views

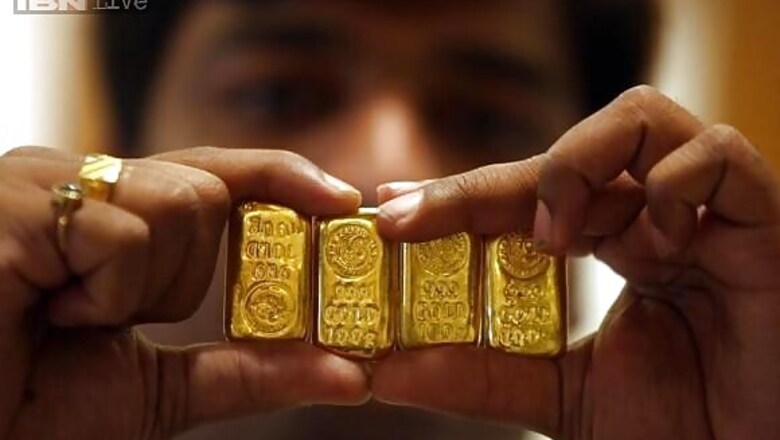

Mumbai: A plan by the Reserve Bank of India (RBI) to swap old gold in its vaults for purer metal abroad that it could pledge or sell would have the added benefits of reducing gold imports and easing pressure on the balance of payments.

The RBI would sell relatively impure gold from its own vaults - some dating back to before independence - and receive the equivalent worth of purer yellow metal delivered to the Bank of England, under a scheme outlined on Wednesday.

The swaps would not involve money changing hands, according to three officials aware of the development.

The RBI has parked gold abroad in the past, once in the throes of the 1991 financial crisis. It did a similar swap in 1998, according to a report at the time, before Russia's default and devaluation caused a meltdown across emerging markets.

Governor Raghuram Rajan had to contend with a balance-of-payments shock when appointed last autumn and has taken several steps to improve the management of India's $315 billion of gold and foreign exchange reserves.

The old gold is held in the RBI vault at Nagpur, considered to be the geographical centre of British colonial India - in other words, about as far away as possible from the international financial system.

Holding the gold offshore would make it possible for the RBI, if needed, to raise funds using the metal as collateral, or to sell it to defend the value of the rupee.

Import substitution

The so-called location swaps would also reduce the need for imports in gold-mad India. On average, Indians bought 2.3 tonnes of gold a day - the weight of a small elephant - until about a year ago. Most was hoarded and handed down as heirlooms to hedge against inflation.

"To the extent the banks will get the gold, they will not have to import. So this should take some pressure off gold imports," one of the officials said.

The RBI has approached several state-run, private and foreign banks and agencies to carry out the swap deal, including State Bank of India, Corporation Bank, Bank of Nova Scotia and MMTC, according to industry sources.

"The entire cost will have to be borne by the local bank," said a senior official from one private bank. In a letter, the RBI asks the banks to respond by July 15 but does not specify swap ratios or timing of the deals, the official added.

No official comment was available from the banks. The officials declined to be identified as they were not authorised to talk to the media. The RBI has officially confirmed the proposed gold swap but not elaborated on the reason for it.

The central bank in September announced steps to raise money from overseas investors and has intervened frequently since March to buy dollars, building its reserves to guard against any possible selloff of the rupee.

At the same time, India is seeking to reduce its reliance on gold imports, which have cost the country dearly. India paid $54 billion to import 1,017 tonnes of gold in the year ending March 2013, which helped the current account deficit balloon to a record high of 4.8 percent of gross domestic product.

The current account deficit was a major factor in last year's rupee crisis, in which capital outflows were triggered by a warning that the U.S. Federal Reserve would wind down its monetary stimulus. As a result, the RBI and government took stringent steps to curb gold imports.

After those measures, gold imports slumped to just $5.3 billion in the March quarter, helping to narrow the current account deficit to just 0.2 percent of GDP versus 3.6 percent a year earlier.

But the World Gold Council reckons that 200-250 tonnes of gold have been smuggled into India since the imposition of import controls.

"The moment the supply of gold increases, the supply from smuggling will come down," said Madan Sabnavis, chief economist at CARE Ratings.

The RBI holds 557 tonnes of gold, and according to the World Gold Council it has the 11th-largest gold reserves.

However, the officials said there was no deeper meaning attached to the timing of the gold swap and no connection to Finance Minister Arun Jaitley's maiden budget on July 10. One of the officials called it a "housekeeping" activity.

"There is no monetary angle to this. It is an executive decision. It would be far fetched to connect this operation to the budget," the second official said.

Comments

0 comment