.

Add to your savings frequently. The frequency of your contributions (e.g. weekly, monthly, or yearly) has an important impact on your long-term success. If you have trouble remembering to add to your savings account, try setting up an automatic monthly transfer from your checking account (e.g., $100 per month). Savings is the process of moving funds into a separate bank account. You segregate money between a savings account and a personal checking account. This process helps ensure that you don’t spend the amount you intend to save. You can then invest your savings account balance in CDs, stocks, bonds, or other types of investments. Saving money more frequently means you can add less each time you contribute. This can make it easier to fit each investment into your personal budget. For example, starting at age 5, you could save $12.50 per week (assuming a 4–week month). You could also save $50 per month or $600 per year. The total you’re investing is the same, but it’s easier to save smaller amounts more often.

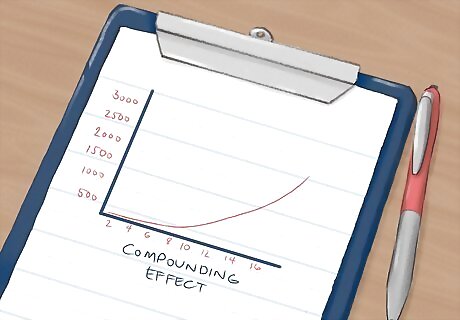

Use compounding when you invest. Once your funds are in savings, move the funds into an investment as soon as possible. You'll earn a higher rate of return from an investment. When you move money from savings into an investment vehicle, take advantage of compounding. Compounding will make your investments grow faster, like a snowball rolling downhill. The longer it rolls, the faster it grows. Compounding works faster if you invest more frequently. When you compound your investments, you are earning “interest on interest.” Over time, you earn interest on both your original investment and on the prior interest you earned.

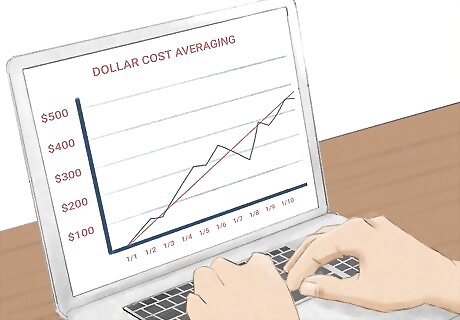

Use dollar cost averaging. The index value on any investment may be higher or lower in any given year. Over time, however, the index has generated average return of about 10% per year. You can use dollar cost averaging to benefit from short-term declines in an investment’s value. When you invest using dollar cost averaging, you invest the same dollar amount each month. Dollar cost averaging is typically used with stock and mutual fund investing. Both of those investments are purchased in shares (stock shares or mutual fund shares). If the share price goes down, you end up buying more shares. Say, for example, that you invest $500 each month. If the share price is $50, you’ll buy 10 shares. Assume that the share price goes down to $25. The next time you invest $500, you’ll purchase 20 shares. Dollar cost averaging may reduce your cost per share. As the share price increases over time, a lower cost per share increases your profit.

Let your wealth compound. If you invest in bonds, compounding is the multiplying effect of interest on interest. For stocks, compounding is generating earnings on your prior dividends. In both cases, you should reinvest any interest or dividends your investments earn. Frequency and time are also important. A greater frequency of compounding means you receive and reinvest earnings more often. The more often this occurs and the longer you let it continue, the more powerful the effect. For example, let's say at age 25 you start saving $100 per month, and you earn 6% interest. By age 65, you will have invested $48,000. That money would actually grow to nearly $200,000, however, if you compounded the interest monthly over that 40-year period. In contrast, let's say you wait to start saving until you are 40, but decide to save $200 a month at the same 6% interest rate. By age 65, you will have invested $60,000. However, you will not have as much time for your interest to compound each month. The result is that you will have only $138,600 saved for retirement (rather than the approximate $200,000 in the earlier example). You will have saved more of your money but end up with less after compounding.

Understanding Your Saving and Investment Options

Use a savings account or buy a certificate of deposit. A savings account gives you access to your money at any time with very low risk. This option, however, offers a low interest rate on your investment. A certificate of deposit (CD) offers a slightly better return, but with less flexibility. You must leave the money with the bank for a period of time ranging from months to years. These investments have several benefits. They are easy to set up, and they're typically insured for up to $250,000 by the FDIC, meaning they're very safe. The downside is that these investments pay very little interest. Without much interest, you don’t generate as much compounded interest. As a result, CDs and savings accounts are suitable only for holding small amounts of money for very short periods of time. They may improve as savings vehicles in times of high interest rates. Smaller banks and credit unions will sometimes offer higher interest rates in order to attract customers away from larger institutions.

Invest in government or municipal bonds. When you buy bonds, you are loaning money to a government or municipality. You can also invest in bonds issued by corporations. Bonds pay a fixed rate of interest on your investment each year. You can reinvest your interest in more bonds and allow compounding to work for you. Payment of your original investment (principal) and your interest is based on the credit rating of the issuer. Government bonds and municipal bonds are often guaranteed by tax dollars that the issuer collects, so risk is low. A corporate bond’s payments are based on the creditworthiness of the corporation. A company that generates consistent earnings will have a better credit rating. You can buy bonds through your bank, or using a financial advisor. There is a downside to bonds investing. When interest rates are low, returns can be small. Even in times of higher rates, bonds usually offer lower returns than stocks. Bonds, however, are normally considered less risky than stocks. The average return on bonds since 1928 (including compounding) is 6.7% per year, compared to 10% for stocks.

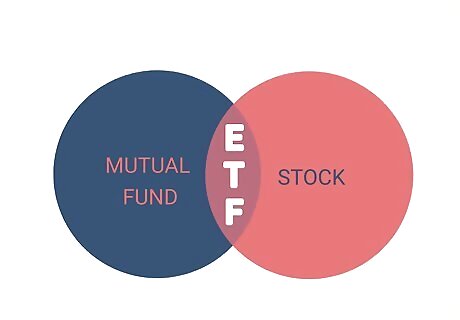

Buy stocks. When you buy stocks, you are a company owner. Stock investors are also referred to as equity investors. Investors buy stocks to earn dividends and to benefit from an increase in the stock’s price. Stocks offer better returns on average than most other types of investments. While stocks offer higher returns, they also involve more risk. The longer you are able to invest in stocks, the more time you have to recover from a stock price decrease. If the company generates earnings, they may elect to pay a share of those earnings as a dividend to stockholders. You can purchase stocks by opening a brokerage account. You’ll be asked to complete a new account form. Once your account is open, you can deposit funds and purchase stock. Consider using a financial advisor to invest in stocks. Buying individual stocks is riskier than investing in a mutual fund or ETF (Exchange Traded Fund).

Invest in a mutual fund. A mutual fund is a pool of money contributed to by many investors. The funds are invested in securities, such as bonds or stocks. The mutual fund portfolio can generate bond interest or stock dividend income. Fund investors may also benefit if a security is sold for a gain. Mutual fund accounts are easy to open and maintain. Investors pay fees to the fund for money management. You can add to your investment regularly and reinvest your earnings, if you choose. Funds allow you to invest in a variety of stocks and bonds. This provides the safety of diversity, protecting you against losing money when just a few securities decline in value. Most mutual funds allow you to invest with a small initial amount and to add small, periodic investments. If you don't have much to invest, this will be important. Some funds allow you to begin with as little as $1,000 and add in increments of as little as $50 or $100.

Try trading Exchange Traded Funds (ETFs). An ETF is a type of marketable security that acts like a cross between a mutual fund and a stock. You can trade ETFs through a broker or an electronic advisor, such as Betterment. ETFs have the advantage of costing less and being more tax efficient than individual stocks. A few of the most popular ETFs include the SPDR S&P 500, the SPDR Dow Jones Industrial Average, and various sector and commodity ETFs.

Take advantage of retirement plans with matched contributions. If your job offers a retirement plan, find out if your employer will match your contributions to your retirement account. If so, this is a great way to both save money and build your wealth quickly. You may be able to get matching contributions if you have an IRA, a SIMPLE retirement plan, or a 403(b). Your employer may match up to 1 full dollar for every dollar you invest in your retirement account, up to a certain percentage of your salary (e.g., up to 3%).

Look into other investment opportunities. Aside from stocks, bonds, and mutual funds, you may be able to invest in other areas. Do some research on the current market to find out what investment opportunities are most likely to pay off. A couple good places to invest include: Peer-to-peer lending. Use platforms like Lending Club and Prosper to make small loans to individuals who may have trouble getting bank loans. You may be able to score a rate of return of 6% or higher. Real estate. If you don’t have the money to buy investment property, you can use companies like Fundraise to invest a small amount of money in commercial real estate owned by the company.

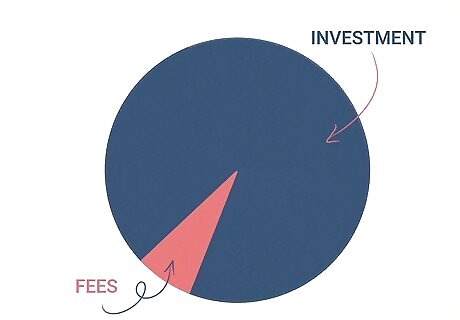

Find out about fees you may have to pay on your investments. Some investments may come with a lot of fees that can significantly cut into your returns. Before making any investment, look at the fine print and talk to your financial advisor (if you have one) about what kinds of fees you can expect to pay. Some common types of fees include: Fees to cover operating expenses on mutual funds Investment management or advisory fees Transaction fees, which may be charged any time you buy or sell a mutual fund or stock Annual account fees or custodian fees

Increasing Your Investable Dollars

Consider starting a business. If you have a full-time job, you can increase your investable income by starting a part-time business. Use the extra income to increase your monthly investing. By increasing your investing, you’ll accumulate wealth faster. Take a microjob. One new business trend is the need to hire people to perform small, specific tasks. For example, a writer might review resumes for job candidates. Since each project only requires a small amount of time, you can take on these jobs to generate more income. You may find that you can take on enough business to eventually create a full-time job for yourself.

Turn your hobby into a business. If you’re passionate about a hobby, you may be able to turn that hobby into a business. Say that you enjoy surfing, for example. If you develop enough expertise, you may find a way to solve a problem for other people who surf. Maybe you could design a new surfboard, based on your surfing experience. Successful business products and services solve a problem for the customer. Ask other people who surf what problems they face. You may be able to come up with a solution.

Take a serious look at your personal spending habits. If you don’t create a formal budget for yourself, you may be wasting money that could be put toward investing. Create a budget using your take home pay from work and all of your expenses. Look at your variable spending each month. Some spending, like your car payment and home mortgage are fixed. Other types of spending, such as money spent on groceries, gas, or entertainment, are variable. Make sure to account for your fixed spending, as well. This includes things like your rent or mortgage payments, insurance premiums, and monthly payments on loans. Review the money you spend on entertainment for the month. Say that you spend $300 on movies and dining out. You decide to put $100 of that spending into your investing plan. If you are diligent about investing that amount each month, it will help you to accumulate wealth over the long haul. Depending on your circumstances, you may also be able to cut expenses by refinancing your mortgage or by selling your vehicle and using public transit instead.

Comments

0 comment