views

X

Research source

In this article, we’ll show you the best ways to verify an organization’s 501(c)(3) status, as well as how to avoid charity scams and investigate the status of your own 501(c)(3) application.

- Enter the organization’s name or EIN on the IRS Tax Exempt Organization Search site to check the status of a nonprofit.

- Ask the organization for an IRS letter of determination, or check the Secretary of State's website for the state in which the nonprofit is registered.

- Religious organizations are automatically tax-exempt if they meet IRS requirements and may not always appear on exemption lists.

Navigating the IRS Online Database

Gather information about the nonprofit to filter your search. Before you begin your search, check the organization’s website or written materials to find their Employer Identification Number (EIN). Reputable nonprofits often display this number prominently for transparency (it may be listed as a nonprofit Tax ID instead of an EIN). Other helpful information includes: The exact name of the organization. The city, county, and/or state where the organization is located.

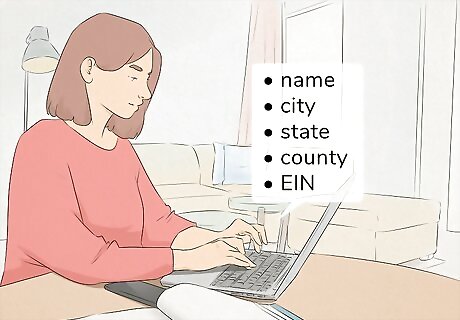

Visit the IRS Tax Exempt Organization Search site and select a database. The IRS maintains an Exempt Organization List of every 501(c)(3) in the country. Once you’re on the page, choose which database to search from the dropdown menu titled “Select Database” in the upper left corner: Choose Publication 78 Data to find organizations eligible for tax-deductible charitable donations. Select Auto-Revocation List to find organizations whose tax-exempt status has been automatically revoked because they’ve failed to file a Form-990 tax return for 3 consecutive years. It’s possible an organization on this list has been reinstated and may not be currently revoked. Choose Determination Letters to find IRS-issued letters stating an organization meets the requirements for tax-exempt status. Click Copies of Returns to see a nonprofit’s annual tax returns available for public inspection. Choose Form 990-N (e-Postcard) to find tax-exempt organizations whose annual gross receipts are normally less than $50,000 (meaning they don’t have to file a Form-990).

Enter the requested information in the other search fields. Under the “Search By” field, select either “Organization Name” or “Employer Identification Number (EIN),” then fill in the other boxes. Organizations are listed under whatever name is on file with the IRS, either their legal name or the name they’re doing business under (or both). For example, if you choose to search by name and enter Red Cross, entries with either the word “Red” or “Cross” will show up. Put the name in quotation marks to search for the phrase. Alternatively, enter the organization’s EIN (if you have it on hand) for a more precise search. When searching, avoid using common words such as “Foundation” or “the” since these will turn up many more results to scroll through. If you need a bulk file of all organizations in a particular database, download these files from the IRS Tax Exempt Organization Search Bulk Data Downloads page.

Check if an organization’s status was revoked if you can’t find it. If an organization isn’t appearing in a database of compliant nonprofits, select “Auto-Revocation List” from the “Select Database” dropdown menu and search again. Use the same information from before (name, location, EIN) and select a date range to limit the search to organizations whose tax-exempt status was automatically revoked between specific dates. At the bottom of the form, select “501(c)(3)” from the “Exemption Type” dropdown menu, then click “Search.” Alternatively, download the entire database of organizations that have had their federal tax exemption revoked from the IRS Tax Exempt Organization Search Bulk Data Downloads page.

Checking the Status of Your 501(c)(3) Application

Collect your application number, EIN, and other information. Before contacting the IRS to review your application status, make sure you have the following information on hand. This information will make it easier for the IRS to look up your application and verify that you’re legally allowed to inquire about it. You will need: Your personal contact information. The name of the organization. The organization’s Employment Identification Number (EIN) or Tax ID (available on your application or Form W-2). Your application number. The date the application was submitted. Whether you’re a director or officer legally allowed to represent the applicant or organization.

Then, call the IRS toll-free at 877-829-5500 (or fax 855-204-6184). Have the necessary information on hand and call the IRS to speak to a representative that can look into the status of your application. Alternatively, fax the necessary information to the IRS and wait for a reply. Note that the IRS will not respond to any inquiries sent via email. Consider calling the IRS after submitting your application to verify that it was received and is being processed. Keep in mind that wait times will probably be very long (especially during tax season).

Or, check the organization’s mailbox for a letter of determination. It typically takes about 21 days for the IRS to review and approve an application. Once they do, they will mail their letter of determination to the mailing address indicated on the application. If there was a designated power of attorney on the application, they will also receive a copy of the letter. If you plan to send in your application by mail, arrange a confirmation of delivery with the mail carrier (whether it’s USPS certified mail or a commercial carrier). This way, you’ll know when the IRS receives your application. If there is an error on your application or the agent assigned to it needs more information, they will likely contact you by mail. Keep an eye on the mail so you can respond to any inquiries quickly and speed up your application processing time.

Other Ways to Determine 501(c)(3) Status

Ask for a copy of an IRS determination letter from the organization. Once an organization has been given 501(c)(3) status, the qualified non-profit will receive a determination letter from the IRS. Ask for a copy of the letter by email or over the phone, and explain you’d like to double check their nonprofit status to ensure your donation is tax-deductible. If the organization hesitates to show you its letter, you should hesitate to donate to them. The organization might claim they can’t find their letter. Tell them they can request a new copy from the IRS at 1-877-829-5500.

Contact the Secretary of State to check that the nonprofit is registered. In the U.S., a charity typically needs to register with the state where it’s located before it can start fundraising. Check with the Secretary of State’s office for the state where the charity is located (which may be different from the state you live in). Visit your Secretary of State’s official government website (typically ending in “.gov”) to find nonprofit databases to search yourself and/or an email address or phone number to contact the office directly.

Know religious organizations are tax exempt even if they aren’t registered. Churches, mosques, synagogues, and other worship centers do not need to apply for tax-exempt recognition (although many do for transparency and credibility). Instead, they’re automatically tax exempt if they meet IRS requirements under article 501(c)(3). For this reason, many religious organizations will not appear in the IRS Exempt Organization List. A religious organization must meet the following requirements to be tax exempt: It has been organized exclusively for religious purposes. Net earnings do not benefit any private individual or shareholder. The organization can pay a minister or other faith leader a reasonable salary. However, it cannot pay an excessive salary or transfer property to any insider for less than market value. The organization cannot be substantially involved in influencing legislation. For example, it cannot encourage members to contact politicians either in support or in opposition to legislation. The religious organization cannot participate in political campaigns. Although a church might invite a political candidate to speak, it should provide an opportunity for opposing candidates to speak as well. The organization’s purpose and activities cannot be illegal. Note: A religious organization may appear on the Auto-Revocation List if the IRS recognizes them as a different type of organization and the organization hasn’t filed returns for 3 consecutive years. However, if they meet the requirements above, then your donations are still tax exempt (regardless of their listing in the IRS database).

Researching a Non-Profit’s Legitimacy

Ask the nonprofit for details on their mission, personnel, or finances. Legitimate charities should be willing to provide substantial information to potential donors. This information is often found on their website, but if you can’t find it, contact the organization to inquire. For example, they should share the following information readily: The organization’s proof of 501(c)(3) status, such as an IRS determination letter The charity’s identity and mission. Operating and/or programming costs. Financial statements or information about how donations will be used. A roster of staff and board members.

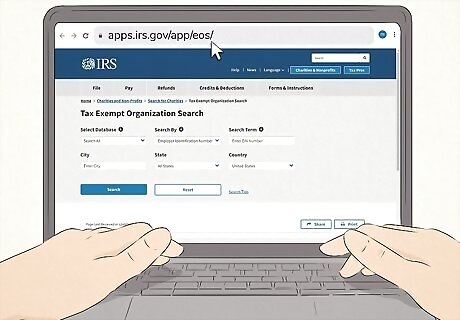

Look at the organization’s financial statements or tax returns online. Many non-profits put their financial information, including their annual tax returns, online for prospective donors to review. Check their website to see if this information is posted (it may be on their “Make a Donation” or “Support Us” page). If you can’t locate it, search for the organization on a nonprofit financial records site like GuideStar. Pay attention to the following red flags that may indicate the organization is illegitimate or in bad shape: The organization’s financial statements are not audited. They have a growing deficit from year to year. Their budgeted income and revenue are not based on accurate assumptions. The accounting and finance functions all lie with one person. Revenue sources change drastically from year to year. The Board of Directors is not involved in financial review or auditing.

Be wary of organizations that pressure you into donating. A legitimate nonprofit will not coerce, manipulate, or otherwise pressure you into giving them money in person, over the phone, or through writing (online or printed). Notice if they use tactics like insisting time is of the essence, which doesn’t give you time to research and vet the charity. If so, you may be talking to a scammer. To verify their legitimacy, ask for the following information: The organization’s complete name and address, plus the names of its principal officers. Whether the solicitors are volunteers or paid telemarketers. The organization’s stated purpose and annual reports for public review. The percentage of donations that go to the fundraisers’ salaries and administrative costs. The percentage of donations that goes to the organization’s stated cause.

Stay alert for scam tactics like asking for cash donations. A fraudulent non-profit might be hard to spot. However, there are several common red flags to look out for. Listen to or read their solicitations closely for questionable practices including: The non-profit has a name that is similar to a better-known organization. They may be trying to confuse the public. The non-profit thanks you for a donation you don’t remember giving. The non-profit asks for cash donations. You should be able to donate using a check or credit card. The charity attempts to collect the donation quickly. For example, they might ask for overnight delivery service. There’s no reason a legitimate charity would need a donation that quickly.

Ignore sweepstakes offers in exchange for a donation. Some illegitimate nonprofits may employ sweepstakes to raise funds. Under this scheme, you get a chance to win the sweepstakes in exchange for a donation. However, federal law in the U.S. prohibits making eligibility contingent on giving a donation. Ignore these solicitations and do not donate to the organization. Avoid any non-profit that employs this scheme.

Use non-IRS databases to verify finances and accountability. Fortunately, there is a wealth of information on the Internet about non-profits that is easy to access. When in doubt, perform thorough research before donating to any organization by checking the following sources: Better Business Bureau’s Wise Charity Alliance: BBB accredits charities that meet its standards for accountability. You can search by charity at its website. Charity Navigator: This watchdog organization grades charities based on their financial health and their accountability. Charity Watch: This organization analyzes the financial reports of non-profits to determine how efficiently they will use your donation. It sometimes conducts special investigations of charities. However, you must become a member to access their information. GuideStar: Use this site to obtain balance sheet data for up to 5 years and IRS filings for up to 3 years. You can also find revenue and expense data for the current year.

Comments

0 comment