views

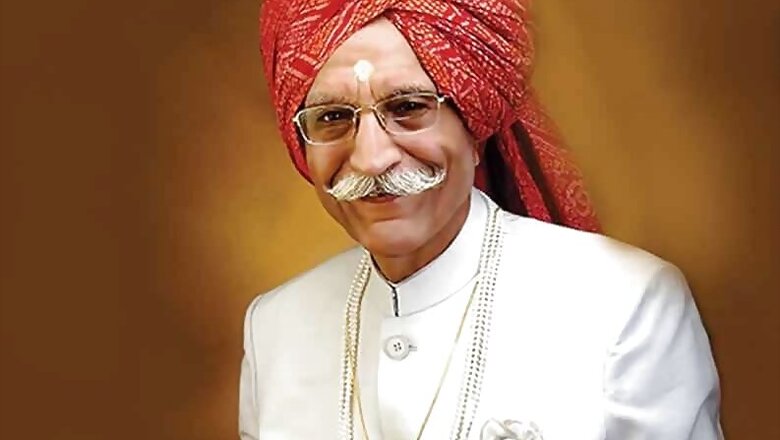

Spice maker MDH has denied the reports of its sale, which started making rounds recently. The company called the reports baseless. This development comes on the back of the news that the FMCG major HUL is in discussion to acquire a majority stake in the established spice maker Mahashian Di Hatti (MDH).

MDH’s official Instagram handle, however, made a public announcement on behalf of its chairman Rajeev Gulati, on March 22 denying all reported claims. “We are committed to take the legacy forward with all our heart,” it said.

Spice business has been a tough market to crack for bigger companies, as consumer preferences and cooking habits differ from state to state. The MDH brand is, however, has a wider presence in the country through its innovative TV commercials.

MDH Spices sells more than 60 products across the country and deals with at least 1,000 wholesalers and hundreds of thousands of retailers. Its website claims the company can produce 30 tonnes of spices a day.

The packaged spice market in India has a few significant independent players While MDH is one of them, others like Everest and Badshah are also not part of any major FMCG umbrella whether it be MNCs like HUL, P&G, or homegrown FMCG giants like ITC, or Marico.

The acquisition, if true, would have heralded a new era where a major FMCG giant would make play for the Indian packaged spice market.

As news reports of the takeover surfaced, earlier this week, the share price of Hindustan Unilever took a fall of nearly 4 per cent. The HUL stock is down 15 per cent for the past one year – as inflationary pressures have battered down the valuations.

HUL’s Business Model Attractive

IIFL has add call on Hindustan Unilever with a target price of Rs 2350. The current market price of Hindustan Unilever is Rs 1995.4. Time period given by analyst is a year when Hindustan Unilever price can reach defined target.

Hindustan Unilever, incorporated in the year 1933, is a Large Cap company (having a market cap of Rs 481948.16 Crore) operating in FMCG sector. Hindustan Unilever key Products/Revenue Segments include Personal Care and Other Operating Revenue for the year ending 31-Mar-2021.

If a company’s business model is attractive, management capable, strategy is correct and execution good, adverse environment factors such as cost inflation and demand weakness generally provide a buying opportunity. HUL has a demonstrated track record of managing cost inflation. Volume sluggishness is a natural consequence of high price inflation and weakness in consumption; the brokerage believes these issues are temporary and will resolve over a few quarters.

Promoters held 61.9 per cent stake in the company as of 31-Dec-2021, while FIIs owned 16.98 per cent, DIIs 8.6 per cent.

For the quarter ended 31-12-2021, the company has reported a Consolidated Total Income of Rs 13499.00 Crore, up 3.05 per cent from last quarter; Total Income of Rs 13099 Crore and up 10.33 per cent from last year same quarter; Total Income of Rs 12235.00 Crore. The company has reported net profit after tax of Rs 2300.00 Crore in latest quarter.

Read all the Latest Business News and Breaking News here

Comments

0 comment