views

X

Expert Source

Bryan HambyCar Buying Expert

Expert Interview. 11 June 2019.

Get an official receipt and paperwork to seal the deal.

Making the Payment

Withdraw the cash from your bank if you want a fool-proof process. When you’ve found a car that you want, you may be able to pull the cash directly from your savings or checking account. It’s important to check with your bank in advance regarding their withdrawal policies. Some banks put a limit on daily cash withdrawals or charge associated fees. Pulling cash directly out of an ATM isn’t a great option, as your withdrawal amount is usually limited each day.

Get a cashier’s check from your bank if you want the added security. Go to your bank during standard business hours and follow their instructions to fill out an application for a cashier’s check. The teller will check to see if you have enough money in your account to cover the check amount. They will then withdraw this money and write you out the check. You can then sign this check over to a dealership or private seller to purchase your car. Some banks charge a fee to prepare a cashier’s check. Others will do this service for free if you are a regular customer. If you are not a bank customer, you can also hand over cash bills and then request that the bank creates a check for you.

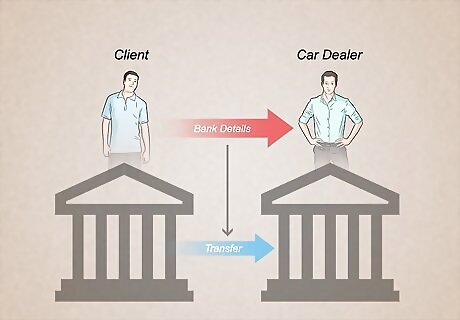

Wire transfer the money from your bank if you want an instant payment. To complete a wire transfer, you’ll give a dealer your banking information. They will then transfer the funds from your account to theirs. Because of the detailed nature of this process only large dealerships will usually consider wire transfers. Be aware that it’s very difficult to reverse or refund wire transfers. Make sure that you know all of the details regarding your car purchase before you agree to a transfer.

Budgeting and Shopping for Your Car

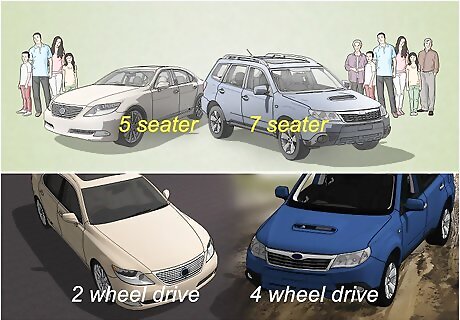

Consider your daily car needs. Think about how many people you’ll need to transport each day, as this will determine how many seats you’ll need. Consider your driving habits and whether or not you’ll need a car suited primarily for highway or side-street driving. Think about weather conditions in your area and if you’ll need a car equipped with certain features, such as 4-wheel drive.

Calculate the long-term costs of car ownership. Buying the car, even with cash, is only the first step of the ownership process. Go through and add together the other negotiable costs, such as monthly insurance. Then, try to estimate your daily costs, like gas usage. Don’t forget to include government fees or charges, such as registration or inspection. For example, it’s generally cheaper to insure an older model car with higher mileage, as opposed to a new car straight off the lot.

Set a realistic cash purchase budget. Look over all of your finances and try to determine how much cash you can set aside for a car purchase. Make sure to include any bills and living expenses, as well as an emergency fund in your calculations. You want to come up with a cash number that will leave you comfortable in the long term, instead of strapped for money.

Decide whether to buy a new or used vehicle. It’s almost always cheaper to purchase a used car, as opposed to a new model. However, used cars do often rack up more maintenance charges in the short and long term. They are also less likely to include warranties, unlike their new counterparts. Keep in mind that a new car will depreciate quickly and lose some value almost immediately after purchase. Look at online automotive forums and review sites to see if the type of car that you are interested in has a tendency to have mechanical problems. You can also look into how a car might keep its value for resale.

Keep saving until you have enough cash on-hand. If you’ve set a budget and determined what kind of car you want, then it’s just a matter of saving up the money. Cutting out small expenses, such as eating out, can help you stash some cash over time. You can also pretend to make monthly car payments and instead send the money straight to a car savings account.

Take into account your current car’s trade-in or sales value. If you need additional cash, you might want to consider selling your old car privately or trading it in at a dealership, if you have one. Do some research before online to see how much your car might be worth. You can expect a private seller to give you cash right away, whereas a dealer will likely just subtract their purchase offer from the total price of your new car. If your car is an older model, you might get more money by selling it privately. Dealers are often forced to off-load older cars at auctions, so they don’t offer much for them in trade.

Compare car prices. Begin your car search online by looking at popular listing websites, such as Edmunds or Kelly Blue Book. These sites will allow you to enter in your location and see a list of what vehicles are available for purchase. You can also scan the classified in your local paper or even visit car dealership personally and browse their inventories. As you find cars that fit your criteria, write down their details and price. Then, you’ll get a good idea regarding how far your money will go towards purchasing the car type that you are interested in. Be prepared to be patient, as it might take a long time to find a car that fits both your budget and requirements.

Choose to buy from a dealer or private seller. If you buy from an individual, then they will expect you to pay the full price of the car in cash. So, there will likely be little to no pressure to take out a loan or try another payment plan. If you buy from a dealer, then they will almost always accept cash, but may try to steer your towards other payment options. Many car dealers make some of their profits by financing car loans in-house. This is why they may be less than enthusiastic about accepting a cash payment.

Finalizing Your Purchase

Expect to fill out purchasing paperwork at a dealership. Even if you pay for your car in cash, most dealerships will still need you to fill out a variety of personal documents for security reasons. Many of these documents allow the government to more closely track the movement of cash in transactions, like car buys. The dealership may also run your personal information through a government database to make sure that you are someone that they can do business with legally. For example, the United States Office of Foreign Assets Control publishes a list of individuals banned from large cash purchases.

Talk to the dealer about the tax requirements. Depending on your government, you may still need to pay a tax on all or part of your cash purchase. Discuss this with the dealer or seller prior to buying. You may also want to talk with a tax professional to determine the best way to buy with cash.

Don’t fill out a credit application unless you want to. Some dealerships might try to pressure you into filling out documents for a loan, even if you’ve stated that you will be paying in cash. If this happens, you can either walk away from the deal, refuse to fill out the credit documents, or fill out the documents partially but write “No Loan Accepted-Cash Payment” across the signature lines.

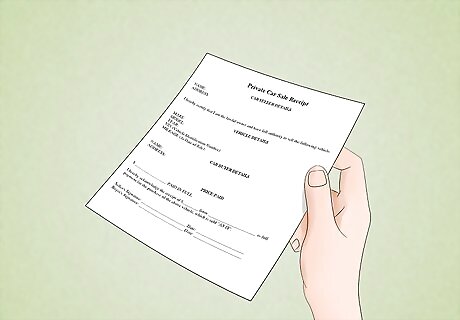

Get a clear receipt showing payment from both private sellers and dealerships. In exchange for handing over your cash payment, make sure that you receive a receipt and paperwork clearly noting that you’ve paid the balance in full in cash. This document should include all of your information, as well as that of the seller. It should be dated and signed by both parties. A private seller should also sign over the title or title paperwork directly to you after the purchase. A dealer will also have you sign title paperwork, but they may have to mail it in to local authorities as well.

Comments

0 comment