views

Buying Scrap Gold

Manage your risk. Collecting and storing scrap gold has become a popular investment strategy. With gold prices steadily rising, buying scrap gold is a low-risk way to invest in this valuable resource. Term (duration) of Investment: Varies Nature of Investment: Low risk. Gold is the safest investment option available. The potential reward far outweighs the minor risk. Profile of Investor: Ideal for the first-time gold investor or for someone just looking to set something aside for a rainy day.

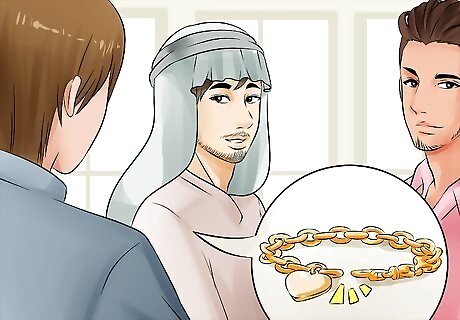

Keep it in the family. Ask family and friends if they have gold they are looking to get rid of. Practically everyone has broken necklaces, damaged rings, mismatched earrings and other forms of scrap gold that they would love to turn into cash. Work out a price they are happy with while leaving plenty of room for your profit.

Place an ad in the newspaper. Have an ad run in both the classified section and the help wanted section of your local paper. Most people who are looking at the help wanted ads are in financial distress of some sort, so placing an ad offering to help them make money by selling gold to you can work wonders.

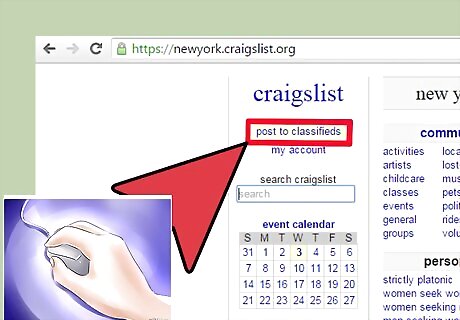

Place an ad on Craigslist. This is similar to a newspaper ad yet is entirely free and has the potential to reach more people.

Monitor Internet auctions. Gold items will often sell for less than their scrap value, making them a great investment tool. Be sure to factor in any taxes or shipping costs before bidding.

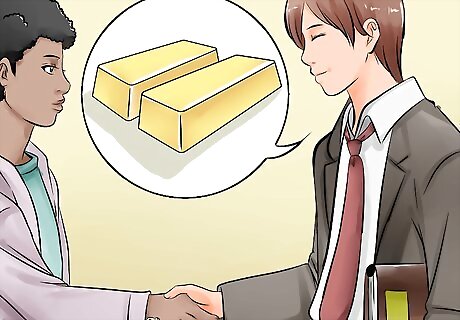

Develop relationships with local pawnshops. Leave your contact information with them and have them contact you if anyone comes in to sell gold items that the pawnshop doesn’t want. Some smaller shops may not have access to a refiner or even want to deal with scrap gold.

Buying Gold Bullion

Buy gold bullion. Countries around the world (including the United States) continue to spend money they don’t have, creating unstable economies. Gold bullion is the only true hedge against this kind of instability. Term of Investment: For the long term, even if the economy picks up, inflation will follow close behind. Which asset resists inflation? Gold. Nature of Investment: It's low-risk. Experts agree that the investment-allocation pyramid is built on a low-risk base that includes gold bullion. Profile of Investor: Gold is a perfect component for a new investor's portfolio.

Decide what type of investment-grade gold bullion you want to buy. You have a choice of gold coins, gold bars, and gold jewelry. Gold coins: Historic (pre-1933) gold coins tend to retain the most value, as these have numismatic value in addition to their gold content. Examples of historic gold coins that do not sell at an excessive premium over the gold price because they contain only 90 percent gold are the British sovereign, British guinea, Spanish escudo, French 20 and 40 francs, Swiss 20 francs, and American Gold Eagles ($10 face value), Half-Eagles ($5 face value) and Double Eagles ($20 face value). The British sovereign and the American Eagle gold coin are notable exceptions with 91.66 percent gold content (or 22 karat). Other gold bullion coins include the Canadian Maple Leaf, the Australian Kangaroo, and the South African Krugerrand (which sparked the entire gold-coin-investment industry), and the 24 karat Austrian Philharmonic. Gold bars: Gold is also sold in bars that are usually 99.5 to 99.99 percent fine (that is, pure gold). Popular gold refineries include PAMP, Credit Suisse, Johnson Matthey, and Metalor. You’ll see the names of these refineries stamped on the bars they process. Gold jewelry: The problem with buying gold jewelry as an investment is that you pay a premium for the craftsmanship and the desirability of the design. Any piece of jewelry marked 14 karat or less will be below investment quality, and any resale for the sake of investing will be impacted by the need to refine the gold. On the other hand, it is possible to pick up antique or vintage gold for very little at estate sales and similar auctions where a seller may not recognize the true value of the metal content or if people simply aren't in the mood to bid much for it. Older pieces can carry more value due to their unique craftsmanship, so this can be a lucrative and enjoyable way to collect gold.

Choose the weight. Clearly, the greater the weight, the greater the price. Something else to keep in mind is your ability to store the metal safely. The American Eagle gold coin and the other coins listed above are made in four weights: 1 oz., 0.5 oz., 0.25 oz. and 0.10 oz. Gold bullion bars are generally sold by the ounce and include 1 oz., 10 oz. and 100 oz. bars.

Find a source that sells gold bullion. Often dealers, brokerage houses and banks will sell both coins and bars. When assessing a dealer, see how long they've been in business, whether they're certified with an industry or government body and in what investment activities they specialize. In the United States the national mint provides a list of authorized sellers that you can check. See Buy Gold Online for details on how to invest in gold through online marketplaces. Jewelers sell gold jewelry, but if you decide to go this route, be sure to choose a reputable store that has been in business for a long time. Auctions can be another source of gold jewelry, but be aware that auctioned items are sold “as is." It’s up to you to ascertain their value.

Determine the current market price for gold. There are many sites online that will give you the current spot price for gold and other precious metals. Kitco is one such site.

Aim to buy gold coins or bars at or below the prevailing market price, plus a premium of approximately one percent. Most dealers have purchase minimums, charge for shipping and handling, and offer quantity discounts. Get receipts for all purchases and get a confirmation of delivery date before you pay for the bullion. If purchasing jewelry, retain all receipts in a safe place. If purchasing at an auction, remember to add on a buyer's premium and any sales tax.

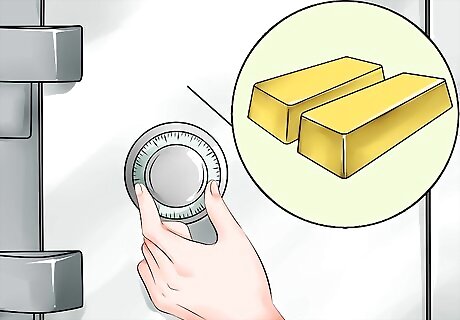

Store your bullion securely, preferably in a safe-deposit box. This is a very important aspect of investing in gold, because your investment strategy is only as safe as your storage strategy. Invest in high-quality security mechanisms, or pay a company to store the metal for you.

Buying Gold Futures

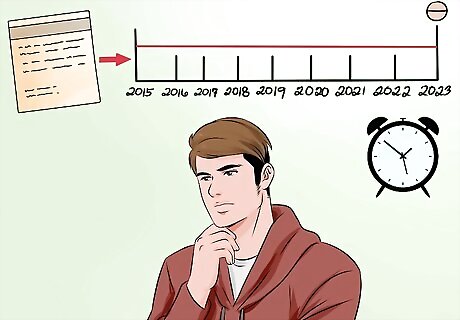

Think ahead. Those willing to absorb a bit more risk may decide to invest in gold futures. However, it is important to note that such a strategy isn’t so much “investing” as it is speculating, which equates to gambling in some respects. Term of Investment varies. In general, investing in gold futures is like making a short-term prediction of what the price of gold will soon be. However, many savvy investors invest and re-invest in gold futures over a period of years. Nature of investment: High risk. There is high volatility associated with gold futures, and many inexperienced investors have lost money on them. Profile of Investor: Futures are primarily for seasoned investors. Very few novices make money this way.

Open a futures account at a commodity trading firm. Futures allow you to control a larger amount of gold than you have in cash.

Invest capital that you can afford to lose. If the price of gold drops, you could end up owing more than you invested once commissions are added.

Buy a gold futures contract. Gold futures are legally binding agreements for delivery of gold in the future at an agreed upon price. For example, you can buy 100 oz. of gold for a two-year contract worth $46,600 for as little as three percent of the value, or $1,350. The commodity trading firm charges a commission for every trade. Each trading unit on the COMEX (Commodity Exchange) is equivalent to 100 troy ounces. Electronic trading on the Chicago Board of Trade (e-CBOT) is another way to trade gold.

Wait for the contract to end. Then you can collect your earnings or pay your losses. An investor can exchange a futures position for physical gold, referred to as EFP ("exchange for physical"). However, most investors offset their positions before their contracts mature instead of accepting or delivering physical gold. When you buy a futures contract for a fraction of the actual cost of the assets involved, you are basically betting on a small change in the price of the assets. You can make a lot of money buying gold futures if the value of gold goes up relative to your currency, but if it goes down, you can lose everything you invested and possibly more (if your futures contracts do not simply get sold to someone else when you do not have enough money down). This is a way to hedge a risk or speculate but not in itself a way to build savings.

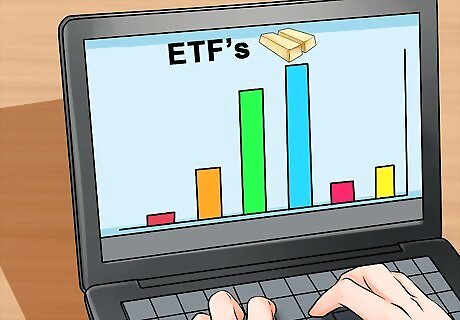

Buying Gold Exchange Traded Funds

Use ETFs. Some exchange-traded funds (ETFs) aim to track silver and gold prices and are generally bought through a stockbroker. They are much like derivative contracts that track prices, but they differ in that you will not own the underlying metal assets. Two examples of ETFs are Market Vectors Gold Miners and Market Vectors Junior Gold Miners. The Market Vectors Gold Miners ETF attempts to replicate (before expenses and fees) the yield performance and price of the New York Stock Exchange Arca Gold Miners Index. The portfolio contains gold mining companies of all sizes from around the world. The Market Vectors Junior Gold Miners ETF debuted in 2009. This ETF has become quite popular among investors seeking to have indirect access to gold assets. Although similar to the Gold Miners, the Junior Gold Miners focuses on smaller companies involved in an ongoing search for new sources of gold. Because these companies are less established, there is more risk involved. Term of Investment: Short term. There is a fee assessed each year that deducts from the amount of gold backing your investment, making this an expensive way to invest. Nature of Investment: Medium risk. Because a typical ETF investment can be short- term if you prefer, risk can be minimized.

Use a broker. Use the same broker you would use to buy stock, a mutual fund, or shares in a gold ETF, such as GLD and IAU on the New York Stock Exchange. A gold exchange-traded fund is designed to track the price of gold while maintaining the liquidity of a stock. Note that gold exchange-traded funds do not give you the ability to physically control the gold. Therefore, some gold advocates believe this is an inferior way to own the commodity. Another disadvantage is that ETFs trade like stocks, and you may have to pay a commission to buy and sell on the exchange. Moreover, any capital gains you realize must be reported for tax purposes.

Comments

0 comment