views

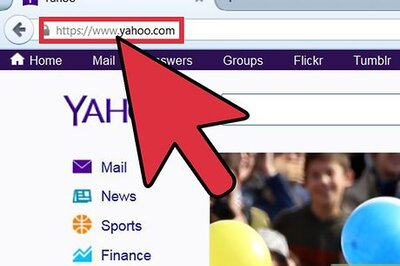

Mumbai: Domestic rating agency Icra further revised down its GDP estimate for the country on Monday and now expects the Indian economy to contract by 11 per cent in FY21. The agency, which was earlier estimating a contraction of 9.5 per cent, said the revision has been done as the rate of new COVID-19 infections remains elevated.

It can be noted that some analysts have pegged the economy to contract by up to 14 per cent after the release of the official GDP data for Q1FY21 which showed a 23.9 per cent decline. The RBI is yet to give its estimate on the Gross Domestic Product (GDP) and has been maintaining that it will be contracting.

The rating agency added that if the number for Q1FY21 gets revised down after data for the small businesses and less formal sectors becomes available, the overall GDP outcome for FY21 “could be even worse” than estimated by the 11 per cent contraction. For the ongoing second quarter, it is maintaining its earlier estimate of a contraction of 12.4 per cent.

“With the pandemic continuing in India for over six months, we sense that economic agents are now adapting to the crisis, resulting in a graduated recovery to a new post-COVID normal. Nevertheless, with rampant COVID-19 infections, we expect behaviours to remain altered for longer than what we had earlier presumed,” its principal economist Aditi Nayar said. The agency has revised its projections for Q3FY21 and Q4FY21 and now expects contractions of 5.4 per cent and 2.5 per cent, respectively, in the two quarters which will imply a full year contraction of 11 per cent.

Construction, trade, transport, hotels, communications and services related to broadcasting will recover with the longest lag and continue to underperform the rest of the economy, it said. Nayar said activity in some sectors, especially those like travel, tourism and recreation, where social distancing is difficult, will depress economic activity.

“Additionally, the continued economic uncertainty and health concerns would result in a prolonged impact on consumption and investment decisions,” she warned. The revenue shock being experienced by the Central and the state governments would limit the extent of fiscal support that may be forthcoming and result in protracted fears about deferral of both the capex and the release of timely payments, the agency warned.

Nayar said there are some early green shoots, such as the sharp revival in passenger vehicles and motorcycles, but those seem to be driven by pent up demand as well as inventory restocking and cast some doubts on their sustainability.

Comments

0 comment