views

Receiving the News

Listen closely to what your employer tells you. You may need to use some of the information that your employer gives you to file a lawsuit or unemployment benefits so pay attention to everything that they tell you. Wait until they have told you everything before you start asking questions. Consider writing down important notes so you can remember them later. Ask your employer to clarify something if you're not sure what they mean or what they said.

Ask for specific reasons for your termination. Knowing your employer's reasons for firing you will help you to understand it. It will also help you know whether or not they will be a good reference or a benefit to any future jobs that you seek. Ask your employer if you are being fired or laid off. There is a big difference, especially when it comes to collecting benefits and when you go to look for a new job. Do not get angry if the answers you get are unsatisfactory. Make a note of the reasons they give you for your termination.Tip: If you were fired before you got a chance to ask any questions, you could send a formal email asking for the reasoning behind your termination.

Avoid losing your temper or arguing with your employer. It's completely natural for you to be feeling strong emotions while you're getting fired. You may be feeling angry, scared, disappointed, betrayed, or a complex mixture of several emotions at once. Understand that getting angry or shouting at your employer will not change the outcome. Focus on leaving the meeting with pride and dignity. Don't damage your reputation with your coworkers or your former employer by getting angry or violent. You don't want to jeopardize any future jobs you could get. Stay calm and keep a cool head.

Find out if your employer plans to take your pension funds away. Ask your employer if they plan to take back any contributions that they may have made to your retirement pension if you have one. Depending on the circumstances of your firing, they may seek to reclaim their contributions, and it would be helpful for you to know whether they plan to do so. You need to know this information definitively, so ask something like, “Do you plan to take back your pension contributions?” Don't leave any mystery about it.

Hold off on signing a severance package until you review the terms. You may be offered a severance package as part of your termination. A severance package can help you make ends meet in the aftermath of getting fired, but you don't want to sign it until you've had a chance to consider it. You may want to negotiate for a higher amount. Look over the entire document yourself to make sure your employer isn't trying to get away with anything. Have a lawyer review the severance paperwork to make sure it's acceptable. If you're happy with the terms and the amount of the severance, then sign it.Tip: Because you were fired before retirement and likely have worked for the company for a long period of time, you may be able to negotiate a higher severance package.

Discuss the way your termination will be described to others. Ask your employer what they plan to tell your coworkers about your firing, and request that they choose to describe it in a neutral tone. More importantly, ask your employer how they will describe your termination to any future employers that may call them for a reference. For example, you could ask your employer to tell your coworkers that you were laid off instead of fired. It's important for you to know what your employer may say to any potential future employers so you can decide if you want to list them as a reference.

Shake hands with your employer when the meeting is over. You want to try to leave on as good of terms as possible with your now former employer. They may prove to be helpful when you apply for benefits or another job. Don't burn any bridges and ruin what could be a great reference for potential future employers. End the meeting by thanking them for their time and a firm handshake. Ask if you can list them as a professional reference.

Gather all of your belongings and leave. You may have spent a lot of time working for the company that fired you, so you may have lots of belongings there. Take your time to collect and pack up everything that you own. Try to leave on good terms with your former employer and avoid talking with your coworkers about the firing. Pack up your belongings in a large box so you can carry as much as possible and don't need to make multiple trips. Don't take any company property so you can't be accused of theft. If you were fired and asked to leave immediately, your belongings will likely be mailed to you. Make mental note about all of your belongings so you can make sure you get everything when they're delivered to you.

Taking the Next Steps

Admit to yourself and others that you were fired. You may feel betrayed, angry, and embarrassed after being fired by a longtime employer, but you need to be open and accept it in order to move on. Don't be afraid to tell people that you were fired. It could open up opportunities for you that you weren't aware of. Turn to your family for guidance. If you have a son or daughter who is able to help you make ends meet, you may be able to take early retirement. Don't deal with it alone. Talk to your partner or a therapist about the emotions that you're dealing with.

Contact an employment lawyer to know your rights as an employee. If you had a pension plan that your former employer also contributed to, they may be able to take back the contributions that they made. Seeking the help of a lawyer will ensure that your rights are protected. For example, if you had a retirement plan with your former employer in the form of a 401(k), they cannot take away any of the money you contributed to the plan. A lawyer will also be able advise you about whether or not your termination was lawful.

Assess your finances to plan your next move. If you have enough savings, you may want to use your firing as an opportunity to take an early retirement. Take stock of your savings, account balances, bonds, stock options, and any other assets that you have. Because you were fired before you retired, you may be eligible for certain benefits and programs that are designed to help older workers. For example, being fired in your 60s means that you're eligible to take withdrawals from your IRA or 401(k) without any penalties or fees. You can use the money to help pay bills or to boost your savings to fund your retirement. A financial advisor can help you organize your finances and create a plan to help you deal with the unexpected firing.

Make a spending budget. Given the recent loss of income, you need to be as frugal as you can be with your money until you figure out what you're going to do. Make a budget for necessities like food and bills. Stick to your budget and don't overspend so you can be as financially stable as possible for the time being.Tip: Make a spreadsheet for your budget so you can easily track and update it.

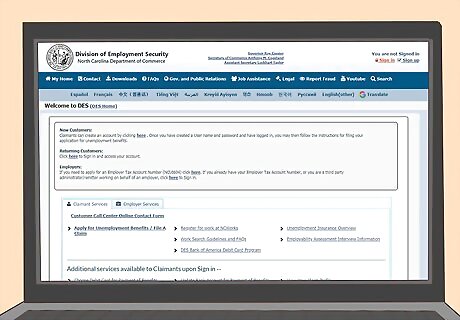

Apply for unemployment benefits to help you get by. Because you were fired before you retired, you more than likely have worked enough to qualify for unemployment benefits. Contact a local unemployment office by phone or go online to apply for unemployment benefits. Apply as soon as you can. The process can take some time, so you don't want to delay. Unless you were fired for serious misconduct or you quit without a good reason, you should be able to collect unemployment to help make ends meet. If you are denied, request a hearing to have the office review your information more closely to make a determination.

Get health insurance or enroll in Medicare. If you're 65 or older, you can enroll in Medicare and get health benefits through the program. If you're younger than 65, you can pay for COBRA to keep the health plan that you had at your former job. You could also look to buy your own health insurance on the open market. Notify your insurance company that you were fired and request a COBRA election notice that you can complete and return to apply for COBRA. You can get health insurance even if you are unemployed.

File for Social Security if you need to do so. If you are older than 62, you can file for Social Security and start to collect monthly benefits. However, if you start collecting benefits before you reach the full retirement age of 66, then you will receive a reduced monthly payment that will remain in effect for the rest of your life. Only file for Social Security as a last resort if you haven't reached the full retirement age. You can collect Social Security and unemployment benefits at the same time. However, you may receive a reduced amount from unemployment if you have outside income, which can include Social Security.

Looking for a New Job

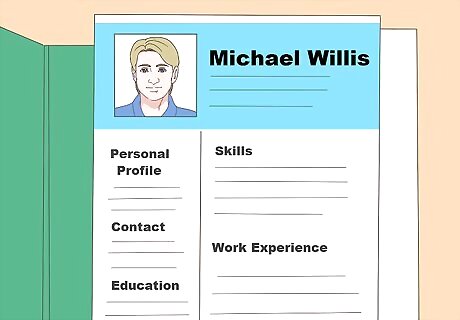

Update your resume so it's current. Even if you're not sure if you're going to get another job, updating your CV or resume so it's current is a good idea. You'll have it ready to go in the event that an opportunity suddenly arises. Be sure to highlight your experience and list reliable references. Look online to compare your resume to examples that you find. It may have been a while since you've applied for a job, so you don't want your resume to look outdated or not formatted in the current fashion. Do not mention the reason you left your former workplace unless you're asked by a potential employer.

Reach out to your business contacts for employment opportunities. You may have built an extensive network of business contacts, coworkers, industry representatives, clients, and vendors in your field. If you'd like to get right back into work in the same industry, try reaching out to them to see if there are any positions open. Since most of these folks probably know the company you used to work for, you may want to be candid about your termination. They may be more sympathetic than other companies.Tip: Create a LinkedIn account and add any business contacts that you have to your network.

Try contract or consultant work if you don't want another full-time job. You probably have tons of experience in your field, but you may not want to dive back into another full-time position, so you can offer your services on a contract basis. It may also be easier for you to find work as a consultant in your field rather than a salaried position. Part of the beauty of contract work is you can accept or reject any offers and set your own hours.

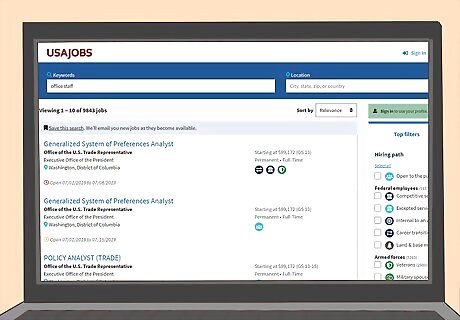

Look at classifieds and job postings online. You can check online classifieds for job postings at websites like Craigslist. You can also join employment websites like Monster.com or Indeed to search for jobs in your given field. Don't take a scatter-gun approach and apply for every open position that you find. Instead, focus on positions that match your skill set and experience. Upload your resume to your account so you can easily send it to potential employers.

Practice job interviews so you're ready. Chances are it's been a while since your last job interview! You will want to rehearse the interview with a friend or family member so you nail it when you do the real thing. Focus on your strengths, which will include your experience and professional relationships in the industry. Show that you're willing to adapt and learn new technologies and procedures.

Comments

0 comment