views

Getting Help

Find a lawyer. You could definitely benefit from a lawyer’s help. If you want to sue a debt collector, then the lawyer can help you draft court documents and represent you in court. Lawyers in this area of the law are often called "consumer attorneys." To find a qualified lawyer, contact your local or state bar association, which should run a referral program. For example, in California, you can call a state bar hotline and talk to someone about a referral. That person will ask you questions about your situation and the type of help you need. At the end of your conversation, they will give you a list of qualified attorneys that will be able to help you. You should hire an attorney as soon as possible after the abuse begins. An attorney will communicate with the debt collector directly and will be valuable in getting a resolution quickly. In addition, if a debt collector knows you are being represented, the abuse will generally stop.

Search for legal aid organizations. You might not be able to afford a lawyer but still desire legal help. In this case, you should look for local legal aid organizations. These organizations provide free legal help to people in financial need. Stop in or call and ask if they can assist you. To find legal aid, you can visit the Legal Services Corporation’s website at www.lsc.gov. On the homepage, click on “Find Legal Aid” and then enter your address. You might also check with any law school nearby. Law schools often run clinics staffed with students who work under the supervision of an attorney. They frequently represented clients for free.

Meet with the lawyer. You should schedule a consultation to meet with the attorney. The consultation will typically last a half-hour. To prepare, do the following: Gather relevant documents. Take copies of the letters or other communications from the debt collector. Your attorney will want to see them. Information on the debt collector. Is it a separate collection agency or have you been harassed by the original creditor? Documents related to any injury you have suffered. If the harassment has forced you to seek counseling or medical attention, then bring bills showing how much you have spent.

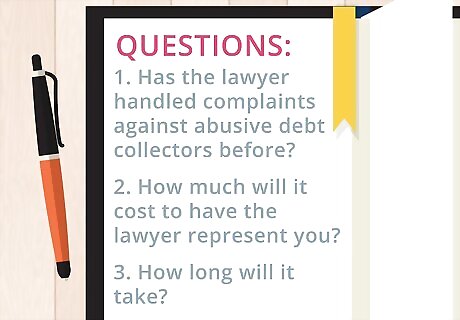

Ask questions. Before hiring a lawyer, you should try to get some information on his or her experience. You should also ask questions specifically about the strength of your case against the abusive debt collector. Sample questions might be: Has the lawyer handled complaints against abusive debt collectors before? If so, how many? How much will it cost to have the lawyer represent you? Will the lawyer represent you on a contingency fee agreement, where he or she foregoes fees in favor of taking a percentage of any amount you win at trial? What would the lawyer’s strategy be for bringing a lawsuit against the debt collector? What are possible outcomes of suing the debt collector and how long would it take?

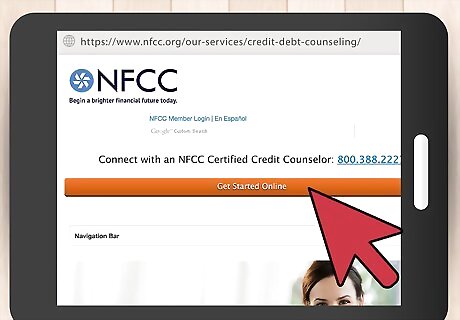

Sign up for credit counseling. Even if a debt collector abuses and harasses you, you still remain responsible for the debt. Accordingly, you need to come up with a plan for paying off your bills. Any debt in collections stays on your credit report for up to seven years. Legitimate credit counseling services are usually non-profits. You can find them by checking with a nearby university, credit union, or housing authority. If you are in the military, then your military base might provide credit counseling. A reputable credit counseling agency should also send you information about themselves without requesting any information from you. If the agency requires that you provide information upfront, then you should consider this a red flag.

Complaining to the Federal Government

Identify who the debt collector works for. The federal Fair Debt Collection Practices Act (FDCPA) prohibits abusive behavior in debt collection. However, the act applies only to debt collection agencies. If the debt collector works for the original creditor, then it does not provide protection. For example, if you owe $10,000 to a credit card company, that company can hire a collection agency to collect the debt. If an employee of the debt collection agency abuses you, then you can complain. However, if a credit card employee contacts you, then you cannot use the federal law as protection. Find out if the person calling you or sending you letters works for your creditor or works for a collection agency. They need to identify themselves if you ask. If you are being harassed by the original creditor, you can still report the conduct to your state and to the federal Consumer Financial Protection Bureau.

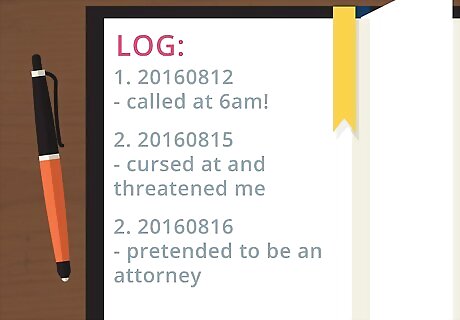

Document unreasonable behavior. The FDCPA prohibits certain abusive behavior. You should try to document this behavior by writing down the dates and times or by keeping examples: repeatedly calling you or calling you at an unreasonable time, such as before 8:00 am or after 9:00 pm failing to identify themselves as bill collectors claiming to be attorneys calling you at work when your employer prohibits it using or threatening violence using profanity claiming you owe more than you do adding interest, fees, and charges when not authorized to do so sending you anything that resembles a legal document contacting third parties about your debt (with a few exceptions)

Contact the Consumer Financial Protection Bureau (CFPB). This agency handles complaints about collection practices. You can call the agency toll free at 855-411-2372 or visit their website at www.consumerfinance.gov. At the website, click on “Debt collection” under “Products and Services.” Then click on “Get started.” You will be asked a series of questions about the type of debt that is being collected as well as a description of the tactics used by the debt collector. You also must provide information on the company as well as your own contact information.

Send a copy to your state agency. Each state has an agency that is tasked with regulating collection agencies. You should print off a copy of your complaint to the CFPB and mail it to your state agency. To find your agency, perform an Internet search. Type “your state” and “debt collection complaint.” Often, the Secretary of State handles these complaints. Be sure to first find out where the collection agency is located. You might live in Kansas but the collection agency could be located in Iowa. In this situation, you would contact Iowa’s state agency.

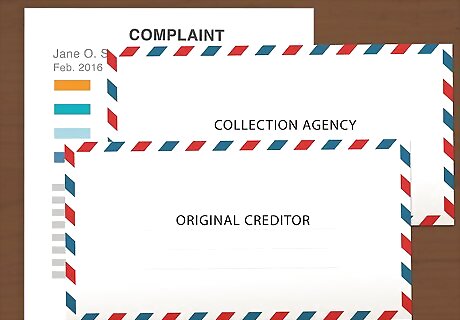

Send copies to others. You should make two other copies of your complaint and mail them to the collection agency and the original creditor. Be sure to send all communications certified mail, return receipt requested. Your receipt is proof that these organizations received your complaint.

Filing a Lawsuit

Find a favorable law. You will not always sue under the FDCPA. Some states have more advantageous laws for debtors. If you live in a state with favorable state laws, consider suing under a state statute as opposed to a federal one. Check with your state to determine the quality and breadth of their debt collection statutes. California is a great example of a state with laws favorable to debtors. In California, debt collectors are governed under the Rosenthal Fair Debt Collection Practices Act (RFDCPA). Unlike the federal FDCPA, California's law protects debtors from more than just collection agencies. For example, the RFDCPA regulates original creditors (i.e., creditors trying to collect debts on their own behalf). Under the federal FDCPA, original creditors are not regulated. Therefore, in California, you may have a valid complaint under state law when you would not have one under federal law.

Choose a court. Depending on how much you are suing for, you might want to bring a lawsuit in small claims court. Small claims court has some advantages over civil court. For example, small claims court is designed so that you don’t need a lawyer. Also, small claims cases tend to wrap up quicker than lawsuits in civil court. Find the maximum amount you can sue for in small claims court. This amount will differ by state. For example, in Alaska you can sue in small claims if you are seeking $10,000 or less. In Rhode Island, by contrast, you can sue in small claims court for up to $2,500. Calculate your damages. You are entitled to compensation for any damage caused by the abusive behavior. For example, you can get money to cover the cost of therapy or counseling. You are also entitled to up to $1,000 in statutory damages. You may also recover costs and attorneys’ fees. Add up all of your damages to see if you can file in small claims court or if you must file in regular civil court.

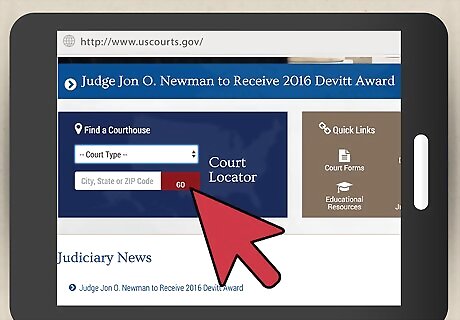

Consider filing in federal court. If you are suing a debt collector under federal law, you might want to file your lawsuit in federal court. Doing this will be helpful because federal courts are usually better equipped to handle federal issues. If you think this is an option, look at the federal courts website for information about where and how to file. This information can be found at http://www.uscourts.gov/. If you are suing a debt collector under federal law, it will most likely be under the FDCPA.

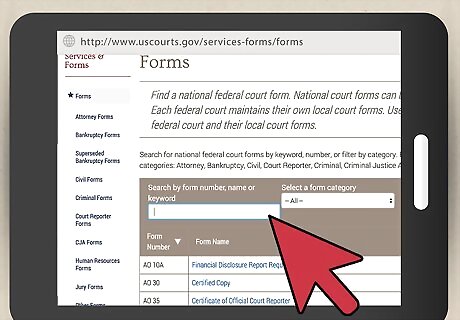

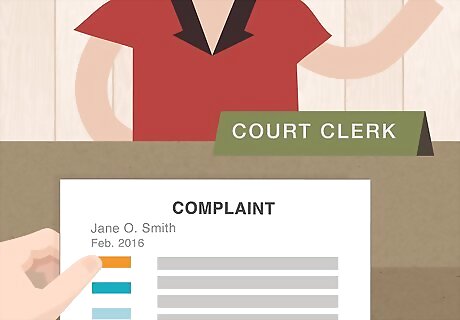

Find a complaint form. You will begin a lawsuit by filing a complaint with the court. In this document, you explain the factual circumstances and tell the court how much you want to be compensated. You do not need to go into extensive detail in the complaint. Instead, you should give the court a good general idea of the events that led to the lawsuit. Many courts (and most small claims courts) have printed “fill in the blank” complaint forms you can use. Stop in and ask the court clerk. If you can’t find a complaint form, then you can use this form from the New York Court System as a sample: http://www.nycourts.gov/courts/6jd/forms/srforms/complaint_examp.pdf. Revise it according to the facts of your case.

Fill out the complaint. You should provide the following information in your complaint: your name, address, and telephone number the name, address, and telephone number of the debt collector a description of the abusive practices, including dates and times a description of the law that authorizes you to sue (e.g., the federal Fair Debt Collection Practices Act or your state’s equivalent statute) your requested relief (how much money you demand the debt collector pay you as compensation)

File the complaint. After you complete the complaint, you should sign it. Then make several copies of your completed complaint and take them all to the court clerk. Ask to file the original. The clerk should stamp your copies with the date. This will prove that you filed the complaint. You will probably have to pay a filing fee. This fee will differ by court. Ask the court clerk for the amount of the filing fee and acceptable methods of payment. If you cannot afford the filing fee, then ask the court for a fee waiver form.

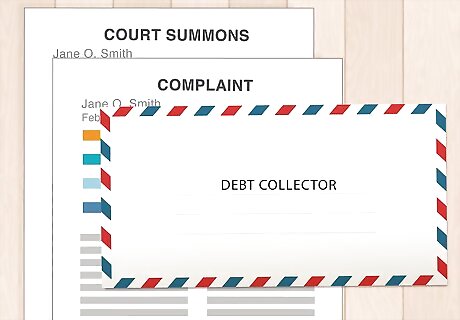

Serve a copy on the debt collector. You must send a copy of your complaint to the debt collector. You will also send a summons, which the clerk can print off for you. By sending these documents, you provide notice of the lawsuit and give the defendant a chance to respond. Ask the court for acceptable methods of service. If you are in small claims court, you can typically mail the complaint to the debt collector. In regular civil court, you may have to hire the sheriff or a process server to make service. Process servers can be found in your phone book and generally cost around $45-75 per service.

Comments

0 comment