views

Providing Your Basic Information

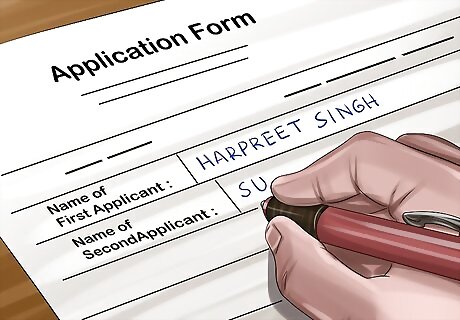

Fill in your name. At the top of any mutual fund form you will be asked to give your name. Fill in your full legal name, so that the investment will be correctly assigned to you. Some forms will have you put your last name first, while others will have you put in your first name first. Read the directions on the form and follow them while filling in information.

Add additional investors. If you would like to have another person on your mutual fund account, you can add them at this point. However, having someone else's name on the account makes them an equal partner in the investment, so do this cautiously. If you would like to set up an account for your child or grandchild, you can do this by adding their name to your account. This has to be done in a specific part of the form that is usually designated for "investments on behalf of a minor." They cannot have their own account if they are under 18 years old. However, by having their name on your account, they will be the beneficiary.

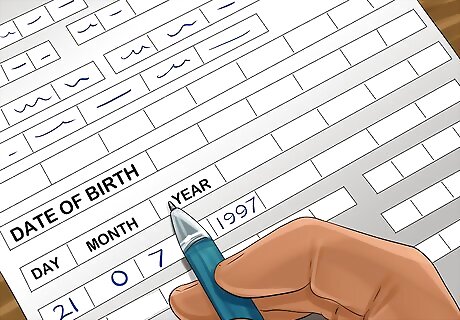

Provide your date of birth. In order to verify your identify, the form will ask for your date of birth. Your date of birth will also help the investment firm ensure that you are old enough to invest in a mutual fund. It is most likely that you will be asked to input your date of birth with only numeric digits. In the US, this is done by putting the month, day, and then year. In other countries, the day will be put in before the month.

Fill in your contact information. In order for the investment company to contact you about your account, you should give them both a phone number and email address where you can be reached. In most cases, the email address will be used for correspondence. Legally, the mutual fund is required to keep you updated on changes on a regular basis. These updates will typically be emailed to you.

Give your address. You will also need to provide a street address in order to open a mutual fund account. This helps the investment company and the government ensure that you are allowed to open an account and it gives them somewhere to send correspondence about the account. When opening a mutual fund you are likely to get updates about your investment mailed to you. You will also get tax information sent to you by the government.

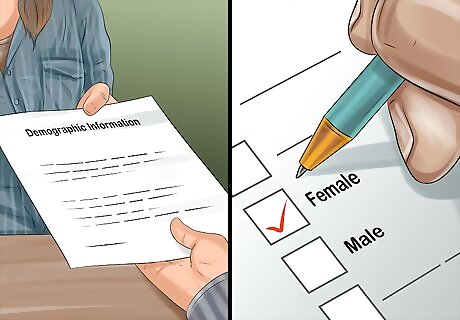

Provide additional demographic information. Depending on the company you are using to open your mutual fund account, they may ask you a variety of other questions. These are typically just demographic questions that they use in house for statistics or promotional campaigns. For example, the form may ask your gender or sex. This is typically used so that the company knows the breakdown of their investors and so that they can use the correct pronouns with you when you interact with them.

Giving Your Financial Information

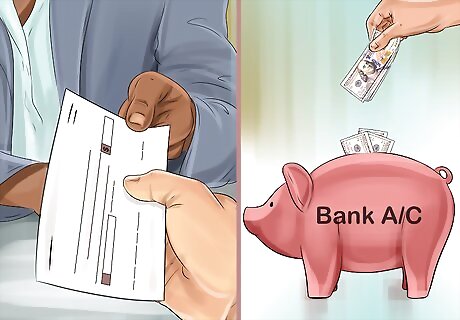

Mark how you will be paying for your investment. In order to pay for your investment, you can typically link to a bank account or pay with a check. There should be a box to check that signals which form of payment you will use. Depending on the amount you are investing and what your investment company prefers, you can use a personal check, money order, or certified check to pay for your investment.

Specify how much money you will be putting into the mutual fund. The form should include a summary of how much money you are investing in the mutual fund. The money may be put into a variety of funds, but the total amount you are paying should be specified.

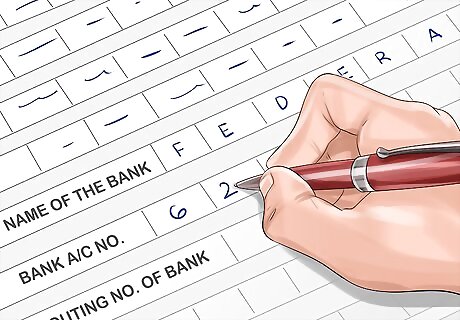

Give your bank account information. If you are paying with a transfer directly from a bank account, you will need to provide the name of your banking institution and the routing number of that bank. You will also need to provide your specific account number so that funds can be requested from the account.

Specifying the Investment Fund

Identify exactly what mutual funds you are investing in. In order to ensure that you are investing your money exactly where you want to be, the name of the fund should be specified. If you are putting money into to several different funds, they should all be listed. There are 4 main types of mutual funds: money market funds, bond funds, stock funds, and target date funds. The type of fund you are investing in should be indicated on the form. If you are unsure of the name of specific mutual funds, allow your investment advisor to write them down. The name of the fund may vary slightly depending on if you are investing thorough an independent broker or a broker for the fund.

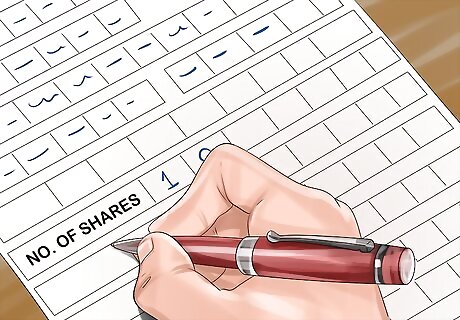

Specify how many shares you are buying. For each mutual fund listed, you will need to write down how much money you are investing and how many shares that buys you. If you are only investing in one mutual fund, the amount of money you list will be the same as your total payment. The price of shares in a mutual fund are set daily. This price is called the NAV (net asset value). This is how the price will be referred to on your form.

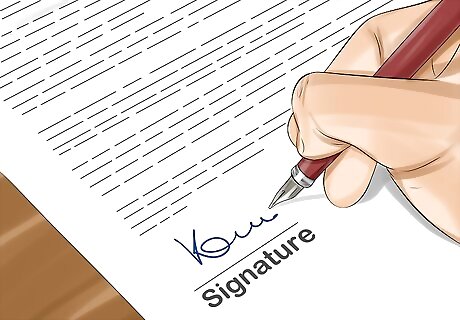

Verify your investment. After you have filled in all the required information, you will be asked to verify the investment with your name and signature. This will allow the investment firm to transfer of funds into your new mutual fund account.

Comments

0 comment