views

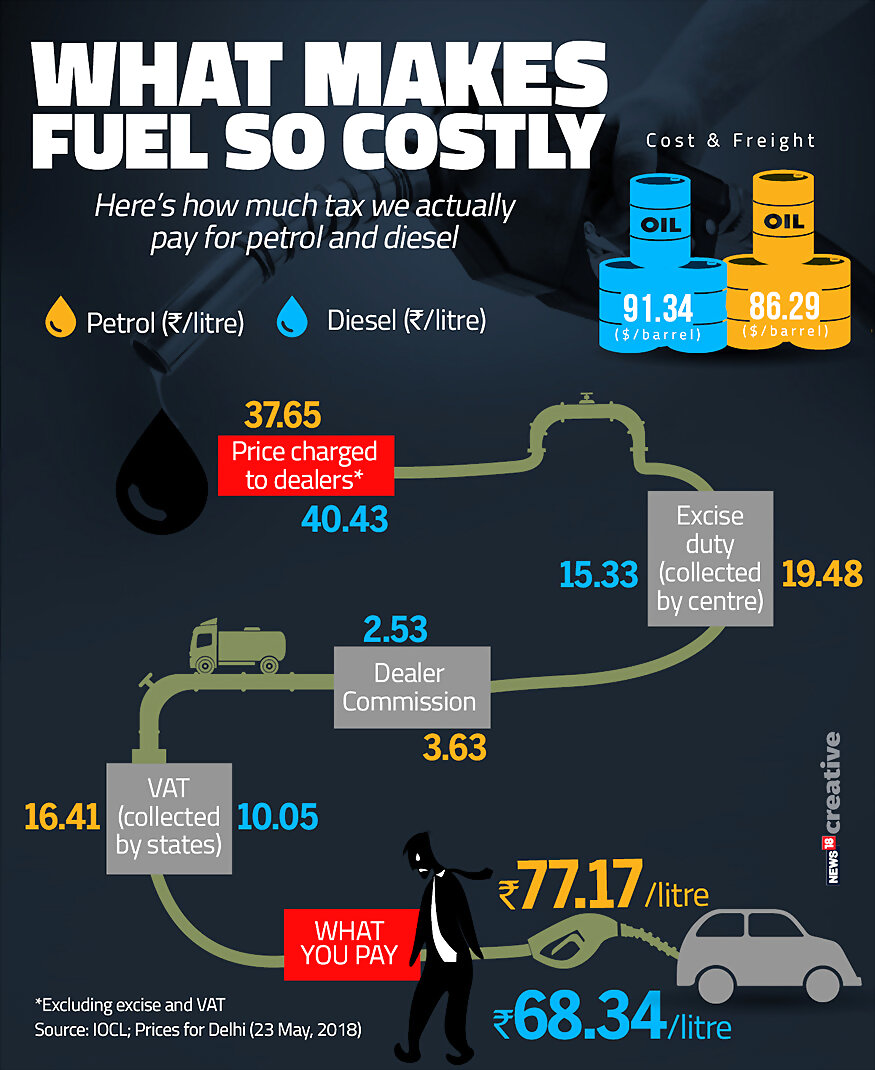

Fuel prices in India have reached an all-time high with the recent price increase on 3rd September, 2018. As per the official data from Indian Oil Corporation Limited, the petrol prices in Delhi are Rs 79.15/ litre and the diesel prices are Rs 71.15/ litre. This means that the price difference has been reduced to Rs 8 per litre. Now compare it to fuel prices on 1st January 2018, the diesel price in Delhi was Rs 59.70, while the petrol price was Rs 69.97, meaning a difference of Rs 10.27 per litre.

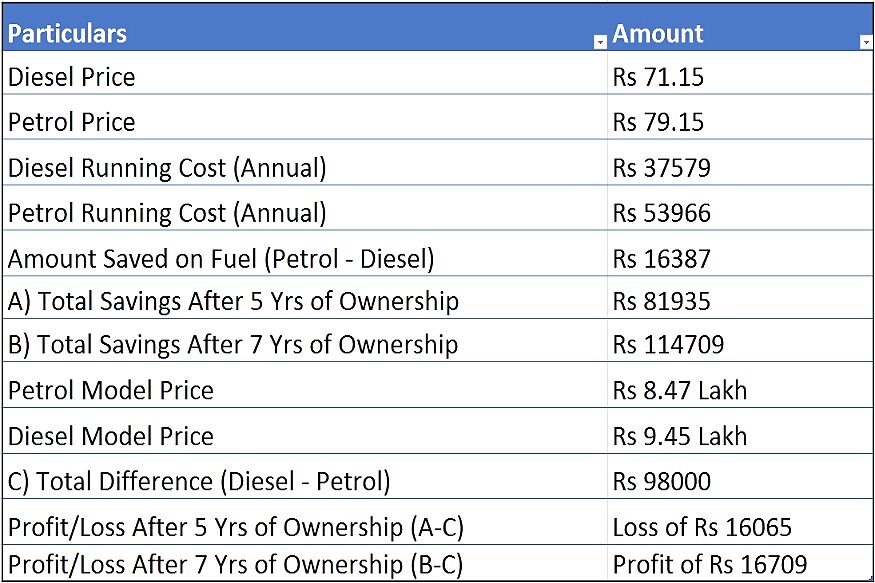

While the diesel car is initially priced more than a petrol car, the diesel fuel cost less than the petrol. This is why a lot of people are confused over their buying preference and we get this constant query – ‘Should I buy a Petrol Car or a Diesel Car?’ We did an analysis to find out whether it makes sense to buy a diesel car over a petrol car?

The debate on Petrol vs Diesel car is an age old issue now and simply put, here are the factors one used to consider while choosing between a diesel and a petrol car–

1. High-maintenance of diesel cars

2. High efficiency of diesel cars

3. Low cost of diesel fuel

4. High cost of diesel cars

Out of the above mentioned four points, the high-maintenance cost of diesel-fuel cars is not true anymore. Just so you know, the quality of diesel fuel in India has been sub-standard when compared to petrol. This led to clogging of diesel filter quite often, leading to higher cost of maintenance of diesel cars. This is no more the case as the diesel fuel has been refined exponentially to match international standards, eliminating the quality factor.

Next up is the efficiency of the diesel run cars, which is definitely the truth. Take any diesel car and compare it with its petrol alternative and you will find a difference of at least 4-7 kmpl. For our analysis purpose, we will consider the new Maruti Suzuki Dzire as the base car. Here’s a look at the mileage of Dzire petrol and diesel-

Maruti Suzuki Dzire Petrol Mileage – 22.0 kmpl (MT & AGS)

Maruti Suzuki Dzire Diesel Mileage – 28.4 kmpl (MT & AGS)

That’s a whopping 6.4 km difference per litre of fuel burned.

Talking about the difference in the pricing of fuel itself, diesel in India is priced relatively less than petrol. The price of fuel alone tempts buyers to go for a diesel car. Here’s the current fuel prices and we will take prices of New Delhi for reference-

Petrol price in New Delhi – are Rs 79.15/ litre (as of 3rd September, 2018)

Diesel price in New Delhi – are Rs 71.15/ litre (as of 3rd September, 2018)

Last is the difference between the ex-showroom prices of the petrol and diesel car, which is roughly a lakh rupees before taxes in most of the cases. For our study purpose, we have considered the Maruti Suzuki Dzire prices-

Maruti Suzuki Dzire ZXI+AGS – Rs 8.47 Lakh (Ex-Showroom Price, New Delhi)

Maruti Suzuki Dzire ZDI+AGS – Rs 9.45 Lakh (Ex-Showroom Price, New Delhi)

Most of the people use their cars for home-office-home commuting. If you live in Delhi-NCR, your daily average run would be around 50 km for a 20 working day month-

50*20*12 = 12000 km annually. Add to it 3000 km for weekend run, your annual running would come out to be 15000 km.

Let’s calculate the running cost now (Formula = Annual Running/ Average * Fuel Cost)-

Diesel Car- 15000/ 28.4 * 71.15 = Rs 37579

Petrol Car- 15000/ 22.0 * 79.15 = Rs 53966

Petrol – Diesel Difference = Rs 16387

Considering that you pay a lakh bucks extra for procuring diesel car, it would take you at least 6 years just to recover the basic ex-showroom price difference. And that too when we neglect the interest on the loan amount, if any.

Our suggestion, if you are planning to buy a car and have an annual running less than 15000 km, opt for a petrol variant. The extra lakh bucks you save can be used to buy a high-end safety equipment rich variant. Furthermore, invest the amount you saved in an RD or FD. The interest earned at the end of 5 year tenure will be a delightful one.

We wish you a Happy Buying!

Comments

0 comment